BofA Goes to the Head of the Class by Teaming Up with Khan Academy

In 2013, the American Customer Satisfaction Index ranked Bank of America (BAC) below JPMorgan Chase (JPM), Citigroup (C), and Wells Fargo (WFC) for overall customer satisfaction. A 2012 J.D. Power report on mortgage lenders ranked Bank of America dead last out of a field of 14 contenders. And a poll of banking customers conducted in 2013 -- this time asking customers their opinions of 30 banks -- came to precisely the same conclusion.

So, what's a bank to do when its reputation is this deep in the dumper? The first step should obviously be damage control -- burnishing the bank's reputation by any means possible.

And the second step ought to be taking action to address the reasons that customers hate the bank in the first place.

Bank of America's recent alliance with Khan Academy accomplishes both of these things.

Khan Gets Kudos

Few websites boast a reputation as good as that of Khan Academy, the totally free, nonprofit site that former hedge fund analyst Sal Khan set up in 2006 to help teach kids (and adults) about everything from basic mathematics to the Federal Reserve's policy of quantitative easing.

PCMag.com rates Khan Academy 4.5 stars (out of 5) as "a place where you can learn, or simply refresh your learning, in dozens of subjects." Yelp (YELP) gives Khan 4.5 stars, with one reviewer exclaiming: "I wish I could give it 10 stars."

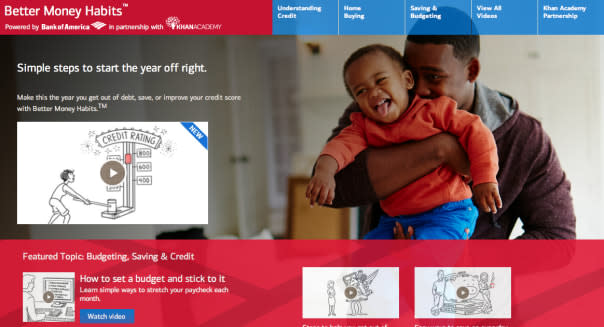

So when Bank of America teamed up with Khan Academy last April to build bettermoneyhabits.com, it picked the right "halo" to bask in.

The substance looks pretty good, too. In a release announcing the site's opening, Bank of America boasted that its new website would offer "free, self-paced, easy-to-understand resources to develop better money habits" -- and would provide these resources not just for free but also "commercial-free." And the website's open to anyone, not just Bank of America customers.

From Bad Reputation to Good, Untainted Advice

Ten months into the project, we can call bettermoneyhabits.com a success. Bank of America and Khan Academy have developed 42 instructional videos covering subjects broadly grouped as "saving and budgeting," "understanding credit" and "home buying." Among the more popular:

A video on "steps to help you get out of debt" has attracted more than 2 million page views.

"Building credit and keeping yours healthy" has done even better -- 2.3 million views.

A video explaining the differences between credit cards and debit cards is the most popular, with 2.7 million views.

Other videos address such financial mysteries as how mortgage interest rates work, %VIRTUAL-article-sponsoredlinks%the pluses and minuses of fixed-rate versus adjustable-rate mortgages and how compound interest works -- what Albert Einstein famously dubbed "the eighth wonder of the world." Perhaps especially useful this time of year, the site also offers videos on how to calculate tax deductions, state income taxes, and federal income taxes.

A sampling of these videos shows them to be of pretty high quality, in terms of both the information provided and production quality -- which in several instances exceeds that found on the Khan Academy site.

And as promised by Bank of America, the videos are blessedly free of product pushing. Indeed, but for the Bank of America logo shown at the end, you wouldn't know that the bank was involved in production at all.

Bettermoneyhabits.com may not go all the way to erasing consumers' poor opinion of Bank of America. But it's a start -- and a good one at that.

Motley Fool contributing writer Rich Smith has no position in any stocks mentioned. The Motley Fool recommends Bank of America, Wells Fargo, and Yelp. The Motley Fool owns shares of Bank of America, Citigroup, JPMorgan Chase, and Wells Fargo.