How Good Faith Estimates Help You Shop Mortgages

By AJ Smith

When buying your first home, you'll have lots of lingo to get caught up on quickly. Understanding the process can help limit the surprises during what is likely the biggest purchase you have ever made in your life. A good faith estimate can help.

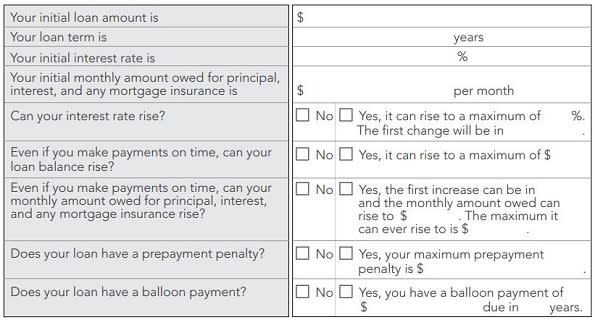

A good faith estimate approximates the final cost of completing the purchase of a property. It is supplied by potential lenders so you can best compare mortgage options. The lender must give you a good faith estimate within three days of you making a loan application (not including Sundays or legal holidays). Once the lender provides the estimate (an excerpt of the form is shown below), it is bound by the terms except under certain circumstances.

What It Tells You: A good faith estimate will tell you the total origination fee of the lender. It will also show all other settlement charges that involve third parties like the appraisal, title insurance, attorney fees, etc. So looking at multiple good faith estimates should give you an idea of the difference in cost by lender. The GFE will also show the interest rate associated with the potential mortgage. If the rate is locked, it will also show the expiration date.

%VIRTUAL-pullquote-While the terms in a good faith estimate are binding, providing one does not bind a lender to a borrower.%The estimate will indicate whether the rate is fixed or variable. A summary of the loan will list the principal and interest, as well as mortgage insurance if applicable, but may not be the total payment you will owe. For example, if you are rolling your taxes and insurance into your mortgage payment, that will not be reflected in the loan summary portion of the GFE.

When It Can and Cannot Change: The lender is legally bound to the fees listed on the good faith estimate they provided, but it is an approximation. While the origination fee cannot change at closing, the third-party fees can be changed by up to 10 percent of the initial quote.

If the borrower's requests change, the GFE is no longer valid. The lender must supply a revised GFE containing the new terms within three days.

The same is true if the terms of the good faith estimate expire. While the terms in a good faith estimate are binding, providing one does not bind a lender to a borrower. The lender does not have to continue the lending process with someone who is not eligible to get a mortgage from their institution.

More from Credit.com about homebuying:

Why You Should Check Your Credit Before Buying a Home

How to Search for Your Next Home

The Ultimate Mortgage Glossary

More on AOL Real Estate:

Find out how to calculate mortgage payments.

Find homes for sale in your area.

Find foreclosures in your area.

Find homes for rent in your area.

Follow us on Twitter at @AOLRealEstate or connect with AOL Real Estate on Facebook.