Is Movado the Right Pick for Your Portfolio?

Watch retailer Movado's third-quarter results made investors quite hopeful about the current holiday season. Considering that there are many retailers who are struggling to stir demand for their high-end products, Movado bucked the trend. Its results beat the Street's expectations, helped by great demand for its products.

Quarterly numbers

Revenue surged 18.4% to $189.7 million over last year, largely driven by growth in Movado's licensed brands. By providing new designs and a great collection, Movado lured customers to its products. Also, its newly launched Scuderia Ferrari watches played an important role in driving sales northwards. Adjusted earnings for the quarter rose to $0.89 per share, a 33% gain over last year's quarter.

One of the primary reasons behind the extraordinary performance was that Movado introduced a new range of products. Bold bangles, Bold ceramic and Bold with diamonds were some of the items which were introduced at different price points in the Movado Bold segment. New products were accompanied by increased advertising, which helped attract more customers.

Competition in play

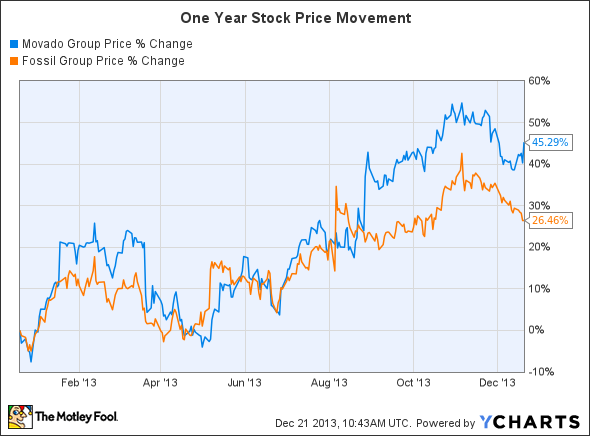

Not only did Movado put up a great quarter and delight its investors, it has outperformed its peer Fossil when stock price performance is considered.

Movado has been an impressive performer with shares increasing 45.3% in the last year. However, Fossil also performed well with stock price appreciation of 26.5%. Fossil's performance has been largely boosted by Michael Kors' success. Since Fossil manufactures watches for Michael Kors and sales at Michael Kors have been on the rise since its IPO, Fossil has benefited.

Fossil's recent quarter was also a great one with sales increasing 18.1% over last year and earnings increasing by 25% to $1.58 per share. Moreover, customers loved the watch maker's new designer launches, such as Karl Lagerfeld early this year. However, this is not the end--Fossil plans to launch a new Tory Burch collection next year, which should bring in additional revenue.

Therefore, Movado faces stiff competition from Fossil. Also, Movado's licensed brands have not been as attractive. For example, Coach's last quarter was a lackluster one. It reported a slightly lower top line with a decline of 1% and a flat bottom line. Coach's comparable-store sales fell 6.8% as it witnessed decreasing traffic in its stores, resulting in a lowered outlook.

However, Movado announced that Coach's watches are expected to do well as the company has introduced 150 new styles and packaging along with better marketing strategies. This move might attract more customers during the fall. In the licensed brand division, Coach Tristen was one of the successful products for Movado, which drove its segment revenue higher.

Strategies for the fall

Additionally, Movado has a host of efforts in place in order to lure customers and make the most of the peak season. It will be launching a number of new products such as updated versions of Cerena, an extension in the Mesh bracelets, and additions to the ESQ One collection.

Moreover, the watch manufacturer has geared up its marketing efforts. It has been advertising in leading fashion magazines and newspapers. Also, it will launch three new commercials for television in December, which should help revenue grow.

Therefore, Movado has been innovative with its products as well as its promotional efforts in digital and social media. Its products are well placed at different price points and cater to a variety of customer categories.

Final thoughts

Despite stiff competition Movado has been able to outpace players such as Fossil. Also, its own growth has been good enough to justify an investment. It has been posting great numbers and providing great returns to its investors. Moreover, it has been pretty active on the strategic front as well, with new products and increased marketing for the current quarter. Investing in this company should prove to be rewarding.

What's the Fool's favorite stock for 2014?

There's a huge difference between a good stock, and a stock that can make you rich. The Motley Fool's chief investment officer has selected his No. 1 stock for 2014, and it's one of those stocks that could make you rich. You can find out which stock it is in the special free report: "The Motley Fool's Top Stock for 2014." Just click here to access the report and find out the name of this under-the-radar company.

The article Is Movado the Right Pick for Your Portfolio? originally appeared on Fool.com.

Pratik Thacker has no position in any stocks mentioned. The Motley Fool recommends Coach, Fossil, and Michael Kors Holdings. The Motley Fool owns shares of Coach. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.