Could Verizon's Dividend Double?

The telecom sector is an income investor's dream. Multiple companies offer yields of at least 4%, and each company offers its own positive and negative attributes. However, when it comes to Verizon Communications , there are several reasons to believe that this company's dividend could easily double in the future.

The growth driver that everyone knows

It's no secret that Verizon Wireless has been a big driver behind the company's growth in the past, and will continue to be in the future. With Verizon taking total control of this division, investors should expect even better results from Verizon Wireless.

Verizon Wireless seems to consistently outperform its peers and, in particular, AT&T . In each company's recent quarter, Verizon grew wireless revenue by nearly 6% compared to AT&T Wireless' revenue increase of less than 5%. Verizon also reported a higher operating margin at nearly 30% compared to AT&T's 21% margin. Verizon's postpaid additions grew faster and the company reported a lower rate of churn.

No longer distracted

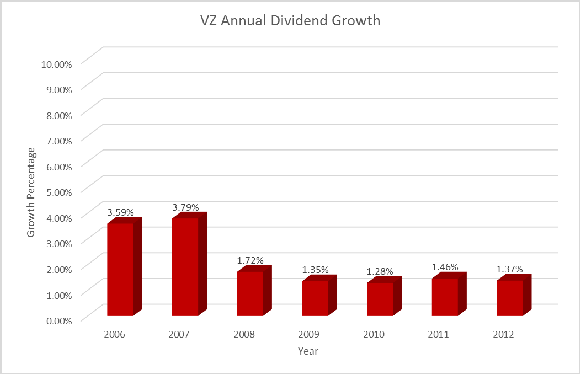

Now that Verizon Wireless will be wholly owned by Verizon, the company can focus on growing this business, rather than managing it to make payouts to Vodaphone. If you look at Verizon's dividend growth rate over the last several years, you can almost see the company being conservative because it knew a dividend to Vodaphone was expected.

Source: NASDAQ.com

With dividend increases in the last few years hovering below 1.5%, investors haven't had a lot to cheer about. Some investors might even think that going with a higher-yield stock would make sense. A local telecom like CenturyLink might be a good candidate.

CenturyLink offers a yield of nearly 7%, and as of last quarter had a core free cash flow payout ratio of roughly 52%. The company appears to be improving its operations, as revenue declined only slightly and management is forecasting strong free cash flow next year as well.

However, the difference between CenturyLink and Verizon is that Verizon is expected to grow its earnings by about 10% annually over the next few years, whereas CenturyLink is expected to see a 1% decline in this same time frame. As Verizon's earnings increase, the company should be able to grow its dividend, whereas CenturyLink's dividend isn't expected to increase anytime soon.

How could the dividend double?

The claim that Verizon's dividend could double is based on a few factors. First, Verizon's payout ratio is significantly lower than its peers. In the last three years, Verizon's average core free cash flow payout ratio has been just under 38%.

In the current quarter, Verizon's payout ratio dropped to just over 25%. By comparison, we already know that CenturyLink's ratio was 52%, and AT&T's payout ratio was just under 61% last quarter. Most investors would suggest that a payout ratio of 60% or less in the telecom sector is a sustainable number. Of course the caveat is that Verizon is issuing about $60 billion in stock to purchase the part of Verizon Wireless it doesn't already own. In theory this stock distribution would increase Verizon's outstanding shares by about 30%.

However, keep in mind during the last few years, Verizon Wireless has distributed $4.5 billion to Vodaphone in 2011, $4.5 billion in 2012, and just over a $3 billion dividend to Vodaphone in 2013. With Verizon owning the whole company going forward, this would have allowed Verizon to keep this $12 billion in-house.

In the last 12 months, Verizon generated $23.5 billion in core free cash flow and paid $5.9 billion in ordinary dividends. With 30% more shares, Verizon would have needed $7.7 billion to cover its dividend outlay. Given the company's cash flow, the new payout ratio would still be relatively low at 32.8%. In order for Verizon's dividend to double, the company would have to pay $15.4 billion in dividends. With $23.5 billion in free cash flow, this would equate to a core free cash flow payout ratio of about 66%. While a 66% ratio would be significantly higher than today, AT&T's ratio is already at 61%, and it's not unusual to see payout ratios of 60% or more in the telecom sector in particular.

Given Verizon's strong growth prospects and cash flow generation, it's plausible that the company could grow its payout ratio to 66%. The stock carries a yield of roughly 4.5% today. If the payout ratio was 66%, Verizon would offer investors a 9% yield at current prices. With an expected earnings growth rate of 10% per annum in the next few years, Verizon already looks like a good buy. If the company is aggressive with its dividend growth after the Vodaphone deal, investors could be in for a big surprise.

I wouldn't suggest waiting to see if the company's dividend doubles, add Verizon to your buy list today.

You can profit from the smartphone wars

Want to get in on the smartphone phenomenon? Truth be told, one company sits at the crossroads of smartphone technology as we know it. It's not your typical household name, either. In fact, you've probably never even heard of it! But it stands to reap massive profits NO MATTER WHO ultimately wins the smartphone war. To find out what it is, click here to access the "One Stock You Must Buy Before the iPhone-Android War Escalates Any Further..."

The article Could Verizon's Dividend Double? originally appeared on Fool.com.

Chad Henage owns shares of CenturyLink and Verizon Communications. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.