Why Navistar International Shares Could Slow Down in 2014 After Rallying 73% This Year

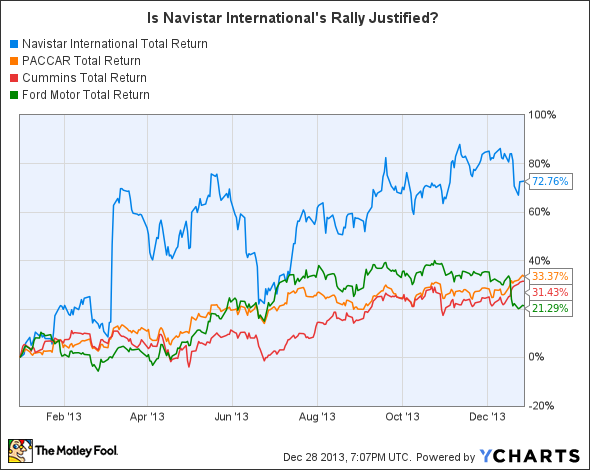

After ending 2012 with losses to the tune of $3 billion, no prudent investor would have wanted to invest in Navistar International for 2013. But as much as those massive losses left investors shocked, Navistar stock's rally this year has been equally surprising. The stock has tacked on 73% so far, easily beating every close competitor by a gaping margin -- Cummins and PACCAR have returned just a little more 30% returns year to date, while Ford shares have gained only 21% so far.

NAV Total Return Price data by YCharts

But while Cummins and PACCAR shares followed trends of the broader trucking industry through the year, and Ford had some great product launches for support, Navistar's gains had little to do with industry conditions. The company's business moves, internal shake-up, and aggressive efforts to turn around 2012's awful events kept investors' hopes alive. But with Navistar still nursing losses, and with competition heating up, can investors expect the stock to maintain its momentum in 2014, or has the bullishness already been baked into the share price?

A task well-handled...

Navistar management had an uphill task of reviving the company as it stepped into 2013. The U.S. Environmental Protection Agency, or EPA, rejected Navistar's ex-CEO Daniel Ustian's ambitious engine technology last year, and the company's warranty claims on 2010 engines shot through the roof. Navistar's losses hit a new high, its reputation tanked, and it lost customers rapidly.

Without wasting time, management ousted the CEO and added Cumminsengines to its trucks. By April of this year, Navistar received the EPA's certification for its own 13-liter engine that ran on the tried and tested selective catalytic reduction, or SCR, emissions technology. By October, Navistar had added the SCR technology to its full line-up of trucks in the Class 8 segment. That was a major milestone, since Class 8 is the most important segment in the heavy-duty-truck market.

Perhaps, Navistar's wisest decision was introducing Cummins engines into its trucks in December last year. Within the next nine months, Navistar bagged 11,500 orders for Cummins ISX engines. Meanwhile, its 13-liter MaxxForce engine received good response, crossing 6,000 orders within six months of launch.

...but the struggle continues

With so much happening at the company, investors' optimism wasn't misplaced. But those efforts didn't quite show up in Navistar's numbers. Its revenue slipped 15% while losses before tax rose 12% in 2013 (I've considered losses before tax here because the company recorded a huge one-time tax expense worth $1.8 billion in 2012). The weak performance can be broadly attributed to two factors - ongoing warranty issues and low market share. And until these two factors are taken care of, Navistar can't really grow.

While management blamed "weaker industry conditions" for low fourth-quarter sales, industry sales figures presented an entirely different picture. Navistar continued to struggle with weak market share even as peers gained ground. During the first half of the year, while Navistar lost five percentage points in the Class 8 market share, Daimler's Freightliner gained eight percentage points and PACCAR sold double the number of trucks as Navistar. From hitting the mid-twenties in 2009, Navistar's share in the segment dropped to 15% this year.

The medium-duty-truck segment is an equally big challenge, with Ford making huge headway. Ford's F-series pickups continued to outperform this year, retaining the crown of America's best-selling vehicle. Ford's trucks make up 60% of the total industry sales in the Class 2 through Class 5 segments, and it owns 58% of Class 5 market share. Since Navistar's flagship brand, International, covers Class 4 and Class 5 segments, Ford's dominance is disruptive.

Navistar really needs to buck up, especially since its market share has dwindled in each product segment. The following chart, which shows Navistar's market share over the past three years, says it all:

Traditional Markets (U.S. and Canada) | 2013 | 2012 | 2011 |

|---|---|---|---|

School buses | 37% | 41% | 45% |

Class 6 and 7 medium trucks | 24% | 32% | 38% |

Class 8 heavy trucks | 12% | 15% | 17% |

Class 8 severe service trucks | 22% | 29% | 31% |

Total "traditional" markets | 18% | 22% | 27% |

Combined Class 8 trucks | 15% | 18% | 20% |

Source: Company financials

Navistar maybe targeting 21% share in the total traditional market for 2014, but the bulk of it needs to come from the Class 8 segment if it really wants to get back in the game. Navistar also loses out in the hot natural-gas-truck market. Ford introduced Westport Innovations'compressed natural gas systems in its F-450 and F-550 pickups this year, and PACCAR is expanding the recently launched Cummins-Westport ISX12 G engines to more truck models. Navistar's initiatives in the natural-gas market are nothing to write home about.

Foolish takeaway

The good news is that Navistar has ended 2013 with 26% greater backlog value. The bad news is that its warranty claims continue to remain high. Navistar's financials don't look good either - Navistar was free cash flow negative by $500 million, its long-term debt increased 10% to $3.9 billion, unfunded pension liabilities stood at $1.4 billion, and cash and equivalents were only $755 million for the financial year 2013.

Navistar clearly has a lot of work to do, and its stock may give up recent gains if it doesn't improve its market share, profits, or financials soon. If you're a Navistar International shareholder, brace for a volatile 2014.

Hoe to make huge profits from the natural-gas revolution

Record oil and natural gas production is revolutionizing the United States' energy position. Finding the right plays while historic amounts of capital expenditures are flooding the industry will pad your investment nest egg. For this reason, the Motley Fool is offering a comprehensive look at three energy companies set to soar during this transformation in the energy industry. To find out which three companies are spreading their wings, check out the special free report, "3 Stocks for the American Energy Bonanza." Don't miss out on this timely opportunity; click here to access your free report before the year ends.

The article Why Navistar International Shares Could Slow Down in 2014 After Rallying 73% This Year originally appeared on Fool.com.

Fool contributor Neha Chamaria has no position in any stocks mentioned. The Motley Fool recommends Cummins, Ford, and Paccar. The Motley Fool owns shares of Cummins, Ford, and Paccar. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.