3 Reasons Why Wal-Mart Is in Trouble in 2014

In 2013 the competition among retailers was fierce. 2014 will be no different as retailers like Wal-Mart , Dollar General, Tuesday Morning, Big Lots , and Target search for additional ways to gain market share and generate margin. Unfortunately for Wal-mart, the company has several challenges to contend with before it can make that happen. Like its big box counterparts, Wal-mart has issues with declining traffic that appear to be connected to the general economy. Additionally, operating expenses, especially relating to legal matters, are growing fast, and may be a drain on earnings for years to come.

Same store sales are down

Net sales for Wal-Mart rose 1.6% for the company overall, and 2.4% in the U.S. Same-store sales, however, dipped (0.2)% and (0.3)%, respectively. Clearly the company has relied on new store growth to keep the top line growing; the obvious issue is the decline in same-store sales growth.

In the most recent earnings report Wal-Mart blamed same store sales declines on a host of issues that included "lower consumer spending primarily due to the slow recovery in general economic conditions, and the 2% increase in the 2013 payroll tax rate." In other words, customers have less money to spend, so sales are down.

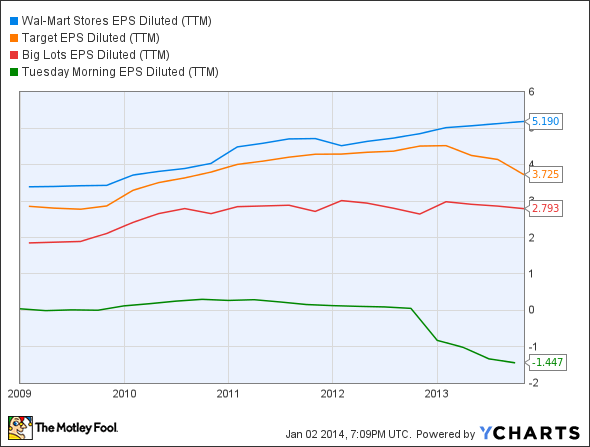

This may seem overly simplistic, but it has become a common problem among discount retailers. Target and Big Lots had a particularly bad year in 2013 as they reported negative earnings growth, while Big Lots reported negative earnings on top of negative earnings growth.

WMT EPS Diluted (TTM) data by YCharts

Target attributes the decrease to a decline in the number of transactions and the number of units per transaction. Wal-Mart doesn't go into the same level of detail that Target does, but it is telling us something about the effect the macro economy may be having on the company. Perhaps the issue is related to cuts in government spending, more specifically the sequester. Nearly $1 trillion in across the board spending cuts started in March 2013, which includes the 1.3 million people cut off from emergency federal unemployment relief at the end of December and another 3.6 million who will be cut off in 2014.

Growing operating expenses

One of Wal-Mart's stated objectives is to grow operating expenses at a slower rate than new sales. It's a commendable objective, but for the nine months ended Oct. 31, 2013 operating expenses increased 2.2%. The reasons given for the increase were lower than expected sales, higher capital investment, and additional expenses related to litigation.

Wal-Mart is also embroiled in several legal cases that may have more impact on sales than expenses. One such legal case involves the Foreign Corrupt Practices Act, or the FCPA.

Growing expenses related to the Foreign Corrupt Practices Act

According to the United States Department of Justice, the "The Foreign Corrupt Practices Act of 1977 was enacted for the purpose of making it unlawful for certain classes of persons and entities to make payments to foreign government officials to assist in obtaining or retaining business." In other words, it's a law against bribery.

On Dec. 18, a three-judge panel in the U.S. Court of Appeals for the Eighth Circuit refused to grant Wal-Mart a stay, which effectively opens the door for other lawsuits against the company to move forward. The bulk of the complaints have come from a group of shareholders after a reporter from the New York Times revealed evidence that Wal-Mart de Mexico executives paid $24 million in bribery payments in exchange for market share in Mexico. The lawsuits allege a breach of management's fiduciary duty and the investigation itself has expanded into China, Brazil, and India.

The Foolish bottom line

2014 is going to be a difficult year for Wal-Mart. It's hard to know exactly what impact these issues will have on the company's bottom line. Government spending appears to be on a steady decline, and legal issues continue to mount for the company. In 2012 Wal-Mart spent $69 million in the first three quarters of the year on FCPA-related expenses. It spent $224 million on these expenses in the first three quarters of 2013 and it expects to spend another $75 million to $80 million in the fourth quarter, which ends on Jan. 31. We'll have a chance to see if the holiday season provided some relief at the next earnings call on Feb. 20.

But what if Wal-Mart collapses?

To learn about two retailers with especially good prospects, take a look at The Motley Fool's special free report: "The Death of Wal-Mart: The Real Cash Kings Changing the Face of Retail." In it, you'll see how these two cash kings are able to consistently outperform and how they're planning to ride the waves of retail's changing tide. You can access it by clicking here.

The article 3 Reasons Why Wal-Mart Is in Trouble in 2014 originally appeared on Fool.com.

Fool contributor B Bryant has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.