Trends to Watch in 2014

One of the most important things to follow when investing in energy is macro trends in the industry. For example, coal is slowly on its way out as an energy source, and solar power is emerging as increasingly cost-effective. Following these trends instead of fighting them generally makes for better investments and reduces the chance that a stock will fall off the map.

So, what trends should we watch for in 2014? Here are a few to keep an eye on.

Natural gas production

Production of natural gas, and in turn its price, has a huge impact over the rest of the energy industry, so it's always worth watching. When the cost of natural gas falls, power plants begin to use more natural gas to generate electricity, hurting coal demand, and vice versa.

New natural gas plants are the basis for comparison for the solar industry as well, and if costs remain low, then solar power is less attractive for utilities. Just ask the nuclear industry how competitive they've been in building new plants versus natural gas.

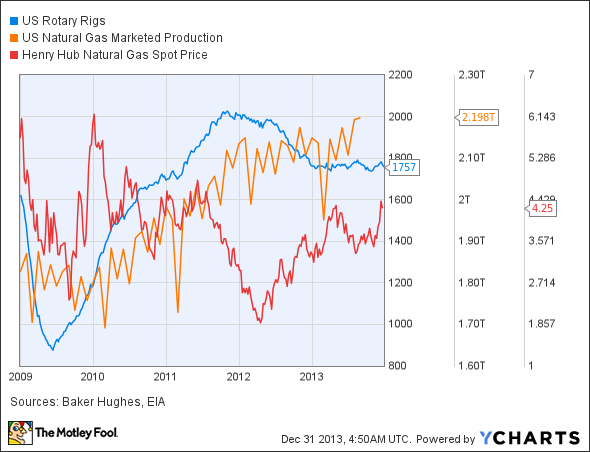

After three years of solid growth, 2013 will be a fairly flat year for U.S. natural gas production, and the reason is that prices fell too low in 2012. There was so much drilling for natural gas that the industry became oversupplied and drilling essentially came to a screeching halt earlier in 2013.

US Rotary Rigs data by YCharts

Production is flat this year, and if production rises or falls next year, prices will do the opposite. Companies that are greatly affected by trends in natural gas drilling are Halliburton and Schlumberger , which provide equipment and technology that make drilling possible. Both have struggled this year as rig counts fell, so keep an eye on drilling trends, because these companies will rise and fall as drilling does.

The price of natural gas now determines where other energy sources stand, so investors should keep an eye on price trends in 2014 to see if natural gas or maybe solar power will be the new industry favorite.

Do solar costs continue to fall?

Solar power is the only energy source where the fundamental cost to produce a unit of energy is falling year after year. The revelation in 2013 was that solar power has passed the grid in cost per kW-hr, and as costs fall, the industry will probably continue to grow.

Since Q1 of 2010, the cost to install a residential solar system has fallen 32.5% to $4.71 per watt, and a utility system has dropped 57.5% to $2.04 per watt.

Sources: GTM Research and the Solar Energy Industries Association.

This success has driven demand for SolarCity's distributed solar offerings and SunPower's large projects and solar panels. Both companies, along with the rest of the industry, are focused on cutting costs and increasing installations. If they can do both, the sky is the limit for the solar industry, because it's lowering costs while every other part of the industry is seeing costs rise.

What happens to oil prices?

While natural gas has gained favor in recent years, oil has come under pressure. Alternative fuels, including natural gas and electricity, are starting to power vehicles around the world. Demand for oil is already declining pretty rapidly in developed countries. If oil prices and gasoline don't fall some in 2014, the trend of moving toward alternatives will accelerate.

US Oil Consumption data by YCharts

It may not seem like it when you fill up your tank with gas, but the oil industry is at a crossroads. Declining demand is driven by new alternatives, and unless companies from ExxonMobil to BP can find ways to profit off alternatives or lower costs, they'll slowly see sales and profits fall.

Foolish bottom line

These are macro trends in energy that investors need to keep an eye on in 2014. Now, more than ever, the energy industry is changing rapidly, so staying ahead of the next big thing in energy is where investors need to be.

Profit from new energy trends

There are lots of ways to make money in energy, some that are hidden well below the surface of the industry. Imagine a company that rents a very specific and valuable piece of machinery for $41,000 per hour. (That's almost as much as the average American makes in a year!) And Warren Buffett is so confident in this company's can't-live-without-it business model, he just loaded up on 8.8 million shares. An exclusive, brand-new Motley Fool report reveals the company we're calling OPEC's Worst Nightmare. Just click here to uncover the name of this industry-leading stock, and join Buffett in his quest for a veritable landslide of profits!

The article Trends to Watch in 2014 originally appeared on Fool.com.

Fool contributor Travis Hoium manages an account that owns shares of SunPower. He also owns shares of SunPower and has long January 2015 $5, $7, $15, $25, and $40 calls on SunPower. The Motley Fool recommends Halliburton and SolarCity and owns shares of SolarCity. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.