Why Facebook Soared 102% in 2013

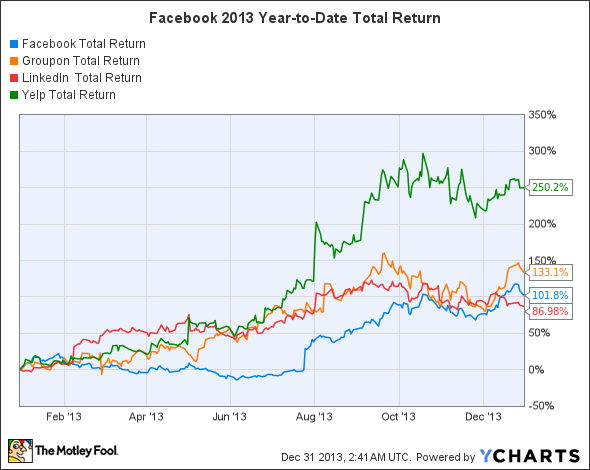

Coming into 2013, Facebook was among the most hated stocks in the market. But in yet another example of the power of contrarian thinking, Facebook stock more than doubled in 2013, as the company finally seemed to crack the code of mobile monetization. Yet in a market that has sent LinkedIn , Groupon , Yelp , and countless other social-related stocks to huge heights, are fears that Facebook is setting itself up for a repeat of the early 2000s tech bust warranted? Let's take a closer look at what happened with Facebook this year and whether its stock could post gains in 2014.

What happened to Facebook in 2013?

For Facebook, this year was a story of investors gradually coming to terms with the fact that the company has a legitimate business model. After the IPO fiasco in 2012, shareholders started to question whether Facebook could deliver on its promise of adapting beyond its initially PC-centered market to create the same opportunities with mobile users. Even well into 2013, investors took Facebook's stellar growth with a big grain of salt. In the first quarter of 2013, revenue jumped 38%, with mobile ad sales making up about 30% of total revenue. Yet as late as mid-year, the stock remained flat for 2013 and down sharply from its IPO price. At the same time, many investors believed that business-network LinkedIn had permanently taken Facebook's place, as both it and fellow social-stocks Yelp and Groupon climbed to gains of between 50% and 100% by the end of June.

But all the doubt seemed to end in July, when Facebook's second-quarter report once again underscored the success that the social-media giant has had in growing its business. Ad revenue jumped 61%, with its growth pace quickening substantially from previous quarters. In just a single quarter, the share of Facebook's overall revenue coming from mobile jumped by more than 10 percentage points to 41%. Moreover, the company combined new member count growth with taking greater advantage of its existing users, boosting average revenue per user by 24% worldwide and raising daily engagement rates by more than 13 percentage points to over 71%. Shortly thereafter, LinkedIn also reported explosive results, raising confidence in the social space overall.

Facebook Total Return Price data by YCharts.

Since then, it's clear that Facebook's shareholders have gotten even more demanding in their expectations of the company. In November, mobile ad revenue once again rose, reaching nearly half of all sales. Yet comments that the company was seeing declining levels of engagement among teens made long-term investors question Facebook's staying power. With lofty valuations based in large part on the sustainability of the business model for years if not decades down the road, Facebook stock suffered temporarily as a result.

Yet in December, Facebook got the ultimate vote of confidence with its long-anticipated entrance into the S&P 500. With index funds having to buy shares, Facebook rose to its highest levels ever, and with the successful launch of Twitter's IPO, Facebook shares finally reflect the promise of the groundbreaking social-media giant's possible future.

Stats on Facebook

Revenue, Past 12 Months | $6.87 billion |

1-Year Revenue Growth | 48% |

Net Income, Past 12 Months | $1.04 billion |

1-Year Net Income Growth | 258% |

Source: S&P Capital IQ.

What's next for Facebook?

The big question for Facebook is whether it can continue to boost its ability to monetize its user base faster than the slowing growth in the number of users Facebook attracts. Worries that Facebook is losing the younger end of its target demographic could put a lid on new adoption among high-value users, but with its uncanny ability to find ways to generate revenue from its existing membership, Facebook can continue to grow impressively even if its member-count growth decelerates.

One thing will remain true for Facebook in 2014 and beyond: the stock will almost certainly never look particularly attractive from a valuation standpoint. Only those who have strong confidence in Facebook's growth promise can feel comfortable with its sky-high earnings multiple. Yet in the social-media space, high valuations are a fact of life. If Facebook can continue to make the most of its ad revenue opportunities, the stock could keep climbing in 2014 and beyond despite its lofty current levels.

Get the right pick for your portfolio

Opportunities to get wealthy from a single investment don't come around often, but in the social-media space, they do exist. Our chief technology officer believes he's found one. In this free report, Jeremy Phillips shares the single company that he believes could transform not only your portfolio, but your entire life. To learn the identity of this stock for free and see why Jeremy is putting more than $100,000 of his own money into it, all you have to do is click here now.

Click here to add Facebook to My Watchlist, which can find all of our Foolish analysis on it and all your other stocks.

The article Why Facebook Soared 102% in 2013 originally appeared on Fool.com.

Fool contributor Dan Caplinger has no position in any stocks mentioned. You can follow him on Twitter: @DanCaplinger. The Motley Fool recommends Facebook, LinkedIn, and Yelp and owns shares of Facebook and LinkedIn. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.