These Are 2 of the Best Dow Dividends Today

The Dow Jones Industrial Average is packed to the rafters with great dividend stocks. Every one of the blue-chip index's 30 members pays a dividend, and the average yield sits at a generous 2.7%. Even better, the average Dow stock has increased its payout by 13.6% a year over the last decade.

But picking a dividend stock off the Dow isn't as easy at it might seem at first glance. The top yielders generally don't deliver strong dividend growth. The top growers often offer below-average yields. So what's a quality-hungry dividend investor to do?

Fortunately, two stocks hover near the pinnacle of Dow rankings for both high yields and fast dividend growth.

MCD Dividend data by YCharts.

Image source: Intel.

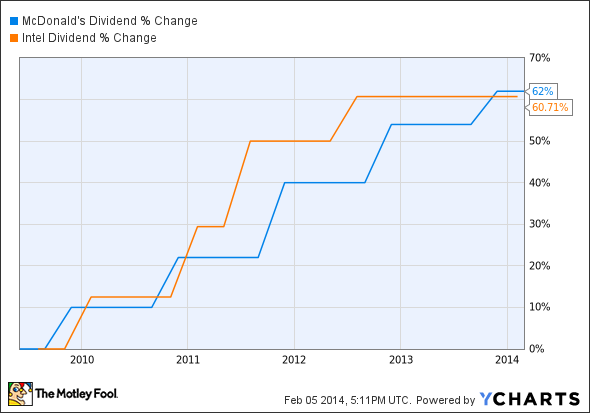

Intel offers the third most generous yield on the Dow, clocking in at 3.8% today. It's also the second fastest long-term payout booster, having increased its dividend by an average of 27% per year over the last decade.

It's not all wine and roses for Intel investors, though. The latest payout increase happened in the summer of 2012, leaving an ugly flatline across the six most recent quarters. The company is battling a semiconductor market in a state of upheaval, conserving cash to defend traditional target markets and to push into the largely unexplored mobile sector.

As an Intel investor myself, I believe that rivals can't keep the chipmaker out of mobile computing forever. The company's unrivaled economies of scale will eventually win out. When that happens, Intel will be able to raise its dividends again -- perhaps even making up for lost time with an extra-generous first helping.

Buying Intel shares now would lock in a low cost base that should translate into very healthy effective dividends down the road.

Image source: McDonald's.

And then there's McDonald's . The fast-food vendor sits just behind Intel in terms of dividend growth, having pumped its payouts an average of 23% higher yearly over the last decade. The 3.5% dividend yield also ranks sixth among all Dow stocks.

McDonald's has increased its payouts without fail since the first dividend check was sent in 1976. That's an unbroken 38-year streak, and the Golden Arches aren't likely to break this shareholder-friendly tradition anytime soon.

Of these two dividend champions, Intel is a somewhat riskier choice but also offers the biggest long-term upside. That said, both stocks are proven winners. if you're looking for one of the Dow's best dividend payers, you can't go wrong by taking a closer look at McDonald's and Intel.

Finding a great dividend is half the battle

One of the dirty secrets that few finance professionals will openly admit is the fact that dividend stocks as a group handily outperform their non-dividend paying brethren. The reasons for this are too numerous to list here, but you can rest assured that it's true. However, knowing this is only half the battle. The other half is identifying which dividend stocks in particular are the best. With this in mind, our top analysts put together a free list of nine high-yielding stocks that should be in every income investor's portfolio. To learn the identity of these stocks instantly and for free, all you have to do is click here now.

The article These Are 2 of the Best Dow Dividends Today originally appeared on Fool.com.

Anders Bylund owns shares of Intel. The Motley Fool recommends Intel and McDonald's. The Motley Fool owns shares of Intel and McDonald's. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.