Cummins, Inc. vs. PACCAR, Inc.: Which Stock's Dividend Dominates?

Dividend stocks outperform non-dividend-paying stocks over the long run. It happens in good markets and bad, and the benefit of dividends can be quite striking -- dividend payments have made up about 40% of the market's average annual return from 1936 to the present day.

But few of us can invest in every single dividend-paying stock on the market, and even if we could, we're likely to find better gains by being selective. Today, two of America's leading heavy-duty truck (and truck component) manufacturers will square off in a head-to-head battle to determine which offers a better dividend for your portfolio.

Tale of the tape

Founded in 1919, Cummins is a Fortune 500 corporation and a global leader in manufacturing diesel and natural gas-powered engines for heavy- and mid-duty trucks, and it also produces engines and generators for the industrial, rail, mining, and construction markets. Headquartered in Columbus, Ind., Cummins employs more than 46,000 people worldwide and serves customers through a network of more than 600 company-owned or independent distributors and 6,500 dealers in more than 190 countries and territories. The company generates roughly two-thirds of revenues from outside the United States. Cummins also has a joint venture with Westport Innovations called Cummins-Westport to develop natural gas engines for truck haulers and tractors. The Motley Fool crowned Cummins "The Best Company in America" last year, based on its positive dealings with investors, customers, employees, and the world at large through philanthropic and sustainability initiatives.

Founded in 1905, PACCAR, Inc. is one of world's largest designers and manufacturers of light, medium, and heavy-duty diesel trucks under its Kenworth, Peterbilt, and DAF nameplates. Headquartered in Bellevue, Wash., the company sells products and services through an extensive network of roughly 1,800 dealer locations in more than 100 countries and territories. PACCAR also provides finance, leasing, and insurance services in 15 countries and boasts an insured portfolio of more than 150,000 trucks and trailers. The company also operates a major full-service truck leasing operation with a fleet of more than 25,000 vehicles. PACCAR generates about half of total revenues and profits outside the U.S.

Statistic | Cummins | PACCAR |

|---|---|---|

Market cap | $26.0 billion | $23.0 billion |

P/E ratio | 17.6 | 19.7 |

Trailing-12-month profit margin | 8.6% | 6.8% |

TTM free cash flow margin* | 7.8% | 2.9% |

Five-year total return | 568.7% | 214.7% |

Source: Morningstar and YCharts.

* Free cash flow margin is free cash flow divided by revenue for the trailing 12 months.

Round 1: Endurance (dividend-paying streak)

According to Dividata, Cummins began its quarterly shareholder distributions in 1985 and has been paying ever since. On the other hand, PACCAR has made uninterrupted quarterly dividend payments since 1941, which works out to a 63-year dividend-paying streak. That's an easy win for PACCAR.

Winner: PACCAR, 1-0.

Round 2: Stability (dividend-raising streak)

Cummins has increased its dividend payouts at least once per year since 2006 after holding dividends firm from 2000 and 2005. PACCAR started raising its dividend payouts, which include a special annual dividend, in 2002 but it halted that special dividend payout in 2008 and 2009 due to the global economic crisis. Therefore, PACCAR's dividend-raising streak only begins in 2010, and that's only if you ignore the fact that the company did not pay a special dividend in 2012.

Winner: Cummins, 1-1.

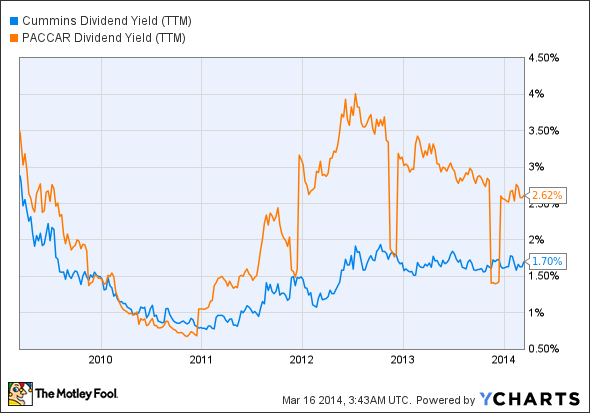

Round 3: Power (dividend yield)

Some dividends are enticing, but others are merely tokens that barely affect an investor's decision. Have our two companies sustained strong yields over time? Let's take a look:

CMI Dividend Yield (TTM) data by YCharts.

Winner: PACCAR, 2-1.

Round 4: Strength (recent dividend growth)

A stock's yield can stay high without much effort if its share price doesn't budge, so let's take a look at the growth in payouts over the past five years.

CMI Dividend data by YCharts.

Winner: Cummins, 2-2.

Round 5: Flexibility (free cash flow payout ratio)

A company that pays out too much of its free cash flow in dividends could be at risk of a cutback, particularly if business weakens. We want to see sustainable payouts, so lower is better:

CMI Cash Dividend Payout Ratio (TTM) data by YCharts.

Winner: Cummins, 3-2.

Bonus round: opportunities and threats

Cummins may have won the best-of-five on the basis of its history, but investors should never base their decisions on past performance alone. Tomorrow might bring a far different business environment, so it's important to also examine each company's potential, whether it happens to be nearly boundless or constrained too tightly for growth.

Cummins opportunities

Nissanchose Cummins' turbo diesel engine for its next-generation Titan pickups.

Cummins-Westport tripled its engine sales in the third quarter and increased revenue by 57% in 2013.

New emission standards in Europe, China and the U.S. bode well for Cummins' more advanced diesel engines.

New fuel-economy standards for medium and heavy duty trucks in the U.S. will also drive Cummins engine adoption.

Navistar has been aggressively installing Cummins' engines in its International brand trucks.

PACCAR opportunities

PACCAR increased the production of its 13-liter engine for Peterbilt and Kenworth trucks.

PACCAR expects strong demand for heavy-duty trucks thanks to improvement in the auto and housing sectors.

PACCAR's SuperTruck boasts greatly improved fuel economy and freight efficiency.

UPS, FedEx, and Lowe's all plan to replace much of their fleets with natural gas-powered trucks.

PACCAR started building DAF trucks in Brazil last year and has big plans for growth there.

Cummins threats

PACCAR's MX is emerging as a serious threat to Cummins in the heavy-duty engine market.

Cummins had to recall more than 25,000 engines, including some Cummins-Westport 12-liter natural gas engines.

Cummins' on-highway engine unit sales are expected to decline in some key geographic markets.

PACCAR threats

Navistar's heavy-duty trucks with Cummins' engines could steal PACCAR's market share.

Ford's F-450 and F-550 pickups are enjoying strong interest in the medium-duty segment.

One dividend to rule them all

In this writer's humble opinion, it seems that Cummins has a somewhat better shot at long-term outperformance, thanks to its dominant position in heavy-duty diesel and natural gas-powered engines. Cummins might compete with PACCAR in engine sales, but the latter company is still one of Cummins' largest customers, and that's unlikely to change anytime soon. Furthermore, tightening global emissions and fuel-economy standards are Cummins advantages, thanks to its technological lead in developing more efficient engines. However, Cummins' growth potential is still tied in no small part to demand for PACCAR heavy-duty trucks, which is still expected to rise in the near term. PACCAR could pose serious threats to Cummins should its own engine division narrow the performance gap, and its SuperTruck and natural gas-powered trucks should both produce sustainable sales growth in the near future.

Since both companies do rely on each other for a great deal of components and sales, investing in both might even be the best option in this case. You might disagree, and if so, you're encouraged to share your viewpoint in the comments below. No dividend is completely perfect, but some are bound to produce better results than others. Keep your eyes open -- you never know where you might find the next great dividend stock!

Looking for more great dividend stocks? Look no further...

One of the dirty secrets that few finance professionals will openly admit is the fact that dividend stocks as a group handily outperform their non-dividend-paying brethren. The reasons for this are too numerous to list here, but you can rest assured that it's true. However, knowing this is only half the battle. The other half is identifying which dividend stocks in particular are the best. With this in mind, our top analysts put together a free list of nine high-yielding stocks that should be in every income investor's portfolio. To learn the identity of these stocks instantly and for free, all you have to do is click here now.

The article Cummins, Inc. vs. PACCAR, Inc.: Which Stock's Dividend Dominates? originally appeared on Fool.com.

Alex Planes has no position in any stocks mentioned. The Motley Fool recommends and owns shares of Cummins, Ford, PACCAR, and Westport Innovations. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.