3 Quotes Reveal Why This Company Is Ahead of Its Better-Known Peers

There is one social network that has seen astounding growth over the last year and may be poised for even more growth in 2014 and beyond.

Do investors "like" the wrong company?

Press wires have been abuzz lately over the Facebook acquisition of WhatsApp for $19 billion. While many have questioned the underlying financials behind the deal, the often-cited 450 million active WhatsApp users is one key point being used to justify the astounding price. Yet those questioning the deal point to the top line revenue of just $20 million to suggest the acquisition is destined to fail.

Many who are enthusiastic about Facebook point to the fact it has been able to churn profits -- $1.5 billion in 2013. The same can't be said of other social networking darling Twitter , which lost a staggering $645 million in 2013 despite logging revenue of $665 million. Even its adjusted income -- which factors out stock-based compensation and other expenses -- still posted a net loss of $34 million.

While it may not be as glamorous as Facebook and Twitter, or draw the same enthusiasm from investors, three quotes from its management team show why LinkedIn (NYSE: LNKD) is a compelling investment consideration.

A true global network

Starting with CEO Jeff Weiner:

Last year we also made significant progress connecting the world's professionals and helping them build their networks. LinkedIn added nearly 75 million members in 2013, the largest single year gain in the Company's history. More than 70% of them came from outside the US, bolstering our status as a true global network.

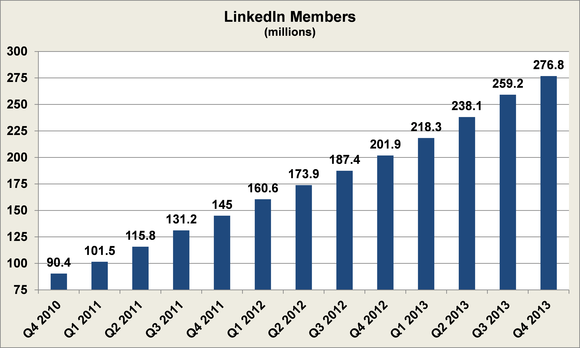

Despite its common standing as the go-to and essentially only social network for professional purposes in the United States, the company has still been on an incredible streak of member-base growth over the last three years:

Source: Company investor relations.

Some may worry that its rate of adding members is slowing -- year over year growth in membership went from 60% in 2011 to 37% in 2013. That is an unjustified concern, as it actually grew membership by the 75 million Weiner noted for 2013, versus 57 million in 2012 and 55 million in 2011.

Another critical thing to note is the global expansion of LinkedIn's users, more than 66% of whom are now located outside of U.S. A key consideration in any investment in a richly valued company is its expansion and growth potential; that LinkedIn is both rapidly expanding and still has room for global growth is certainly worth noting.

Value creation and delivery

Weiner again:

The value we deliver to members remains consistent. We enable professionals to build and manage their identities, create and leverage their professional networks and gain the knowledge they need to be more successful in their careers across multiple screens and devices.

Although LinkedIn saw its earnings improve 20% -- from $21.6 million to $26.8 million -- the results were even more impressive when considered on an adjusted basis, in which earnings grew an astounding 92% from $100 million in 2012 to $192 million in 2013. And while its revenue growth was impressive, jumping from $972 million to more than $1.5 billion, even more noteworthy was the increase in its margin from 7% in 2011, to 10% in 2012, to 13% in 2013.

One of the unique things about LinkedIn is that it provides value to both individuals and institutions. It allows individuals to maintain professional networks and find jobs, while enabling institutions to successfully find the best people for open jobs. This is one key reason why both individual membership grew 37% year over year in 2013, but its corporate solutions customers rose by almost 50%.

All of this indicates LinkedIn is able to create and maintain value to its customers and clients, which ultimately translates to value for its shareholders.

A compelling future

Chief Financial Officer Steve Sordello:

We ended 2013 in a strong position across engagement and monetization, and we are investing aggressively in 2014 for both our member and customer platforms. We are making several key investments including China, jobs relevancy and scale and the publishing platform.

Certainly LinkedIn's performance over the last few years is distinctly admirable, but the company is clear in its understanding that more needs to be done to ensure its lasting value, and is prepared to make the necessary investments to ensure growth continues.

Weiner noted that 2014 was an "inflection point," for the company, and all signs are pointing to it being a year in which LinkedIn is poised to continue its torrid growth. While it is undeniably expensive -- trading at almost 80 times expected 2015 earnings -- LinkedIn certainly appears to have a bright future.

The technological banking revolution

LinkedIn changed the way companies make hiring decisions and people find new jobs, but an even bigger shift is ahead in the banking industry. That's because there's a brand-new company that's revolutionizing banking, and is poised to kill the hated traditional brick-and-mortar banking model. And amazingly, despite its rapid growth, this company is still flying under the radar of Wall Street. For the name and details on this company, click here to access our new special free report.

The article 3 Quotes Reveal Why This Company Is Ahead of Its Better-Known Peers originally appeared on Fool.com.

Patrick Morris has no position in any stocks mentioned. The Motley Fool recommends Facebook, LinkedIn, and Twitter. The Motley Fool owns shares of Facebook and LinkedIn. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.