Abbott Labs vs. Walgreen: Which Stock's Dividend Dominates?

Dividend stocks outperform non-dividend-paying stocks over the long run. It happens in good markets and bad, and the benefit of dividends can be quite striking -- dividend payments have made up about 40% of the market's average annual return from 1936 to the present day.

But few of us can invest in every single dividend-paying stock on the market, and even if we could, we're likely to find better gains by being selective. Today, two health-care companies will square off in a head-to-head battle to determine which offers a better dividend for your portfolio.

Tale of the tape

Established in 1888, Abbott Labs is one of the world's largest pharmaceutical and health care products manufacturers. Abbott was the first to develop an HIV blood-screening test, and it is also a world leader in immunoassays and blood screening. Headquartered in North Chicago, Illinois, the company has more than 90,000 employees working in 150 countries. Abbott has a diversified portfolio of medical treatments and equipment , which includes blockbuster drugs Humira, Norvir, and Synthroid, theXience drug-eluting stents, and FreeStyle diabetes care solutions. Over the past decade, Abbott's also strengthened its business portfolio through the acquisition of Solvay Pharmaceuticals and Piramal Healthcare Solutions, while it spun off its non-generic pharmaceutical operations as AbbVie .

Established in 1901, Walgreen is the largest drug retailer in the U.S., generating more than two-thirds of its sales from prescription drugs -- cosmetics, groceries, and over-the-counter medications contribute the remainder. Headquartered in Chicago, Illinois, Walgreen operates more than 8,500 stores, as well as 750 health and wellness centers and in-store retail health care clinics in the United States, the District of Columbia and Puerto Rico. During the past decade, the company has aggressively expanded its national footprint through both organic and inorganic growth. Walgreens has also entered into a strategic partnership with Europe's Alliance Boots to create the first global pharmacy-led, health and well-being enterprise.

Statistic | Abbott | Walgreen |

|---|---|---|

Market cap | $59.8 billion | $54 billion |

P/E ratio | 20.1 | 19.9 |

Trailing 12-month profit margin | 7.6% | 3.7% |

TTM free cash flow margin* | 4.9% | 3.5% |

Five-year total return | 103.7% | 148% |

Sources: Morningstar and YCharts.

*Free cash flow margin is free cash flow divided by revenue for the trailing 12 months.

Round one: endurance (dividend-paying streak)

Abbott has been paying uninterrupted quarterly dividends since 1924, which equals a 90-year dividend-paying streak. That is a win Abbott over Walgreen, but it wasn't an easy one, as the pharmacy chain began its quarterly shareholder distributions in 1934, and has been paying ever since without interruption.

Winner: Abbott Labs, 1-0.

Round two: stability (dividend-raising streak)

Abbott has increased its dividend payments at least once per year since 1973, while Walgreen has been increasing annual shareholder distributions since 1976. A 41-year long dividend-raising streak for Abbott again narrowly squeaks by Walgreen's own impressive record.

Winner: Abbott Labs, 2-0.

Round three: power (dividend yield)

Some dividends are enticing, but others are merely tokens that barely affect an investor's decision. Have our two companies sustained strong yields over time? Let's look:

ABT Dividend Yield (TTM) data by YCharts

Winner: Abbott Labs, 3-0.

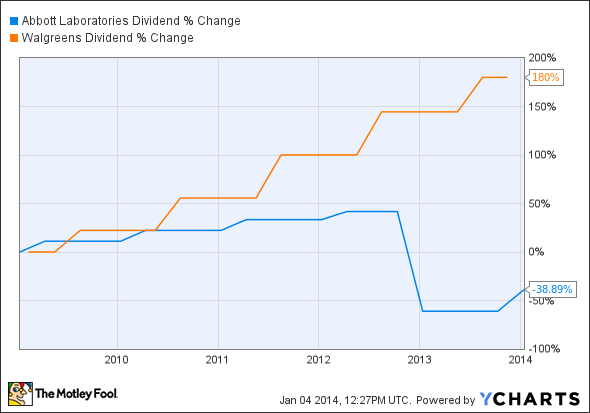

Round four: strength (recent dividend growth)

A stock's yield can stay high without much effort if its share price doesn't budge, so let's look at the growth in payouts over the past five years.

ABT Dividend data by YCharts

Winner: Walgreen, 1-3.

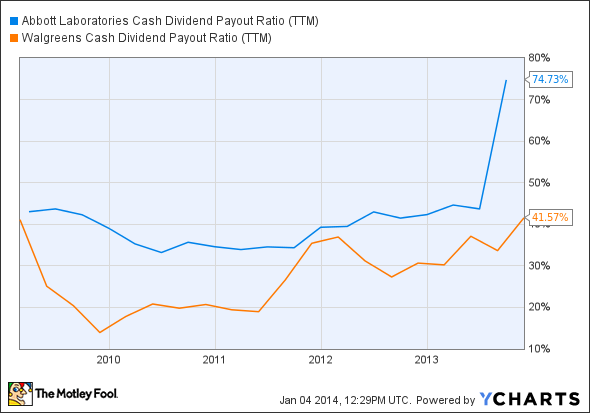

Round five: flexibility (free cash flow payout ratio)

A company that pays out too much of its free cash flow in dividends could be at risk of a cutback, particularly if business weakens. We want to see sustainable payouts, so lower is better:

ABT Cash Dividend Payout Ratio (TTM) data by YCharts

Winner: Walgreen, 2-3.

Bonus round: opportunities and threats

Abbott Labs may have won the best-of-five on the basis of its history, but investors should never base their decisions on past performance alone. Tomorrow might bring a far different business environment, so it's important to also examine each company's potential, whether it happens to be nearly boundless or constrained too tightly for growth.

Abbott opportunities

Abbott spun off AbbVie to unlock the value of star rheumatoid arthritis treatment Humira.

It will acquire vascular stent makerIDEV Technologies to expand in the medical devices market.

Abbott plans to acquire OptiMedica to push into the global cataract surgery market.

It has launched the next-generation Absorb stent in Europe, India, and other overseas markets.

Abbott should benefit from its multi-year contract with Abaxis to distribute Piccolo Xpress.

Abbott has received approval for its hepatitis-C genotype testing device from the FDA.

Walgreen opportunities

Walgreen can capture a large part of the prescription-drug retail market thanks to the rapid urbanization of the United States.

Walgreenteamed up with AmerisourceBergen to diversify from its bricks-and-mortar model.

Generic drugs could gain significant share because of the imminent patent expiration of several blockbuster drugs.

Walgreen expanded its geographical presence through a strategic partnership with AllianceBoots.

Walgreen has been focusing on health-care clinics to reap secondary benefits from the Affordable Care Act.

Walgreen has also partnered with Theranos to offer lab testing services within its stores.

Abbott threats

Rival Johnson & Johnson acquired orthopedics power Synthes to strengthen its position in the medical-devices market.

Abbott's nutrition business may lose traction after the recall of its infant formula in China.

Abbott faces major patent expirations in the next few years, and no longer has the prescription-drug segment to replenish that pipeline.

Walgreen threats

CVS Caremark's integrated business model provides pricing and scale advantages over Walgreen.

CVS formed the U.S. largest generic drug sourcing entity through its partnership with Cardinal Health.

CVS has ambitious plans to open approximately 10,500 MinuteClinics U.S. locations by 2017.

One dividend to rule them all

In this writer's humble opinion, it seems that Walgreen has a better shot at long-term outperformance, thanks to its ubiquitous geographical presence and brand recognition in the U.S. The company should also see further benefits from its long-term partnerships with Alliance Boots and AmerisourceBergen as well as enormous opportunities emerged with the implementation of Obamacare. Abbott seems well-positioned to reap substantial benefits from the growing medical devices market, thanks to its active acquisition strategy, which will further strengthen its business portfolio. However, the loss of its huge pharmaceuticals segment is no small blow, as one blockbuster (such as Humira) can contribute billions in revenue each year. You might disagree, and if so, you're encouraged to share your viewpoint in the comments below. No dividend is completely perfect, but some are bound to produce better results than others. Keep your eyes open -- you never know where you might find the next great dividend stock!

Looking to build a portfolio of dividend dynamos? Look no further ...

One of the dirty secrets that few finance professionals will openly admit is the fact that dividend stocks as a group handily outperform their non-dividend paying brethren. The reasons for this are too numerous to list here, but you can rest assured that it's true. However, knowing this is only half the battle. The other half is identifying which dividend stocks in particular are the best. With this in mind, our top analysts put together a free list of nine high-yielding stocks that should be in every income investor's portfolio. To learn the identity of these stocks instantly and for free, all you have to do is click here now.

The article Abbott Labs vs. Walgreen: Which Stock's Dividend Dominates? originally appeared on Fool.com.

Fool contributor Alex Planes has no position in any stocks mentioned. The Motley Fool recommends and owns shares of Johnson & Johnson. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.