The New Floor for Potash

Russian potash producer Uralkali reached a pricing agreement Monday with Chinese fertilizer importers for the first half of 2013 at $305 per metric tonne, and though that represents a 24% discount to the levels paid a year ago, it should provide a measure of stability to the market that allows it to recover.

Source: PotashCorp.

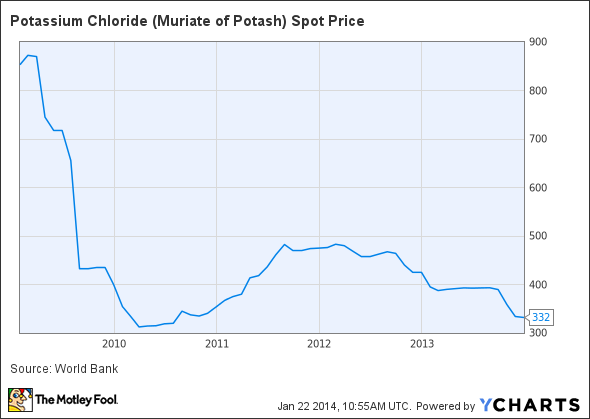

Ever since Uralkali ended its distribution agreement last July with Belaruskali, its joint venture partner in Belarusian Potash Corp., a cartel that controlled roughly 43% of global potash exports, the market for the key fertilizer was thrown into turmoil and caused its price to plunge from the near-$400-per-tonne level it had been trading at midsummer. It was seen as a bid by Uralkali to gain greater market share through higher production levels for the low-cost producer of potash.

Potassium Chloride (Muriate of Potash) Spot Price data by YCharts.

Other global producers, particularly those of the North American marketing group Canpotex, saw their stock prices collapse as well as the move ushered in a period of uncertainty. PotashCorp and Mosaic , which count on potash sales for a significant portion of their operations, tumbled 17% in one day, but ultimately went on to lose as much as a quarter of their market value at their lowest points. Agrium , the third owner of the trio that runs Canpotex but is also a more diversified producer than its peers (potash production counts for less than 15% of its revenues, relying instead upon nitrogen products for about half of its sales), did not suffer a similar rout. Smaller players not part of the marketing agency, and thus without the same muscle to negotiate prices as their larger brethren, felt the pain of the breakup more keenly. Intrepid Potash , for example, plunged 30% in one day.

Although it means the fertilizer component will trade at levels that are just a third of the peak price they hit just before the global recession, the current price was not unexpected and the uncertainty surrounding what China would do has been removed. It should set a floor from which global potash producers can grow.

Moreover, U.S. demand is expected to remain solid given the expected rebound in North American crop yields last year, which should have led to nutrient depletion for all three key fertilizer ingredients. And with minimal retail inventory levels, they'll need to restock supplies, ensuring that producers should be able to make up some of the profits lost from the pricing collapse through volume. Certainly, the lower prices should spark greater demand from farmers.

Shares of Canpotex members have regained 20% or more of the value lost in the days after BPC's breakup, and because the market had already priced in expectations of a $300-per-metric-tonne level, there shouldn't be any upheavals as a result and it's why I anticipated PotashCorp and the others would be candidates for a greater rebound. And if BPC manages to put itself back together again, not a completely unlikely possibility, 2014 could be viewed as the year they catapult themselves to new, higher levels.

2014's top investment

There's a huge difference between a good stock and a stock that can make you rich. The Motley Fool's chief investment officer has selected his No. 1 stock for 2014, and it's one of those stocks that could make you rich. You can find out which stock it is in the special free report "The Motley Fool's Top Stock for 2014." Just click here to access the report and find out the name of this under-the-radar company.

The article The New Floor for Potash originally appeared on Fool.com.

Fool contributor Rich Duprey has no position in any stocks mentioned. The Motley Fool owns shares of PotashCorp. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.