Should You Be Worried About Soaring Bank Closures?

In 2011, boston.com published an article suggesting, "For the first time in 15 years, banks across the United States are closing branches faster than they are opening them."

Here we are four years later and banks are continuing to trim back locations at a remarkable rate. In fact, SNL Financial suggested, "Banks collectively reduced the U.S. branch total by 1,487 locations in 2013."

Source: SNL Financial.

Banks cutting branches

Bank of America led all banks lowering its branch count by 189, and PNC wasn't far behind lowering its count by 160.

PNC CEO William Demchak noted the company improved its efficiency ratio to 61% from 68% last year. While this is a significant improvement, Demchak explained, "[O]ur expenses are higher than they should be and we're focused on doing something about it."

Bank of America's CEO Brian Moynihan is also doing something, and that's observing customer behavior. According to Moynihan, over-the-counter transactions are down, while ATM, online, and mobile have been rising.

It's clear the industry is changing, and more customers are banking online. This should give investors confidence that scaling back branches won't hurt bank's long-term future.

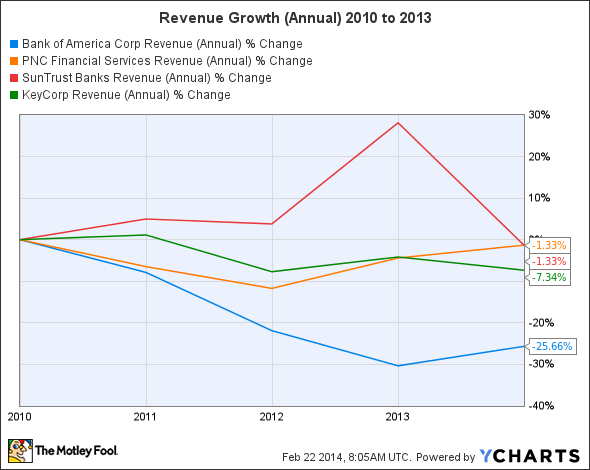

Cost-cutting and profitably, however, are also at the core of reducing branch count. This is because of the four banks with the most closures in 2013, not one has positive revenue growth since 2010.

Bank of America revenue data by YCharts.

Banks adding branches

According to SNL Financial, JPMorgan Chase and Huntington Bancshares have been able to buck the tide of higher compliance costs and a slow loan growth, raising total branch count by 34 and 8, respectively.

Among the banks that increased branch count in 2013, JPMorgan is the outlier. According to CFO, Marianne Lake, there were a few holes to fill in California and Florida, but the bank suggested it's now satisfied with its current footprint.

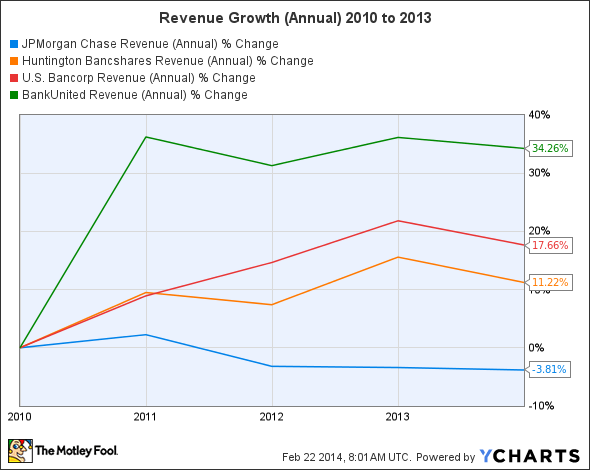

Huntington Bank, on the other hand, looks primed to continue growth. It's a very strong regional bank with top-rated customer service, and one of the best at cross-selling customers. Moreover, Huntington Bank, along with US Bancorp and BankUnited, was able to grow revenue since 2010 -- despite significant headwinds.

JPMorgan Chase revenue data by YCharts.

Should investors be worried about bank closures?

A number of the healthiest banks are decreasing branch counts. With that said, there are signs investors shouldn't be too worried. One, in particular, is deposit growth.

According to Moynihan, "Deposit levels continue to reach records each quarter." PNC, similarly, grew deposits by 4% year over year. This is a great sign that customers aren't running for the hills due to decreasing branch counts. The industry's push toward greater efficiency should, ultimately, allow banks to be in the best position to prosper as the economy continues to strengthen.

Which banks are the best buys?

Looking at the market as a whole, I believe some of the best values lie in the financial sector. While some banks are adding branches and others are trimming back, I see value across the board.

In particular, I like Huntington Bancshares customer-centric approach and growth potential. And on the other side, Bank of America is trading at a favorable valuation, has a very strong market position, and an industry-leading wealth management segment.

Big Banking's Little $20.8 Trillion Secret

Do you hate your bank? If you're like most Americans, chances are good that you answered yes to that question. While that's not great news for consumers, it certainly creates opportunity for savvy investors. That's because there's a brand-new company that's revolutionizing banking, and is poised to kill the hated traditional brick-and-mortar banking model. And amazingly, despite its rapid growth, this company is still flying under the radar of Wall Street. For the name and details on this company, click here to access our new special free report.

The article Should You Be Worried About Soaring Bank Closures? originally appeared on Fool.com.

Dave Koppenheffer has no position in any stocks mentioned. The Motley Fool recommends Bank of America. The Motley Fool owns shares of Bank of America, Huntington Bancshares, JPMorgan Chase, and PNC Financial Services. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.