Will Coal Stocks Rebound in 2014?

It was another terrible year for the coal industry in 2013, whether you were producing thermal or metallurgical coal. Supply continues to outstrip demand, pushing prices lower and virtually eliminating profits in the industry.

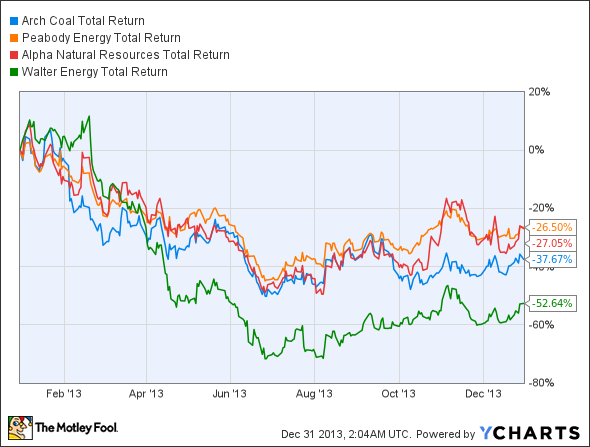

As financial conditions deteriorated, so did the stocks of some of the industry's top coal producers. Arch Coal , Peabody Energy , Alpha Natural Resources , and Walter Energy all lost more than a quarter of their value in 2013.

ACI Total Return Price data by YCharts

So, will 2014 be any better for the coal industry?

What coal needs in 2014

Unless companies start going bankrupt or shutting down mines, demand for coal needs to increase for the bottom line to get better. Peabody Energy recently said it expects 75 GW of new coal generation to come online in 2013 and global demand to increase 1.2 billion metric tons by 2017. Even the U.S. market, which has been besieged by natural gas, has seen a 35 million ton increase in demand so far this year.

The problem is that even increases in production from Walter Energy and Arch Coal haven't resulted in improving financials. In 2014, the industry needs to see a sharp increase in demand from not only China and India, but also the United States. That's where I have a hard time seeing a big improvement.

On the metallurgical side, a construction boom in China will likely slow over the next few years, and I could see a bubble burst resulting in rapidly falling demand for steel. The U.S. and Europe aren't exactly growing infrastructure spending right now, so if China can't hold up demand we're in for weak prices globally for the foreseeable future.

Smog clouds the streets in Guangzhou, China. Source: Wikimedia.

Fighting long-term trends

Pointing to new power plant construction is great, but there are also a lot of coal plants coming offline around the world. The coal industry is fighting increased environmental regulations and even a new understanding of the environmental impact of pollution in China. Domestically, since 2010, the retirements of more than 150 coal plants have been announced, and with natural gas continuing to be an inexpensive alternative, I don't think the trend will slow.

China is still building coal plants at a rapid pace, but with pollution clouding many of the country's most densely populated cities, China has put an emphasis on wind and solar power generation for the future. China may increase demand in the next few years, but it's going to have to replace demand in the U.S., and China doesn't like importing energy long-term. That poses a challenge for coal demand in 2014.

Foolish bottom line

The global trends just aren't in the coal industry's favor, and with most companies already losing money, it's an industry I would avoid altogether. It's better to go with emerging energy trends rather than fighting them.

One way to profit from an energy hungry world

The cost of extracting energy from the ground has skyrocketed over the past decade and on company rents a very specific and valuable piece of machinery for $41,000 per hour. (That's almost as much as the average American makes in a year!) Warren Buffett is so confident in this company's can't-live-without-it business model, he just loaded up on 8.8 million shares. An exclusive, brand-new Motley Fool report reveals the company we're calling OPEC's Worst Nightmare. Just click here to uncover the name of this industry-leading stock, and join Buffett in his quest for a veritable landslide of profits!

The article Will Coal Stocks Rebound in 2014? originally appeared on Fool.com.

Fool contributor Travis Hoium and The Motley Fool have no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.