3 Dividend Stocks You Need to Watch in 2014

Times change. People change. Dividend stocks change. Many utilities investors have had a disappointing year in 2013, and 2014 will continue to separate winners from losers. The energy world is changing fast, and these dividend stocks are in the heat of the battle for 2014's biggest win.

1. Exelon

Source: Exelon.

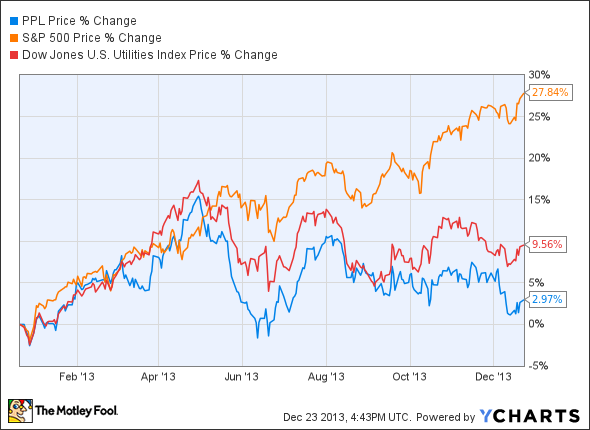

Exelon has had a tough year. Its stock dropped 8.4% while the S&P 500 soared 27.8% and the Dow Jones Utilities Index headed 9.5% higher.

But Exelon stock's stumble may be a buying opportunity for 2014. It's hard to argue that Exelon stock is anything but cheap. Its trailing 12 months P/E ratio clocks in at 15, and Exelon stock trades at a price-to-book value of just 1.1.

But just because Exelon stock is cheap doesn't mean it's worth it. Next year's natural gas prices will dictate the competitiveness of this nuclear stock, and it looks as if 2014 has profits in store. Natural gas prices have headed higher recently, and a variety of factors could keep gas prices pushing up even more in 2014.

2. PPL

PPL has kept its dividend stock in the black for 2013, but a 3% gain is hardly knocking investors head over heels.

But PPL's 5% dividend yield is nothing to sniff at, and its 11.9 P/E ratio and reasonable 1.5 price-to-book value makes its stock all the more affordable. With operations across the U.S. and the U.K., geographic diversity keeps this stock sheltered from a one-country crisis. Its regulated British operations account for more than half of the company's overall earnings, and PPL has beat earnings expectations for every quarter of the last three years expect for third-quarter 2013.

3. Spectra Energy

Source: Spectra Energy

If this employee owns shares of his employer, he's got a reason to smile. Spectra Energy and its newly formed master limited partnership Spectra Energy Partners were hot stocks in 2013. Shares of Spectra Energy soared 38%, while baby brother Spectra Energy Partners managed a respectable 25.5% jump.

Three things are driving Spectra's growth: transmission projects, domestic natural gas, and LNG exports.

In November, Spectra Energy completed the dropdown of all its remaining U.S. transmission, storage, and liquid assets to Spectra Energy Partners. Transmission is a lucrative business for dividend stocks, providing "toll booth" revenue that the company can pass directly to shareholders. Among its inheriting assets, Spectra Energy Partners will push ahead with a NextEra Energy partnership to build a $3 billion gas pipeline through Florida. The pipeline is the state's third major gas transmission line and will play a large role in meeting Florida's growing energy demand .

Spectra Energy has had a banner year of its own. In the month following the dropdown announcement, Spectra Energy stock soared almost 40% higher. The company continues to secure more long-term gas shipment contracts, and its location puts it in a strategic position to take advantage of developing LNG export markets in the Gulf Coast region.

The best dividend stocks money can buy

With dividend stocks lagging market returns for 2013, 2014 could be a year of major moves. There will be winners - and there will be losers. Each of these dividend stocks provides a unique opportunity to pad your portfolio's profits for 2014, but they're not the only ones. Wise investors knows it takes strong, diversified dividend stocks to sustainably boost profits.

To help you out for 2014 and beyond, our analysts sat down to identify the absolute best of the best when it comes to rock-solid dividend stocks, drawing up a list in this free report of nine that fit the bill. To discover the identities of these companies before the rest of the market catches on, you can download this valuable free report by simply clicking here now.

The article 3 Dividend Stocks You Need to Watch in 2014 originally appeared on Fool.com.

Fool contributor Justin Loiseau has no position in any stocks mentioned. The Motley Fool recommends Exelon and Spectra Energy. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.