What is Holding Back Clean Energy Fuels?

Clean Energy Fuels has long been one of the best ways to play the growing natural-gas-fuel market. The company's rapidly growing infrastructure of fueling stations has resulted in a viable alternative for trucking fleets around the country, and better technology from engine companies like Westport Innovations is making the switch viable.

But is this going to be a long-term high-growth business or is if a flash in the pan? Let's take a look at two risks investors shouldn't ignore.

Natural gas won't dominate the passenger-car market

There's no doubt that natural gas is, and will remain, attractive to the trucking market. In the third quarter, Westports Cummins and Weichai partnerships shipped 2,409 and 9,080 units, respectively, up 52% and 88% from a year ago. Clean Energy Fuels' customers ordered 70% more natural-gas vehicles than a year ago last quarter. It's clear that trucking fleets are seeing this as a viable alternative.

But what trucking success hasn't translated to is the passenger-car market. Natural-gas cars haven't been a hit in the U.S., and the growing popularity of cleaner, higher-performance electrical vehicles is a challenge for natural-gas fuel's upside.

The trucking industry will likely see natural gas as a viable alternative as long as prices are low, but there's not a lot of upside outside of the trucking market. That will keep a cap on Clean Energy Fuels' upside.

Natural gas might not always be so cheap

There's no disputing that natural gas is less expensive for trucking fleets than diesel today, but will that be the case long term?

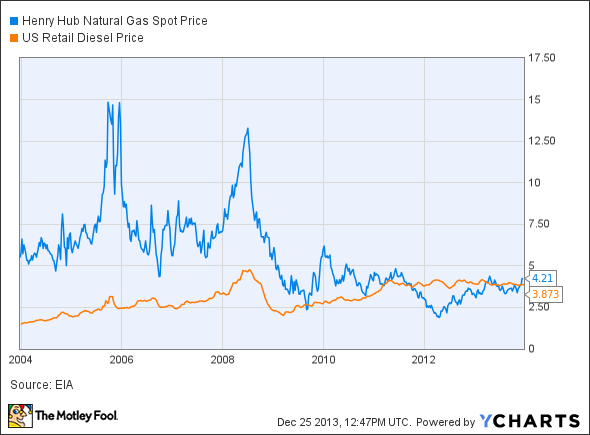

The chart below shows that natural-gas prices have definitely trended lower over the past decade while diesel has become more expense. The challenge is that drilling for natural gas suffered over the past two years as prices plummeted, and the imbalance between supply and demand may not maintain long term. If supply goes down or demand goes up, so could prices, which would kill any price advantage.

Henry Hub Natural Gas Spot Price data by YCharts

The U.S. is already working hard to increase natural-gas exports, which can be sold into markets around the world at much higher prices. That will also increase demand and prices.

Then there's the oil market, which I don't think will see higher prices in the next decade and may even see prices fall. Demand in developed countries is already starting to decline, and as fuel-efficiency standards increase and alternative vehicles become more popular demand could begin to fall worldwide, resulting in falling (or at least stable) prices.

Foolish bottom line

I simply see limited upside for Clean Energy Fuels because what makes it a viable alternative today probably won't last forever. If diesel prices fall, trucking fleets won't see a reason to switch, and the consumer market has never been enamored with natural gas. Worse yet, consumers are beginning to adopt electric vehicles at a rapid rate, passing over natural gas.

Clean Energy Fuels will still grow in 2014; there's just limited upside in building a natural-gas-fueling infrastructure.

Energy stocks to buy now

One of the reasons oil prices may fall is growing domestic production. Finding the right plays while companies drill for more and more oil will pad your investment nest egg. For this reason, the Motley Fool is offering a comprehensive look at three energy companies set to soar during this transformation in the energy industry. To find out which three companies are spreading their wings, check out the special free report, "3 Stocks for the American Energy Bonanza." Don't miss out on this timely opportunity; click here to access your report -- it's absolutely free.

The article What is Holding Back Clean Energy Fuels? originally appeared on Fool.com.

Fool contributor Travis Hoium has no position in any stocks mentioned. The Motley Fool recommends Clean Energy Fuels and Westport Innovations. The Motley Fool owns shares of Westport Innovations. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.