The Dow Bounced Back 5 Years Ago -- Led by Bank Stocks

Time flies when you're having fun.

Five years ago today, the Dow Jones Industrial Average saw a serious turning point in the then-ongoing subprime-and-Lehman Brothers meltdown. Citigroup , which was a Dow member at the time, said it had actually seen a profit through February of that year, instantly restoring some faith in the crippled banking system. The Dow closed 5.8% higher that day, and never looked back at 6,500 again.

Citigroup shares jumped 17% on the same news. Bank of America , which also was a Dow member five years ago, soared 10% higher. JPMorgan Chase , which still holds its Dow seat, raced 12% higher. It was a good day to own financial stocks, for the first time in several months.

Almost exactly six months after Lehman's 2008 bankruptcy filing, the Dow had lost 41% of its value. And that's where the long climb back to healthier returns started in earnest.

This is also a useful reminder of Baron Rothschild's recommendation to buy when there's "blood in the streets."

If you smelled the market bottom and invested five years ago, you'd be enjoying a 150% return on a straight-up Dow tracker today. For even bigger opportunists, each of the bank stocks mentioned above have at least tripled in value.

True, our own Morgan Housel worried then that Bank of America still could implode like another Lehman, and that the single-digit share prices for most of our major banks just made sense. It takes guts to invest in banks against that backdrop.

But then again, master investor Warren Buffett picked the same week in 2009 to say how much he loved bank stocks: "The banks are getting their money very cheaply, deposits are coming in, spreads have never been wider, all the new business they're doing is terrific. They will earn their way out of it [in the] overwhelming number of cases."

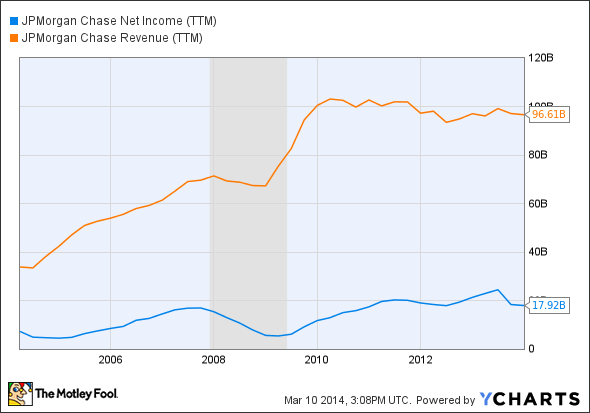

As it turns out, Buffett was right. It didn't take long for the surviving megabanks to earn back their subprime losses, fueling the share-price gains seen in the chart above. Here's JPMorgan's basic performance as an example (with the 2008 recession shaded in):

JPM Net Income (TTM) data by YCharts.

Long story short, five years of perspective makes it much easier to find the investing lessons from the 2008 crash. Keep these nuggets of insight in mind the next time a major market correction rears its ugly head -- it might be another wealth-building blessing in disguise!

Learn more from the world's greatest investor!

Warren Buffett has made billions through his investing and he wants you to be able to invest like him. Through the years, Buffett has offered up investing tips to shareholders of Berkshire Hathaway. Now you can tap into the best of Warren Buffett's wisdom in a new special report from The Motley Fool. Click here now for a free copy of this invaluable report.

The article The Dow Bounced Back 5 Years Ago -- Led by Bank Stocks originally appeared on Fool.com.

Anders Bylund has no position in any stocks mentioned. The Motley Fool recommends Bank of America. The Motley Fool owns shares of Bank of America, Citigroup, and JPMorgan Chase. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.