Scared of Dividend Cuts, Not These 4 MLPs

Over the past five months, investors who follow master limited partnerships have watched two of them cut their distributions in a big way. Eagle Rock Energy Partners did it at the end of October, and Boardwalk Pipeline Partners did it earlier this week. It's the cardinal sin for MLPs, and two cuts in less than six months means that many MLP investors are suddenly taking a long look at their holdings.

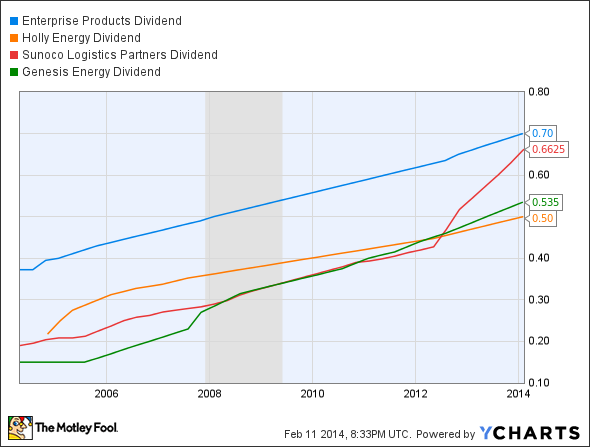

Rest assured there are still rock-solid MLPs out there, and today we're going to look at four of them that have increased their distributions every quarter for at least eight straight years: Enterprise Products Partners , Holly Energy Partners , Sunoco Logistics Partners , and Genesis Energy .

Let's kick things off by taking a look at the chart below that shows the distribution records for our four MLPs over the last:

EPD Dividend data by YCharts.

The gray column is especially significant in this chart. It indicates our last recession, a period when even the strongest MLPs held their distributions flat, or cut them, because of the economic environment. Not these four stars, though -- there's nothing but increases across the board.

Of course, consistently increasing distributions are all well and good, as long as the MLP is generating enough cash to actually cover them. If it isn't, we're likely to see some trouble down the road. That's why the other important metric to note when it comes to distributions is the coverage ratio.

For that information, we turn to our good friends at MLPData.com for a quick look-up. Here's how our four MLPs stand on that front:

MLP | Current Coverage Ratio |

|---|---|

Enterprise Products Partners | 1.55x |

Holly Energy Partners | 1.09x |

Sunoco Logistics Partners | 1.90x |

Genesis Energy | 1.92x |

Source: MLPData.com.

Note that neither Holly Energy Partners or Genesis Energy have reported their fourth-quarter results yet, so their coverage ratio is only good through the first three quarters of 2013. Regardless, each of these MLPs passes this test as well, further supporting the notion that they are built to last.

Bottom line

These are not the only factors to consider before actually investing in a master limited partnership, but they do give you some sense of how strong an MLP is from a mile up. As always, if you do plan to invest in one of these vehicles, make sure ample research is part of your process.

Build your wealth

It's no secret that investors tend to be impatient with the market, but the best investment strategy is to buy shares in solid businesses and keep them for the long term. In the special free report "3 Stocks That Will Help You Retire Rich," The Motley Fool shares investment ideas and strategies that could help you build wealth for years to come. Click here to grab your free copy today.

The article Scared of Dividend Cuts, Not These 4 MLPs originally appeared on Fool.com.

Aimee Duffy has no position in any stocks mentioned. The Motley Fool recommends Enterprise Products Partners L.P. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.