The Gap Inc. Follows Costco's Lead

The Gap isn't only brave, but ahead of the curve. It might have even started a talent war in retail. The practice of paying employees more than peers has been proven to be effective by another retailer, Costco Wholesale (NASDAQ: COST) and this could have major ramifications for Foolish investors.

Higher pay means improved results

Prior to Gap announcing that it will raise its minimum hourly pay to $9 per hour this year and $10 per hour next year, Costco stood out from other retailers. Interestingly, no retailer stopped to think that this approach could also work for them. and this count have major ramifications for Foolish investors.

As a discount retailer, Costco should be less able to afford higher pay for its employees. However, the company currently sports a profit margin of 1.92%. Not sensational, but with consistent top-line growth it gets the job done. Costco also strongly believes that paying its employees well has a lot to do with its success. It leads to increased production, better customer service, and lower turnover. Average pay for hourly cashier at Costco: $15.05 per hour (via Glassdoor.com.)

Gap has a profit margin of 8.12%. Therefore, it can better afford to pay its employees than Costco. However, Gap likely isn't planning on suffering profit declines. Like Costco, Gap believes that increased pay for its employees will lead to increased production, improved customer service, and lower turnover.

Perhaps most important is that Gap will now attract the best talent in the industry. Fortunately for Gap, there are no laws or rules banning the monopolization of talented workers. If Gap attracts the best talent, then sales should increase (potentially more than offsetting higher labor costs.) Thanks to higher pay, the retention rate should be high as well. If all goes according to plan, Gap will have a significant edge over its peers.

A chart tells a story

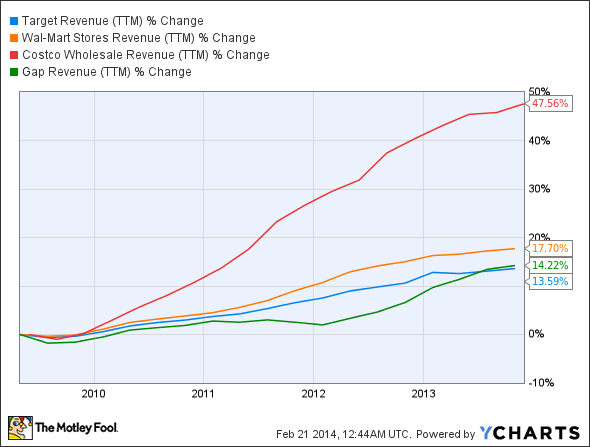

If Costco paid its employees the same way that Wal-Mart Stores and Target paid its employees, do you think the customer experience would be as good? Do you think membership would consistently increase? Do you think the five-year revenue comparison chart below would look like this?

TGT Revenue (TTM) data by YCharts

Costco is clearly outperforming its peers. Gap wasn't placed on that chart to be compared to Wal-Mart, Target, and Costco, but to show you that a successful company has a chance of future market share gains and top-line improvements.

Job impact

According to Gap, its minimum wage increase has the potential to raise pay for 65,000 to 90,000 people across all of its brands. At the same time, the Congressional Budget Office recently stated that raising the national minimum wage to $10.10 could reduce unemployment by 0.03% and help approximately 500,000 people.

These numbers don't add up. It seems highly unrealistic that one retailer -- Gap -- is capable of affected up to 90,000 people while raising the minimum wage to $10.10 would only impact 500,000 people overall nationwide. Either the Congressional Budget Office isn't predicting the numbers correctly or a minimum wage hike to $10.10 will have a very small impact on the economy.

As far as Gap goes, its recent minimum wage increase isn't political whatsoever. Gap launched its reserve-in-store initiative (allows customers to pick up items that were reserved online) well over one year ago, and to put it bluntly, Gap wants quality people to upsell customers when they visit the store. However, Gap's recent move hourly rate increase goes much deeper. As stated above, it wants to lock up the best talent in the industry.

The Foolish takeaway

Gap is taking the initiative. Companies like this tend to outperform their peers over the long haul. If you're the type of person who likes to bet with the more aggressive company, willing to go out swinging if it doesn't work out, then Gap might be for you. Please do your own research prior to making any investment decisions.

Other high-potential opportunities in retail....

To learn about two retailers with especially good prospects, take a look at The Motley Fool's special free report: "The Death of Wal-Mart: The Real Cash Kings Changing the Face of Retail." In it, you'll see how these two cash kings are able to consistently outperform and how they're planning to ride the waves of retail's changing tide. You can access it by clicking here.

The article The Gap Inc. Follows Costco's Lead originally appeared on Fool.com.

Dan Moskowitz has no position in any stocks mentioned. The Motley Fool recommends Costco Wholesale. The Motley Fool owns shares of Costco Wholesale. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.