Does ExxonMobil Corporation's Dividend Have Room to Grow?

ExxonMobil 's dividend policy hits all the right notes. The petroleum products giant offers a 2.7% yield, right in line with the average yield on the Dow Jones Industrial Average . And it's doing so despite crushing the Dow in straight-up market performance over the last decade.

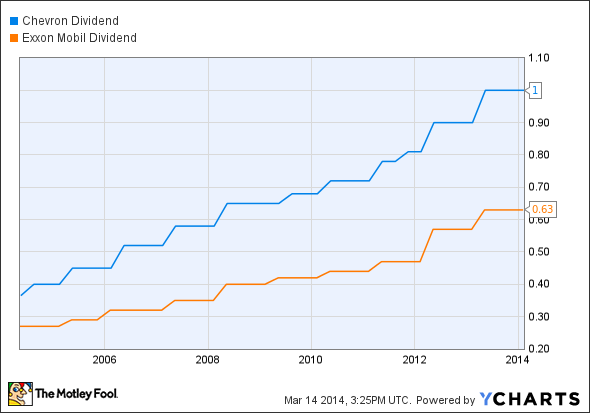

Keeping the dividend strong in the face of skyrocketing share prices takes a serious commitment to payout growth, and Exxon delivers in spades there, too:

XOM Dividend data by YCharts.

Exxon dividends have grown an average of 8.8% a year since 2004, not even taking a break for the 2008 economic meltdown. That's fantastic, and income investors love Exxon for good reason.

But does Exxon's dividend have any room to keep on growing from here?

At first glance, the answer looks like a slam-dunk "Yes, sir!" In 2013, Exxon spent $10.9 billion on dividend payments out of $32.6 billion in net income. That's a very comfortable 33% payout ratio, leaving lots of headroom for further growth.

But things get more complicated if you look at Exxon's cash flow instead. The company only saw $11.2 billion of free cash flow last year, thanks to a massive $33.7 billion in capital expenses. Oil exploration and exploitation is a capital-intensive game, especially as alternative methods such as fracking and converted oil sands become more important to Exxon's big picture.

XOM Cash Dividend Payout Ratio (TTM) data by YCharts.

So Exxon's cash payout ratio is spiking sky-high right now. The ratio actually shot past 100% in 2010, but came back down thanks to fiscal discipline and stabilizing global oil prices.

These spikes are something to keep in mind, but are not necessarily deal breakers. Exxon seems comfortable with raising dividend payments in good times or in bad, and it didn't let a lack of cash flow support hold the dividend back in 2010, either.

With an extremely liquid business model (no pun intended ... well, maybe just a little), Exxon has the freedom to let dividend payments and other cash flow items bob and weave a bit. Exxon also has $24 billion in cash reserves to tide over any short-term cash needs.

At the end of the day, Exxon has delivered annual dividend increases for 31 years running and management takes pride in shareholder-friendly policies. At the analyst day in early March, CEO Rex Tillerson pointed out that Exxon funneled 50% of operating cash flow into dividends and stock buybacks over the last five years -- doubling the payout ratio of closest competitor Chevron .

Chevron is no slouch in the divided department, either. Committing that much more to dividends and buybacks when compared to a strong rival speaks volumes about Exxon's policies.

CVX Dividend data by YCharts.

Exxon might have to pump the brakes on dividends when global oil supplies run out, but there's no reason to worry about dividend growth headroom until then. This company is committed to big and rising payouts, with or without support from strong cash flow.

What's OPEC's worst nightmare? (Hint: It's not Exxon or Chevron)

Imagine a company that rents a very specific and valuable piece of machinery for $41,000... per hour (that's almost as much as the average American makes in a year!). And Warren Buffett is so confident in this company's can't-live-without-it business model, he just loaded up on 8.8 million shares. An exclusive, brand-new Motley Fool report reveals the company we're calling OPEC's Worst Nightmare. Just click HERE to uncover the name of this industry-leading stock... and join Buffett in his quest for a veritable LANDSLIDE of profits!

The article Does ExxonMobil Corporation's Dividend Have Room to Grow? originally appeared on Fool.com.

Anders Bylund has no position in any stocks mentioned. The Motley Fool recommends Chevron. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.