Health Wars: How Coca-Cola and PepsiCo Tackle the Health Craze

PepsiCo and Coca-Cola are under fire for selling unhealthy beverages in a country that has become increasingly obsessed with healthy living. PepsiCo CEO Indra Nooyi gave her company a head start on the health trend by investing in products like oatmeal bars, hummus, and yogurt while de-emphasizing soft drinks. The move led to startling declines in PepsiCo's U.S. soft drink market share, but it forced Coca-Cola to play catch-up in the healthy-products market. With PepsiCo winning the health war and Coca-Cola still dominating the soft drink market, investors are anxious to determine which strategy will produce better results.

A big bet on healthy

PepsiCo's nutrition portfolio consists of two broad classes: Good-For-You and Better-For-You. Good-For-You includes food that is actively nutritious, including Quaker oatmeal, Tropicana orange juice, and Naked Juice. Better-For-You products contain levels of fat, sodium, or sugar that are in-line with government dietary guidelines. This includes products like Fritos bean dip, Baked Lays, and Lipton Tea. PepsiCo also entered the fast-growing yogurt category through a joint venture with Theo Muller -- a German dairy giant -- via its wholly owned subsidiary, Quaker Foods North America.

The leaders in PepsiCo's nutrition portfolio include Quaker, Gatorade, and juice drinks. The company is a leader in each of these categories; it is No. 1 in hot cereals, No. 1 in sports drinks, and No. 2 in juice drinks. The entire nutrition portfolio accounts for about 25% of PepsiCo's overall revenue and is expected to grow faster than the overall beverage business.

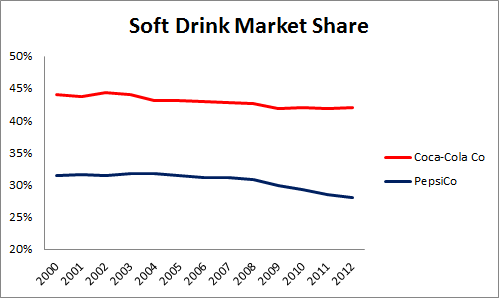

However, the consequences of PepsiCo's push into nutrition are not yet clear. Ever since Nooyi took over as PepsiCo's CEO in 2006, she has advocated a strong push into healthier foods and beverages. Although she successfully expanded the company's portfolio of nutritious products, Nooyi seems to have taken her eye off of the soft drink business. Since 2006, Pepsi and Diet Pepsi have dramatically declined in market share relative to their counterparts at Coca-Cola; Coke and Diet Coke are now first and second in soft drink market share, respectively, while Pepsi is fourth and Diet Pepsi is seventh.

Source: Beverage Digest

PepsiCo's decline in the soft drink market is made even clearer by measuring its overall market share. In 2006, PepsiCo had a 31.2% share of the market and Coca-Cola had a 42.9% share. By 2012, PepsiCo's share had declined by 3.1 percentage points to 28.1%, while Coca-Cola's share had declined by just 90 basis points to 42%.

Source: Beverage Digest

The startling decline has left some investors calling for a break-up of the company to separate the relatively healthy snacks business from the suffering beverage business. However, PepsiCo is sticking to its strategy, endeavoring only to increase soft drink advertising to help stem the decline.

Coca-Cola remains committed to soft drinks

Coca-Cola is not blind to the health trend. Coca-Cola's portfolio includes nutritious brands such as Vitamin Water, Smart Water, Minute Maid, Odwalla, and Powerade. Moreover, Coca-Cola recently acquired Zico Coconut Water and purchased a stake in a company that sells protein shakes. Clearly, Coca-Cola takes the health trend seriously.

However, Coca-Cola remains committed to its core offering. 60% of Coca-Cola's U.S. revenue comes from soft drink sales, compared to roughly 25% for PepsiCo. The company's commitment to the soft drink market has enabled it to maintain its soft drink share while PepsiCo falls apart. Coca-Cola's beverage volume remained at the same level through the first nine months of 2013, while PepsiCo's volume declined 4%. In an effort to change its prospects, PepsiCo is investing hundreds of millions of dollars to refocus its advertising on the declining U.S. soft drink business. There is no telling whether PepsiCo can regain its lost market share, or if it is now wholly committed to its nutritious portfolio.

Foolish takeaway

Consumers' desires are changing, so Coca-Cola and PepsiCo are changing as well. PepsiCo is leading the push toward healthier snacks and beverages to the detriment of its soft drink business. Coca-Cola remains focused on its soft drink business while cautiously entering healthier categories. In the short run, Coca-Cola likely has more to gain from its strategy than PepsiCo has to gain from its strategy; however, U.S. consumer trends clearly favor PepsiCo in the long run.

Eventually, Coca-Cola needs to build out a robust portfolio of nutritious products, but it has plenty of time to make the investment. The United States is still the fourth-largest per-capita consumer of Coca-Cola's beverages and consumption is declining at a manageable rate. As a result, both Coca-Cola's and PepsiCo's strategies could pay off for their respective shareholders.

Would Buffett still buy Coca-Cola today?

Warren Buffett has made billions through his investing and he wants you to be able to invest like him. Through the years, Buffett has offered up investing tips to shareholders of Berkshire Hathaway. Now you can tap into the best of Warren Buffett's wisdom in a new special report from The Motley Fool. Click here now for a free copy of this invaluable report.

The article Health Wars: How Coca-Cola and PepsiCo Tackle the Health Craze originally appeared on Fool.com.

Ted Cooper's family investment club owns shares of Coca-Cola. The Motley Fool recommends Coca-Cola and PepsiCo. The Motley Fool owns shares of Coca-Cola and PepsiCo. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.