Can Crocs Turn Its Business Around?

According to Transparency Market Research, the global footwear market is expected to be worth $211.5 billion by 2018, growing at a compound annual growth rate of 1.9% from 2011 to 2018. The Asia Pacific region is expected to account for 30.1% of this market, followed by Europe. This growth will be fueled by demand for innovative designs, growing awareness about health and an active lifestyle, a rising population, and spreading of the retail culture.

While Crocs , known mainly for its brightly colored clogs, has had a bumpy ride in 2013, its competitors -- Deckers Outdoor and Steven Madden -- have done comparatively better. Let's see if Crocs can turn around and if it is well positioned to grow in the Asian market.

Unimpressive performance

Crocs' third quarter was a challenging one in the U.S. and Japan. Comparable-store sales, or comps, in the Americas fell by 8.3%, with Japan falling by 16.3%, wiping off all the gains in other regions and taking the overall comps down by 4.2% in the quarter. Even Internet sales in these regions declined in the double digits, resulting in a 4.8 % year-over-year decline on a consolidated basis. As a result of this, revenue fell 2.4% year over year and there was a 70% drop in net income. Net income nosedived because of costs associated with expanding the retail network, as expenses rose considerably.

The silver lining

However, there were few positive takeaways in the quarter. Crocs performed well in the Asia Pacific and European regions, which are projected to be the two largest footwear markets by 2018. The European segment registered all around growth with wholesale growing 21%, retail 65%, and Internet revenue rising 35%. The story was equally refreshing in the Asia Pacific segment, with comps rising 9% and Internet sales climbing 26%. Though these numbers are from a far smaller base than the Americas and Japan, they are a silver lining.

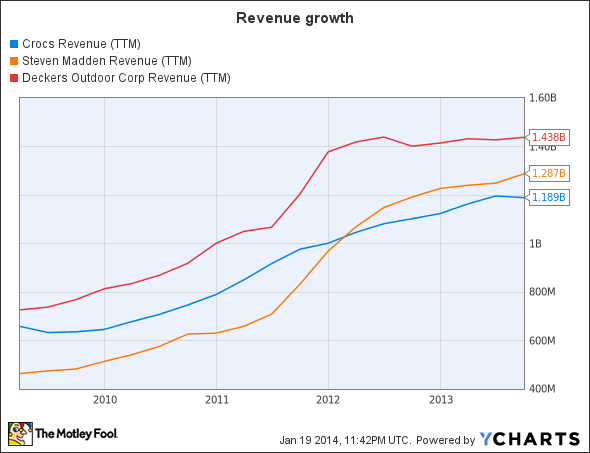

The strong but less-profitable global growth in Crocs' store base wasn't keeping investors happy, as expanding the retail network was also eating into the profits. For example, with nearly 600 retail stores worldwide, its revenue is less than that of Steven Madden with just 117 stores as shown in the chart below, although Madden is heavily skewed toward wholesale.

Crocs revenue (trailing-12 months) data by YCharts

However, recently there have been a few good developments that have kept Mr. Market happy. Crocs' CEO will be retiring, and the new executive should bring a new direction to the company. In addition, Crocs also announced that The Blackstone Group would become a major shareholder by investing $200 million. This impressed Mr. Market, and the shares rallied by 14% in early trading after the announcement.

What are peers up to?

Steven Madden's business model is more wholesale-centric, and the company has transformed itself during the last 10 years. The revenue growth trajectory as shown in the chart bears testimony to that fact. In the third quarter, consolidated net sales increased 10.6% to $394.8 million, and net income grew 16.1% to $44 million, or $0.60 per diluted share.

Steven Madden also posted solid gains in the international markets, registering robust sales in China, Dubai, and Mexico along with a solid double-digit percentage gain in Canada. As a result, the company posted revenue growth of 25% in international markets versus the year-ago period.

Deckers, on the other hand, is reducing its reliance on the wholesale-centric business model and is skewing toward more of an omnichannel business model, and this is reflected in the decline in the wholesale business by 1.5% in its recent quarter. This year, retail sales are expected to contribute around 33% of overall sales, up from 22% three years ago.

After having disappointed investors for quite some time, Deckers posted third-quarter results which blew past analyst estimates on the back of strong sales across all of its brands. Consolidated sales increased 2.7%, versus the same quarter in the previous year, to $387 million. Earnings per share came in at $0.95. The company's increasing focus on the retail segment should result in strong gains in this area going forward and help infuse some life into revenue growth.

Takeaway

Crocs is gunning for a turnaround and is investing heavily in new stores. The company is taking a beating in the Americas, but it is making rapid progress in the Asian market. This is a good development, as the Asian market is expected to account for a bulk of the global footwear market going forward. So, investors shouldn't discard Crocs just yet, as the company can make a comeback in the future.

Start investing ASAP

Millions of Americans have waited on the sidelines since the market meltdown in 2008 and 2009, too scared to invest and put their money at further risk. Yet those who've stayed out of the market have missed out on huge gains and put their financial futures in jeopardy. In our brand-new special report, "Your Essential Guide to Start Investing Today," The Motley Fool's personal finance experts show you why investing is so important and what you need to do to get started. Click here to get your copy today -- it's absolutely free.

The article Can Crocs Turn Its Business Around? originally appeared on Fool.com.

Fool contributor Sharda Sharma has no position in any stocks mentioned. The Motley Fool owns shares of Crocs. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.