SolarCity's New $29,392,600,000,000 Enemy

Source: SolarCity Corporation

Rooftop solar companies like SolarCity Corporation did well in 2013 -- too well. Massive utilities have the spooks, and they're pushing regulators to put the brakes on backyard power generation. Here's what you need to know.

Raising the roof

While solar currently supplies less than 1% of U.S. electricity generation, rooftop solar systems are soaring in popularity: 90,000 businesses and homeowners installed rooftop solar panel kits in 2012, 46% more than the previous year.

In an interview with GreenTech Media, Federal Energy Regulatory (FERC) Chairman Jon Wellinghoff predicted solar is "going to overtake everything ... it could double every two years."

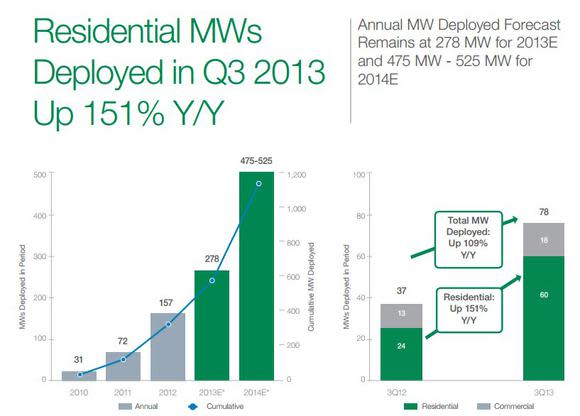

A quick glance at SolarCity's latest numbers confirms Wellinghoff's thoughts about the industry. SolarCity doubled its megawatts deployed for Q3 2013 compared to Q3 2012, with residential systems up 150%. And estimates for 2014 growth have SolarCity set for its strongest growth yet.

Source: SolarCity Corporation

Utilities fight back

Utilities are intimidated, if not scared, by SolarCity's recent success. These century-old stalwarts are seeing their sector shaken up like nothing ever before -- much the same as traditional telecoms reeled to adopt to mobile-phone services. Their collective $29.4 trillion market capitalization may seem unstoppable, but who would've thought U.S. landline use would drop more than 25% in 15 years?

With strong regulatory relationships, several utilities have taken the offensive against solar companies. Yale's environment360 publication reports that Pinnacle West's Arizona Public Service Utility and Xcel Energy have both requested states to cut back on customer incentives to install solar -- or even to levy charges against rooftop solar users. Based in Arizona and Colorado, respectively, Pinnacle West and Xcel Energy assert that rooftop solar users get all the benefit of hooking up to a reliable electricity grid without paying their fair share of upkeep costs.

The argument is complicated, and not all utilities are waging war. Power companies can gain state-mandated renewable energy credits from buying solar back from customers, and decentralized grids reduce system stress and diversify risk. Dominion Resources is leasing roof space from Virginia businesses to research its potential benefits. Last month, Dominion Resources announced it will spend $2 million to install 2,000 panels on the rooftop of a local Canon facility.

Source: Dominion Resources Canon Rooftop Solar Conceptual Drawing

As if things weren't complicated enough, Duke Energy Corporation is taking both sides. It's asked North Carolina regulators to introduce new charges for solar customers, but also invested in Clean Power Finance, a California start-up funding rooftop solar development. The company also acquired its own 4.5 MW urban solar farm in San Francisco last August, tripling the city's solar generating capacity.

Is SolarCity screwed?

Solar is here to stay. Residential systems are rolling out faster than ever, and utility-grade solar facilities are predicted to be cost-competitive with natural gas by 2025. SolarCity and other rooftop solar installers will hit a fair number of snags along the way, but worries over grid upkeep will not kill solar power's potential.

While some utilities are pushing back, the smartest ones are finding ways to work with (and profit from) decentralized systems with thousands of power producers. Keep progressive picks in your own energy portfolio, and you'll be set to pull long-term profit.

Energy innovators

SolarCity is shaking up the energy sector-and it's not the only one. The Motley Fool is offering a comprehensive look at three energy companies set to soar as the energy industry undergoes historical change. To find out which three companies are spreading their wings, check out the special free report, "3 Stocks for the American Energy Bonanza." Don't miss out on this timely opportunity; click here to access your report -- it's absolutely free.

The article SolarCity's New $29,392,600,000,000 Enemy originally appeared on Fool.com.

Fool contributor Justin Loiseau has no position in any stocks mentioned. The Motley Fool recommends Dominion Resources and SolarCity. The Motley Fool owns shares of SolarCity. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.