How Freeport-McMoRan Jumped 19% in 2013

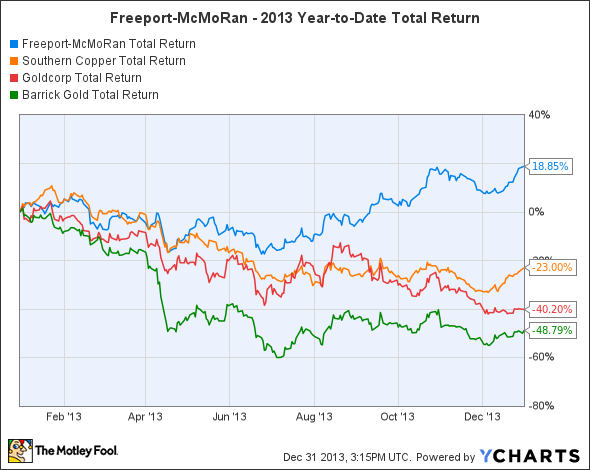

At first glance, the 19% gain that Freeport-McMoRan Copper & Gold posted in 2013 might seem like a disappointment, because even that impressive total return lagged behind the overall stock market. Yet when you look at the carnage among Freeport's peers, including copper rival Southern Copper and gold miners Goldcorp and Barrick Gold , the more surprising thing is how Freeport-McMoRan managed to perform so well this year. Let's take a closer look at what happened with Freeport-McMoRan this year and whether its stock could continue to give shareholders solid gains in 2014.

Grasberg mine. Source: Alfindra Primaldhi (Wikimedia Commons).

What happened to Freeport-McMoRan in 2013?

Coming into 2013, many Freeport-McMoRan shareholders were still reeling from the company's decision to buy out Plains Exploration & Production and McMoRan Exploration, two related business entities in the oil and gas industry. The move reversed a decision two decades earlier to separate out Freeport's gold and copper mining business from its energy divisions, and at the time, energy's prospects seemed less favorable than the mining industry.

As things turned out, though, energy is arguably the thing that saved Freeport from the huge declines that its mining rivals suffered. Copper prices have fallen almost 10% during 2013, sending Southern Copper to precipitous declines. Gold mining giants Barrick Gold and Goldcorp have seen even more dramatic losses in their stock prices, as gold has plunged by more than 25% and put many smaller mining companies in desperate straits. Freeport didn't emerge unscathed from the drop in metals prices, but its bounce in the second half of the year definitely stands out from its mining peers.

Freeport-McMoRan Total Return Price data by YCharts

Freeport still had to handle its share of problems during 2013. At the company's key Grasberg site, fatal accidents led the Indonesian government to close down the gold and copper mine temporarily. But that closure didn't last as long as some had feared, and even though it had an impact on earnings, prospects for the mine have improved. Moreover, a subsequent agreement with worker unions at Grasberg should eliminate the threat of work stoppages for at least the near future, helping to reverse a trend that has been of great concern to investors for years.

Improving conditions in its key industries could also point to future success for Freeport. Copper prices have held up better than many other commodities, and as economies in the U.S. and China start to rebound, demand for the metal could send prices back toward their highs above $4 per pound from a few years ago. Moves like the U.S. Army's decision to replace lead bullets with copper bullets could push demand up even further.

Stats on Freeport-McMoRan

Revenue, Past 12 Months | $19.55 billion |

1-Year Revenue Growth | 10.7% |

Net Income, Past 12 Months | $2.69 billion |

1-Year Net Income Growth | (8.3%) |

Source: S&P Capital IQ.

What's next for Freeport-McMoRan?

The key question for Freeport in 2014 will be whether its energy acquisitions start to pay off. The company's ultra-deep wells in the Gulf of Mexico represent a huge potential play for Freeport, but the efforts that McMoRan Exploration made to develop the play hadn't yet produced the results that investors had hoped to see before Freeport took over the company.

Beyond energy, though, conditions in the copper and gold markets will obviously play an important role in Freeport-McMoRan Copper & Gold's success in 2014. The Indonesian government's recent threat to limit exports of raw ore could force production cuts at Grasberg, even though Freeport remains confident in its ability to keep production levels up. More generally, as investors get used to the idea of Freeport being a diversified natural-resources company again, the stock could continue to climb if the global economy continues to show signs of further recovery.

Is Freeport your best energy play?

Record oil and natural gas production has already changed the energy industry in the U.S. forever. To help you profit the most, the Motley Fool is offering a comprehensive look at three energy companies set to soar during this transformation in the energy industry. To find out which three companies are spreading their wings, check out the special free report, "3 Stocks for the American Energy Bonanza." Don't miss out on this timely opportunity; click here to access your report -- it's absolutely free.

Click here to add Freeport-McMoRan to My Watchlist, which can find all of our Foolish analysis on it and all your other stocks.

The article How Freeport-McMoRan Jumped 19% in 2013 originally appeared on Fool.com.

Fool contributor Dan Caplinger owns shares of Freeport-McMoRan Copper & Gold. You can follow him on Twitter @DanCaplinger. The Motley Fool owns shares of Freeport-McMoRan Copper & Gold. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.