Why Is Dollar Tree Borrowing Money To Buy Back Shares?

The S&P 500 Buyback Index, an index that measures the performance of 100 stocks that have the highest buyback ratios in the S&P 500, was up almost 42% in 2013, but what kind of value do stock repurchases really provide for companies?

Doesn't it bother you, as an honest investor, to make a 42% return from stock buybacks rather than on solid business performance? The answer for most investors is an emphatic no. All the same, it doesn't hurt to take a closer look at the effects of these these transactions in the long run.

Are share repurchases good for the investor?

Finance executives recite the same mantra when asked about buying shares; the response usually has to do with returning cash to the investor. Buying shares with excess cash makes sense if the company has exhausted other investment opportunities and wants to "return" some of that cash to investors. Should a company borrow money to buyback shares, though, especially if the company's shares are trading at their highs?

No more share repurchases for Target

I have a negative outlook on Target's earnings growth, but when the company ran out of funds this quarter it put a stop to share repurchases. "We did not repurchase any shares during the three months ended Nov. 2, 2013, due to our performance and our commitment to maintain our strong investment-grade credit rating" management said in the most recent 10-Q filing. Target is saying "we may be under some pressure to make earnings guidance, but we're not going into debt because of it."

Why is this such a commendable action? Some retail companies are going into debt to make share repurchases because it allows management to improve critical financial ratios.

Dollar Tree is borrowing money to repurchase shares

Dollar Tree Stores is a discount retailer known for its small-box retail locations in strip malls. With over 4,777 stores as of Nov. 2, 2013, the company boasted comparable-store net sales increases of 3.1% for the last 13 weeks. Like Family DollarStores and Dollar General, the company is following trends in food sales by rolling out frozen and refrigerated merchandise to over 3,000 stores, which is to say, it looks like Dollar Tree is doing all the right things to grow earnings.

The effect of share buybacks on measures of performance

Let's take a closer look at the the effect of share repurchases on EPS, ROA, and ROE:

Earnings per share (diluted EPS) goes up when there are fewer shares on the market. The more shares a company buys back, the more earnings there are for each share. This does not increase real earnings, but instead decreases the number of shares outstanding.

Return on assets (ROA) is a measure of management efficiency. It is calculated by dividing net earnings by total assets. When cash is used to purchase shares, assets go down and ROA goes up.

Return on equity (ROE) is a commonly used measure of investment return. ROE can be decomposed into earnings, ROA, and financial leverage. When cash is used to buy back shares, it increases ROE because there is less outstanding equity. When debt is used to purchase shares, it amplifies ROE by increasing total liabilities.

Share repurchases are also used to pay shareholders back when a company has excess cash. Additionally, if the company feels that its stock is underpriced it may be able to make a return from the repurchase of its own shares.

The foolish bottom line

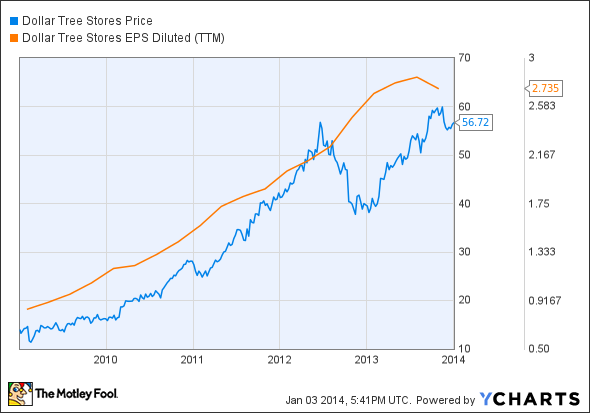

As you can see from the chart below, Dollar Tree's earnings just started trending down, but it's stock price is slowly trending up.

As

Dollar Tree used the net proceeds from three notes totaling $750 million to finance its share repurchase -- the cost of these funds was approximately 4.5%. So, Dollar Tree is paying 4.5% to artificially improve key measures of management performance and benefit from share price appreciation. Meanwhile, no real value has been created for the company. The question for investors is what this means for the stock in the long run, because ultimately future earnings are being exchanged for EPS gains today.

Which retailer is taking down Wal-Mart?

To learn about two retailers with especially good prospects, take a look at The Motley Fool's special free report: "The Death of Wal-Mart: The Real Cash Kings Changing the Face of Retail." In it, you'll see how these two cash kings are able to consistently outperform and how they're planning to ride the waves of retail's changing tide. You can access it by clicking here.

The article Why Is Dollar Tree Borrowing Money To Buy Back Shares? originally appeared on Fool.com.

Fool contributor C Bryant has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.