Facebook Buys WhatsApp for $19 Billion, But Overlooks 3 Big Problems

Facebook recently announced that it was acquiring mobile messaging service WhatsApp for a whopping $19 billion -- the largest purchase in the company's 10-year history. That massive purchase expands Facebook's umbrella to include WhatsApp's 450 million users, 70% of whom use the app on a daily basis.

That deal might sound like a smart way for Facebook to grow its user base -- which consists of 1.23 billion active Facebook users and 150 million active Instagram users -- but the huge premium that it paid for WhatsApp is questionable.

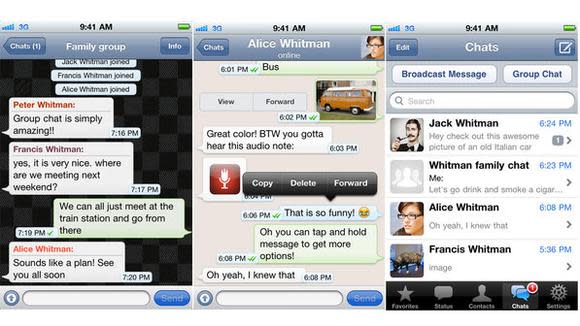

WhatsApp. (Source: Company website)

Let's take a closer look at three big problems with this deal.

1. Redundant cannibalization

Facebook intends to let WhatsApp continue on as an independent service, similar to the course it set Instagram on after purchasing it for $1 billion in 2012.

In my opinion, it would make more sense to merge WhatsApp with Facebook Messenger into a single service, since the two apps directly compete against a fragmented universe of mobile messaging apps, such as LINE, Viber, and WeChat.

Yet the top players in that universe are being acquired by larger companies -- on Feb. 17, Japanese online retailer Rakuten acquired Viber for $900 million. Rakuten's move is similar to Chinese Internet giant Tencent's launch of WeChat in 2011, which it also uses to connect users in its online gaming and e-commerce initiatives.

Rakuten and Tencent's strategies make sense -- they want mobile messaging users to shop online and boost their e-commerce revenue. By comparison, Facebook's strategy makes little sense -- it purchased a redundant, competing service with no plans to assimilate its 450 million users.

2. Fees and value per user

WhatsApp costs a nominal annual fee of $0.99 after its first free year. It's unclear exactly how much revenue WhatsApp generates, but with 450 million users, it's assumed that it can add at least $450 million in annual revenue to Facebook's top line.

However, the $19 billion deal values each WhatsApp user at $42 per user. Here's how that valuation stacks up against leading social networks Twitter , Facebook, and LinkedIn , and mobile messaging app Viber.

Service | Value per user | Total users |

$134 | 646 million | |

$98 | 1.23 billion | |

$93 | 277 million | |

$42 | 450 million | |

Viber | $3 | 300 million |

Source: Forbes, Reuters.

The problem is that Facebook is valuing WhatsApp's user base closer to leading social networks than other mobile messaging services. This apples-to-oranges comparison doesn't make sense for two reasons:

WhatsApp, like other mobile messaging services, uses a user's phone book to locate contacts. Therefore, it's a closed network unlike social networks Facebook, Twitter, or LinkedIn, where other users can search for another user via name or email address.

WhatsApp charges the $0.99 fee because it doesn't want to rely on ad revenue. If Facebook truly wants to let WhatsApp stay independent, then its only real source of revenue will be through user growth.

3. Ignoring its biggest competitor

That brings us to Facebook's core reason for purchasing WhatsApp -- the fact that it is growing its user base at an astounding rate of 1 million users per day. If WhatsApp keeps that growth rate up, it could theoretically generate more than $1 billion in revenue per year.

That stunning growth helped WhatsApp overtake Facebook Messenger as the world's most widely used mobile messaging service in 2013, according to OnDevice's survey of 3,759 Android and iOS users. WhatsApp holds a 44% market share across five key markets -- the U.S., Brazil, South Africa, Indonesia, and China. Facebook Messenger trails at 35% and WeChat comes in third with a 28% share.

More importantly, WhatsApp is not just a popular way to send text messages -- WhatsApp users send out 600 million photos, 200 million voice messages, and 100 million video messages daily. By comparison, Facebook users upload 350 million photos daily.

This chart, from Facebook's own presentation, illustrates the steep growth of WhatsApp over the past four years.

While that growth looks impressive, the chart omits the global growth of WhatsApp's true competitor -- WeChat, which has 600 million registered users and reported 379% year-over-year growth in global users in 2013.

WeChat is expanding rapidly into overseas markets, particularly in Southeast Asia and South America, where the competitive barriers are considerably lower. Tencent also recently signed a deal with Google, which accounts for nearly 25% off all network traffic in North America, to promote WeChat in the U.S. The agreement allows U.S. users to sign into WeChat with their Google accounts.

WeChat. (Source: Tobyhk.com)

WeChat's monstrous growth highlights three major speed bumps ahead for WhatsApp:

WeChat, which is free, offers more features than WhatsApp, which costs $0.99 per year.

WeChat's alliance with Google could make it a major threat to WhatsApp in its core Western markets.

WeChat forms the foundation of Tencent's e-commerce, gaming, and social networking initiatives, which in turn boost its mobile messaging user base. WhatsApp, by comparison, is a stand-alone app that relies on address books for user growth.

If Facebook wants WhatsApp to flourish, it needs to mimic Tencent's model of making its mobile messaging app the front end to its other services. In other words, Facebook needs to integrate its social network, photo sharing capabilities, some third-party games, and even in-app purchases into WhatsApp to make it comparable to WeChat.

The bottom line

In conclusion, Facebook's $19 billion purchase of WhatsApp either seems like a brilliant investment or a desperate move, depending on your growth expectations for WhatsApp.

If WhatsApp can continue its current growth trajectory while charging $1 per year, then Facebook just made a smart investment. However, if WeChat continues growing, Facebook might have to rethink WhatsApp's simple network design and business model to remain competitive.

Want to profit on business analysis like this? The key for your future is to turn business insights into portfolio gold through smart and steady investing ... starting right now. Those who wait on the sidelines are missing out on huge gains and putting their financial futures in jeopardy. The Motley Fool is offering a new special report, an essential guide to investing, which includes access to top stocks to buy now. Click here to get your copy today -- it's absolutely free.

The article Facebook Buys WhatsApp for $19 Billion, But Overlooks 3 Big Problems originally appeared on Fool.com.

Leo Sun owns shares of Facebook. The Motley Fool recommends Facebook, LinkedIn, and Twitter. The Motley Fool owns shares of Facebook and LinkedIn. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.