A Lesson in Rebounding from Bad Investments, Illustrated by J.C. Penney

If you're an investor, at some point, at least one of your investments will turn out to be a colossal failure. In fact, it's quite likely that over your lifetime, you'll invest in multiple companies that don't live up to the expectations you had at the time you bought their stock.

When an investing flop happens to you, you'll want to be in a position to simply lick your wounds and move on, with no real impact to your life. But to do that, you'll have to set up your portfolio in advance to be able to handle those failures successfully.

Can You Tell in Advance?

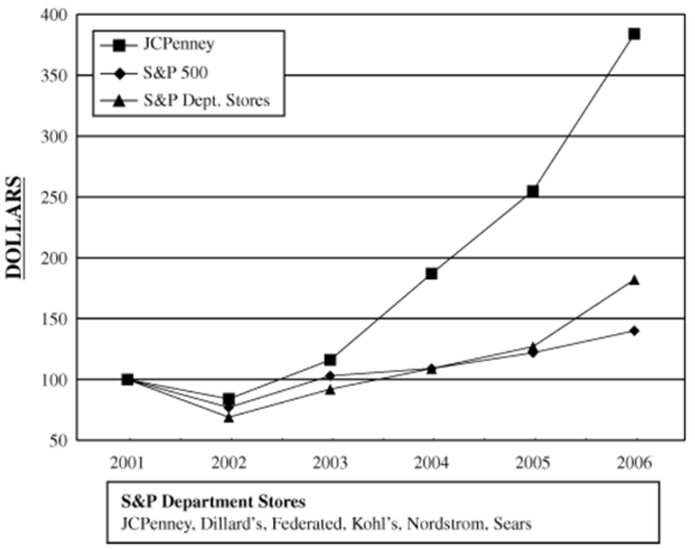

Take clothing retailer J.C. Penney (JCP) as an example of a company that may now be on the road to bankruptcy. Its cash flow problems and debt hangover are incredibly apparent today, but it wasn't so long ago that it looked like it had a solid future. Its shares peaked above $86 in February 2007, and its annual report published in 2007 included the chart below showing how an investment in J.C. Penney trounced the market over the prior five years:

Indeed, J.C. Penney had a lot to be proud of in its heyday. In that same annual report, it boasted of earning $4.96 a share in profits and raising its quarterly dividend to 20 cents a share. Unfortunately, as we all know, the retailer's fortunes have changed dramatically for the worse. J.C. Penney hasn't paid a dividend since 2012. In addition, the company's recent announcement that it closed the fiscal year with more than $2 billion in liquidity simply calls attention to how precarious its situation is. Its stock has tumbled to the neighborhood of $5.

While there's still a chance that J.C. Penney can turn itself around and avoid bankruptcy, at this point, it'll certainly be an uphill battle. But still, to an investor looking at the company in early 2007, J.C. Penney looked like a decent growth story, not a potential disaster.

What Can You Do About It?

Unless you've got a working crystal ball, you've got almost no chance to sell at the high-water mark of any company's stock. Instead, one of the best things you can do is diversify your investments so that the fallout from any one company's failure doesn't destroy your overall portfolio.

%VIRTUAL-article-sponsoredlinks%Until December, for instance, J.C. Penney was a member of the S&P 500 Index (^GSPC). The S&P 500 and the SPDR (SPY) ETF that tracks it had a stellar 2013, even as J.C. Penney was busy falling apart as a member of that index.

Diversification won't keep you from making investments that go bad, but what it can do is protect your overall portfolio from the implosion of any one part of it. The difference between how J.C. Penney performed and how the S&P 500 performed in 2013 is a key case in point of how diversification can protect your portfolio.

In addition to diversifying, you should regularly review each of your investments to make sure it's still worth owning and still playing an appropriate role in your portfolio. If you buy individual stocks and bonds, you need to make sure the companies behind those investments are still operating to expectations and are reasonably valued in the market. If you buy funds, you still need to rebalance to keep any fund or asset class from growing to be a disproportionately large part of your overall portfolio.

The Foundation of a Decent Plan

No matter how you invest, the one-two-three combo of diversification, review and rebalancing plays an important role in protecting your portfolio from the catastrophic failure of any one part of it. Still, there are times when the overall market will swoon and reduce the value of darn near everything you own. For those times, you need the patience to let the market do its thing and the confidence in the long-term strength of your overall strategy to see you through. With an overall plan built in a way that protects you from getting wiped out from the inevitable failure of part of your portfolio, that patience and confidence is a lot easier to achieve.

Motley Fool contributor Chuck Saletta has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.