Molina's Big Problem: Too Much Demand

Molina Healthcare , the private Medicaid insurer, has a big problem on its hands. So many people are signing up for Medicaid insurance that the company is spending big money hiring new people to serve them.

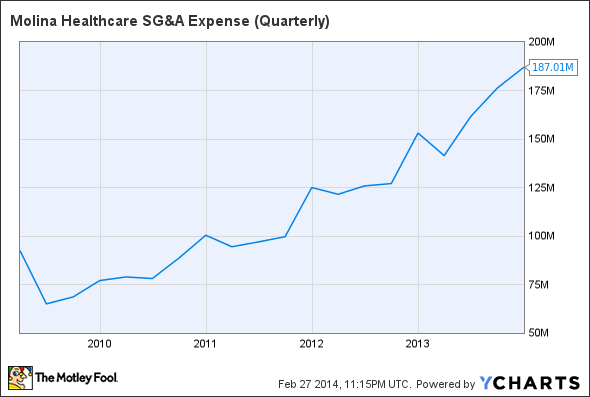

As a result, the company's quarterly selling, general, and administrative, or SG&A spending has jumped more than $50 million since the middle of 2012. That increase is one reason why Molina's operating costs have climbed from $5.87 billion in 2012 to $6.45 billion in 2013.

MOH SG&A Expense (Quarterly) data by YCharts

Razor thin margin

Molina's Medicaid focus means it isn't as profitable as other insurers. The medical care ratio for treating Medicaid patients is substantially higher than individual and commercial markets. In 2013, for example, a medical care ratio of 87% led to anemic margin of just a shade above 2% -- far less than the over 7% margin posted by the more diversified insurance giant United Healthcare .

MOH Operating Margin (TTM) data by YCharts

That skin-tight margin means the industry is unquestionably a business of volume. Historically, that volume came from competitors like Molina , WellCare and Centene under-bidding one another.

In the spring of 2012, for example, Aetna and Meridian Health Plan under-bid Molina , Centene , and WellCare , to win Ohio's Medicaid business. It wasn't until Molina and Centene filed appeals challenging the bidding process that they were reinstated and Aetna and Meridian were dropped.

While competitive bidding will remain a major source of risk and reward for the industry, the Affordable Care Act, also known as Obamacare, has opened up Medicaid coverage to millions of new people, in turn giving private Medicaid insurers one of their biggest gifts since Medicaid managed care was created in the 1980s. That means Molina , WellCare , and Centene have an opportunity to grow without cannibalizing each another.

That expansion has already resulted in more than 3 million people signing up for Medicaid since health care.gov went live last fall, and analysts estimate more than a million of them are newly eligible thanks to reform.

Growing sales opportunity

Molina racked up $6.58 billion in sales during 2013, up from $5.9 billion in 2012. Fourth quarter sales totaled $1.7 billion, up from $1.58 billion a year ago. That represents solid growth, but even better growth may be coming.

In February, Molina issued guidance calling for total revenue reaching $9.9 billion in 2014. If all goes as planned, that revenue spike will translate into earnings per share of between $4 and $4.50 per share, well north of the $3.13 the company earned in 2013, and significantly above the $1.72 Molina earned in 2012.

That revenue and profit advance is being driven by Medicaid enrollment, which has grown to more than 2.1 million people across California, Florida, Illinois, Michigan, New Mexico, Ohio, South Carolina, Texas, Utah, Washington, and Wisconsin as of the end of February. That's up from 1.9 million members at the end of December.

Washington and California remain Molina's most important markets, representing nearly 40% of its Medicaid members. That's important, because both these states embraced Obamacare's Medicaid expansion. California is reporting more than 1.5 million people have enrolled or been found eligible for its Medi-Cal Medicaid program since October 1st. And more than 300,000 people signed up for new coverage in Washington's Medicaid program between October and February 25th -- including 200,000 who were newly eligible, and 100,000 who were previously eligible but hadn't previously signed up.

Medicaid enrollment is also growing in two other large Molina markets, Michigan and Ohio. Combined, those two states make up 20% of Molina's membership. That means four of Molina's top five markets have expanded Medicaid, with only Texas choosing not to.

That's a sharp contrast to competitor Centene , which does a lot of business in Texas, Georgia, Florida, and Mississippi -- all states that have not expanded Medicaid (although Florida still might).

It's also in contrast to WellCare , whose top two markets include Georgia, which didn't expand coverage, and Florida. WellCare's third biggest market, however, is Kentucky, one of the most successful states in signing up new recipients. As a result, the number of people covered by WellCare in Kentucky grew to 292,000 in December from 207,000 a year ago.

Fool-worthy final thoughts

I believe that Molina's presence in states that have embraced Medicaid reform will drive enrollment and revenue significantly higher this year. Despite rising spending tied to serving these new Medicaid participants, Molina still estimates earnings will grow by at least 28% this year. That's kind of growth makes Molina's demand problem enviable.

Looking for other stocks in a potential growth spurt?

They said it couldn't be done. But David Gardner has proved them wrong time, and time, and time again with stock returns like 926%, 2,239%, and 4,371%. In fact, just recently one of his favorite stocks became a 100-bagger. And he's ready to do it again. You can uncover his scientific approach to crushing the market and his carefully chosen six picks for ultimate growth instantly, because he's making this premium report free for you today. Click here now for access.

The article Molina's Big Problem: Too Much Demand originally appeared on Fool.com.

Todd Campbell has no position in any stocks mentioned. Todd owns E.B. Capital Markets, LLC. E.B. Capital's clients may or may not have positions in the companies mentioned. Todd owns Gundalow Advisors, LLC. Gundalow's clients do not have positions in the companies mentioned. The Motley Fool recommends UnitedHealth Group. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.