Halliburton vs. Transocean: Which Stock's Dividend Dominates?

Dividend stocks outperform non-dividend-paying stocks over the long run. It happens in good markets and bad, and the benefit of dividends can be quite striking -- dividend payments have made up about 40% of the market's average annual return from 1936 to the present day.

But few of us can invest in every single dividend-paying stock on the market, and even if we could, we're likely to find better gains by being selective. Today, two oil and gas services companies will square off in a head-to-head battle to determine which offers a better dividend for your portfolio.

Tale of the tape

Founded in 1919, Halliburton ranks among the world's largest suppliers of engineering and construction services for the oil industry. Headquartered in Houston, Halliburton serves the upstream oil and gas industry through two divisions: Drilling and Evaluation, and Completion and Production, which add up to more than 75,000 employees in over 80 countries around the world. In the early 1960's, Halliburton merged with Brown and Rootto create a highly integrated oilfield services firm, but sold off much of these assets as part of a 2007 spinoff. Halliburton now maintains a second headquarters in Dubai to better expand its geographical presence in the Middle East and in the rest of the Eastern Hemisphere.

Founded in 1973, Transocean is one of the leading international providers of offshore drilling services for oil and gas wells. It specializes in deepwater drilling in the harsh environments of the Gulf of Mexico and the North Sea. Headquartered in Geneva, Switzerland, the company has a fleet of roughly 138 mobile offshore drilling units supported by more than 18,000 employees around the world. Over the past few years, Transocean augmented its business portfolio through the acquisition of Aker Drilling in 2011, but it has sold off stakes in both Challenger Minerals and Overseas Drilling. Both of our companies were affected by the deadly 2010 Deepwater Horizon oil spill in the Gulf of Mexico, but the specter of that disaster moves further behind them with each new successful and safe quarter.

Statistic | Halliburton | Transocean |

|---|---|---|

Market cap | $45.5 billion | $15.7 billion |

P/E ratio | 23.1 | 9.8 |

Trailing 12-month profit margin | 7.2% | 17.2% |

TTM free cash flow margin* | 5.2% | 2.1% |

Five-year total return | 209.4% | (18.5%) |

Source: Morningstar and YCharts.

*Free cash flow margin is free cash flow divided by revenue for the trailing 12 months.

Round one: endurance (dividend-paying streak)

According to Dividata, Halliburton began its quarterly dividend payments in 1982, but the company's dividend history can be traced back to 1947, equaling a 66-year long dividend-paying streak. Transocean has only been paying quarterly dividends since 1993, but since it ceased payments between 2003 and 2010 its streak is now only three years long. That makes this an easy win for Halliburton.

Winner: Halliburton, 1-0.

Round two: stability (dividend-raising streak)

Halliburton increased its payouts last year after holding dividends firm from 2007 to 2012. On the other hand, Transocean actually halted shareholder distributions for a quarter before resuming them at a reduced rate in 2013, which gives it no streak at all to brag about.

Winner: Halliburton, 2-0.

Round three: power (dividend yield)

Some dividends are enticing, but others are merely tokens that barely affect an investor's decision. Have our two companies sustained strong yields over time? Let's take a look:

HAL Dividend Yield (TTM) data by YCharts

Winner: Transocean, 1-2.

Round four: strength (recent dividend growth)

A stock's yield can stay high without much effort if its share price doesn't budge, so let's look at the growth in payouts over the past five years.

HAL Dividend data by YCharts

Winner: Halliburton, 3-1.

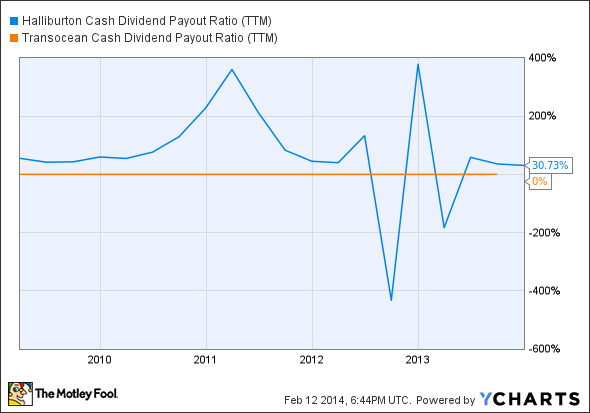

Round five: flexibility (free cash flow payout ratio)

A company that pays out too much of its free cash flow in dividends could be at risk of a cutback, particularly if business weakens. We want to see sustainable payouts, so lower is better:

HAL Cash Dividend Payout Ratio (TTM) data by YCharts

Winner: Halliburton, 4-1. (Transocean's true ratio is over 100%,according to Morningstar.)

Bonus round: opportunities and threats

Halliburton may have won the best-of-five on the basis of its history, but investors should never base their decisions on past performance alone. Tomorrow might bring a far different business environment, so it's important to also examine each company's potential, whether it happens to be nearly boundless or constrained too tightly for growth.

Halliburton opportunities

Halliburton will build a $70 million facility near the Eagle Ford shale to draw more business.

Halliburton has teamed up with Nuverra on a water-recycling initiative.

BP and Chevron have boosted theaverage rig count to 58 in the Gulf of Mexico.

Halliburton's Frac of the Future program could have a killer edge: using convenient and cheap natural gas to fuel drilling equipment.

Halliburton plans to create afrac fluid made of food-service ingredients.

Halliburton has signed big multi-year service contracts in Brazil's Libra field.

Transocean opportunities

Transocean's building 12 new ships to bolster its deepwater capabilities.

The market for drilling units will be undersupplied by about 189 units based on 2020 estimates.

Transocean's pursuing several initiatives to save $800 million on costs by 2015.

Transocean has divested 62 non-core rigs, which will help offset the cost of upgrading its fleet.

Transocean now boasts a $30 billion order backlog.

Halliburton threats

GASFRAC's waterless propane-based fracturing technology could undermine Halliburton's technological edge.

Hydraulic fracturing is full of controversy and still demands millions of gallons of water to drill.

Baker Hughes has been aggressively pursuing shale gas prospects with Chinese partners.

Petrobras might scale down deepwater drilling operations in Latin America.

Transocean threats

Seadrill boasts a far more advanced fleet of about 69 new ships -- 22 of which are still under construction.

Day rates for ultra-deepwater drilling units are expected to drop by 16% to $475,000 per day.

Transocean rival Noble recently offered lackluster predictions for the drilling market in 2014.

One dividend to rule them all

In this writer's humble opinion, it seems that Halliburton has a better shot at long-term outperformance, thanks to its multiple high-tech and lower-waste programs, most notably the Frac of the Future and its Nuverra-backed H2O Forward water-recycling initiative. The company is also likely to reap benefits from a stronger foothold in the booming Eagle Ford, Bakken shale, and the Gulf of Mexico. Transocean, on the other hand, has been struggling to replace its aging drillship fleet, which could offer a big opening for its competitors to dive through. Furthermore, dour predictions for the drilling market along with declining day rates for ultra-deepwater drilling units could create obstacles (at least for a while) to Transocean's sustainable revenue growth. You might disagree, and if so, you're encouraged to share your viewpoint in the comments below. No dividend is completely perfect, but some are bound to produce better results than others. Keep your eyes open -- you never know where you might find the next great dividend stock!

Looking for other stocks set to win from the American energy renaissance?

Record oil and natural gas production is revolutionizing the United States' energy position. Finding the right plays while historic amounts of capital expenditures are flooding the industry will pad your investment nest egg. For this reason, The Motley Fool is offering a comprehensive look at three energy companies set to soar during this transformation in the energy industry. To find out which three companies are spreading their wings, check out the special free report, "3 Stocks for the American Energy Bonanza." Don't miss out on this timely opportunity; click here to access your report -- it's absolutely free.

The article Halliburton vs. Transocean: Which Stock's Dividend Dominates? originally appeared on Fool.com.

Alex Planes has no position in any stocks mentioned. The Motley Fool recommends Chevron, Halliburton, Petrobras, and Seadrill and owns shares of Nuverra Environmental Solutions, Seadrill, and Transocean. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.