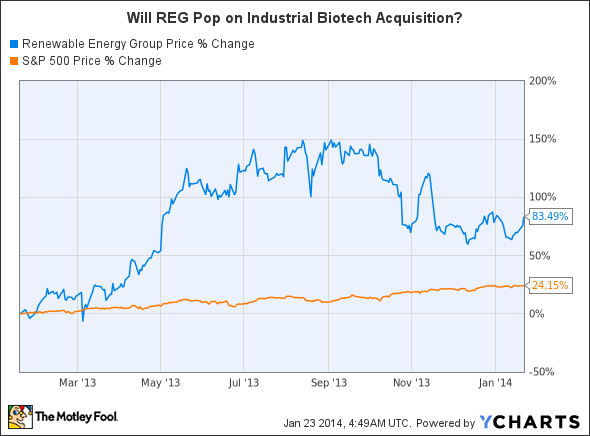

Can Renewable Energy Group Inc Succeed in Synthetic Biology?

The nation's largest biodiesel producer isn't sitting around allowing the expiration of the blender's tax credit, which propped up biodiesel margins in 2013, to derail its growing business. Renewable Energy Group announced the acquisition of struggling industrial biotech company LS9 for up to $61.5 million, assuming developmental milestones are reached, and the formation of REG Life Sciences. Will that override concerns of the volatile biodiesel market?

In other words, REG is now officially involved in industrial biotechnology and synthetic biology and has picked up partners such as consumer products leader Proctor & Gamble , next-generation biobased chemical leader Cobalt Technologies, the largest automobile manufacturer in South America, and a company sporting a leading next-generation sugar technology platform.

Management at REG hasn't been shy about pulling the trigger in the past, but investors may be wondering if the acquisition fits into a product portfolio crowded by first-generation biodiesel and heating oil -- both produced in a simple chemical reaction. Let's explore what LS9 brings to the table, evaluate the motivating factors behind the deal from both sides of the table, and consider how quickly LS9 can begin contributing to the company's top and bottom lines.

What is LS9?

LS9 is an industrial biotech company engineering microbes to produce a portfolio of chemicals and fuels residing in the fatty alcohol and specialty ester categories. An impressive patent portfolio protects its single-step fermentation process and engineered microbes, which create immiscible products that naturally separate from the fermentation broth and make for an easy, high-yield recovery. Final products are rinsed of impurities, but the quality control step is far from cumbersome. In fact, LS9 won the Presidential Green Chemistry Challenge Award from the U.S. Environmental Protection Agency in 2010.

Source: LS9

In April the company announced the successful completion of commercial scale trial runs in 135,000 liter fermenters that validated its process and demonstrated its flexibility by completing additional runs for Cobalt Technologies. While it was hailed as a major milestone for LS9 -- which it was -- the start-up found itself in a difficult position financially soon after the announcement. That ended on Wednesday when REG committed to industrial biotech.

The LS9 point of view

Management at LS9 was looking at an expensive and lengthy development profile, which is common among industrial biotech companies. Access to capital for any company is limited to the willingness of investors to cut checks, but the options are restricted further for private companies that cannot "simply" dilute existing shareholders with a secondary offering. Many in the industry believed financial obstacles were weighing heavily on LS9.

While few outsiders know the exact financial position of the company, it seems difficult to believe that a (potential) $61.5 million exit was what Vinod Khosla of Khosla Ventures or other private investors had in mind. Exiting now may not prove to be a bad deal in the long run, especially considering that there is still a long way to go developing the platform and commercializing products. However, successful commercialization could pay tremendous dividends for a company willing and able to finance development. REG could be just that company.

The REG point of view

Despite the long development timeline ahead, Renewable Energy Group is a great fit for several reasons. First, the company held over $135 million in cash at the end of the third quarter. It remains well capitalized too, on the basis of the opportunity of biobased chemicals and drop-in fuels. Second, it has a viable business generating over $1 billion in annual revenue already in place, which means share price won't be held captive by developmental success or failure.

Investors should feel great about the acquisition of LS9 in the long term. The industrial biotech platform will diversify REG's product portfolio and allow the company to develop an expertise in the important 21st century industry of synthetic biology. Rather than focusing solely on biodiesel and renewable diesel, which both have volatile growth curves thanks to the U.S. EPA's toying with the Renewable Fuel Standard, or RFS, REG can one day introduce important biobased products to the market with key partners.

Various chemicals can be produced for consumer products with Proctor & Gamble, which is making a major push to increase the sustainability of its supply chain and product portfolio. Additionally, Proctor & Gamble will likely be more comfortable working with a well-funded company such as REG than a cash-strapped start-up such as LS9. Meanwhile, the potential to work with Cobalt Technologies could give REG access to the biobutanol market covering chemicals, drop-in fuels, and gasoline blendstocks, while collaborating with major automakers such as MAN could expedite market acceptance and penetration of new fuels.

Foolish bottom line

The acquisition of LS9 -- the second in recent months -- could be a great long term growth opportunity for REG and its shareholders, but it likely won't make an immediate impact in 2014. There is still a lot of work left to be done to develop the technology platform of LS9 into commercially viable products. Nonetheless, it presents an intriguing high-margin product portfolio and will help insulate the company from the risks associated with uncertainty surrounding RFS if successfully developed. REG investors should be excited about the news, but remind themselves that this will take time to be relevant.

OPEC isn't worried about biodiesel, but this company offers a scare

REG is doing its part to create a more sustainable future for America, but there's a long way to go before the nation makes more fuels from sustainable sources than petroleum. Looking for a great opportunity to invest in dinosaur sauce and scare OPEC? Imagine a company that rents a very specific and valuable piece of machinery for $41,000... per hour (that's almost as much as the average American makes in a year!). And Warren Buffett is so confident in this company's can't-live-without-it business model, he just loaded up on 8.8 million shares. An exclusive, brand-new Motley Fool report reveals the company we're calling OPEC's Worst Nightmare. Just click HERE to uncover the name of this industry-leading stock... and join Buffett in his quest for a veritable LANDSLIDE of profits!

The article Can Renewable Energy Group Inc Succeed in Synthetic Biology? originally appeared on Fool.com.

Fool contributor Maxx Chatsko has no position in any stocks mentioned. Check out his personal portfolio, his CAPS page, his previous writing for The Motley Fool, or his work for the SynBioBeta Blog to keep up with developments in the synthetic biology industry.The Motley Fool recommends Procter & Gamble. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.