Housing Starts at Highest Levels Since Before the Recession: Is It Really Different This Time?

The housing market has been described as either a bright spot in a slowly recovering economy, or as just another bubble about to pop. With housing starts up almost 23% in November, following a summer building season somewhat moderated by rising interest rates, investors look to have been fleeing these stocks over the past several months.

Add in the Fed's announcement that it will begin tapering its stimulus of the financial markets, including reducing purchases of mortgage-backed securities by $5 billion per month, will there actually be a decline in housing starts in 2014? For investors in the housing sector, what should you do? Let's take a closer look.

Mixed bag during the recovery: Will more recent results continue?

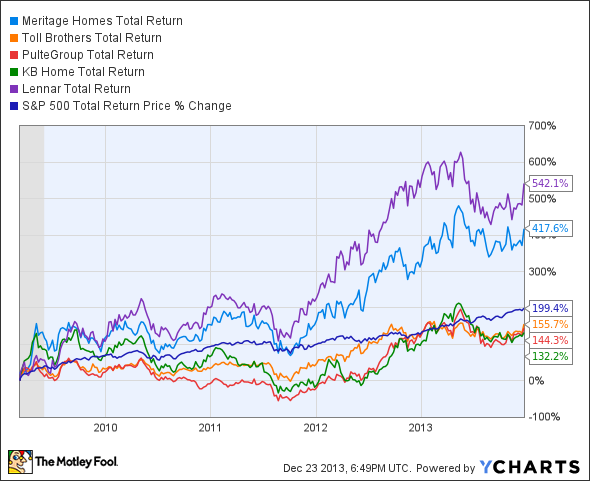

Only a couple of the larger homebuilders have outperformed the market since the lows of 2009:

MTH Total Return Price data by YCharts

Lennar and Meritage Homes have outperformed since 2009's lows, with both absolutely crushing the market. And while peers like Toll Brothers , PulteGroup , and KB Home have performed well, they have seen the overall market do better by more than a 50% margin.

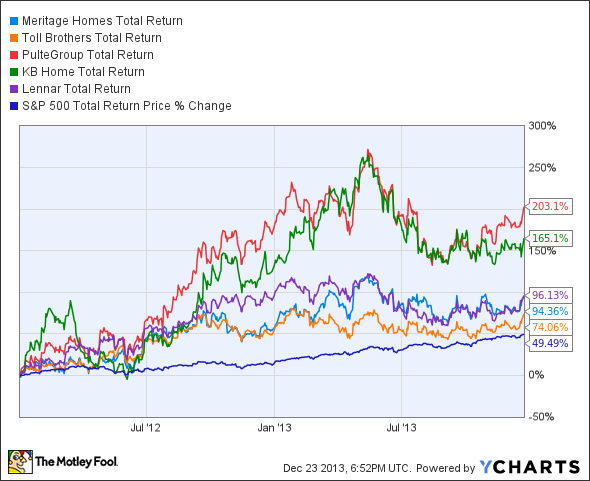

All five have done well over the past two years, outperforming the market since 2012:

MTH Total Return Price data by YCharts

All five have outperformed the S&P 500, but as the chart above also shows, they also gave up a lot of gains over the summer due to pressure from rising interest rates and concerns about the weak economic recovery; both probably sent a lot of investors looking for the exits. The thing is, these specific details are data points that should factor into investing decisions, not things that should direct our actions when investing with a long-term outlook.

Long-term trends

When we go back further, we see something that's worth noting:

MTH EPS Diluted (TTM) data by YCharts

Neither Meritage, Toll Brothers, KB Home, nor Lennar yet have reached their pre-recession earnings-per-share levels. While it's probably unreasonable to expect homebuilders to reach levels attained in an unsustainable building period, the picture above does show how far these homebuilders fell, and how far they have come in terms of making a profit. How does this translate to future results?

As with any cyclical industry, it's important to consider both the cyclical effects, as well as find the best individual performers. Look for competitive advantages and strong growth opportunities, and invest at a good value on the right side of the cycle, has historically been a great path to wealth. First, let's take a look at the cycle:

US Housing Starts data by YCharts

New housing starts must at least keep up with new household formations, or there's a shortage of housing. As you can see, indicated by the gray bands, new household formations tend to really fall off during and after a recession, as less economic opportunity forces more people to stay at home; especially young adults looking to get out on their own.

However, the long-term trend is for new household formations to consistently be between 1 million and 2 million per month, and that new housing starts tend to consistently trend just a little bit higher than that to support population growth, demolished properties, and people upgrading or downsizing. As long as new housing starts remain below the long-term average, there will be room for growth.

Opportunity only matters if you invest in the right companies

Buying the best companies for a good price is a better bet than buying a good company at a great price, to paraphrase Warren Buffett. After all, it's the company's performance that will generate growth. In my eyes, Meritage Homes and Toll Brothers both offer a strong mix of competitive advantages, solid management, and great growth opportunities.

Meritage Homes reported a 44% increase in revenue from home closings last quarter, with EPS up 421% for Q3, and an astounding 583% so far in 2013. These metrics are largely being driven by a 22% increase in the average home sales price, as the company continues to grow its sales mix in the upscale market. The effect this is having on gross margins is fantastic, with the latest quarter's 22.8% the highest since 2006. Expenses are rising, but largely a result of hiring and growth, and are declining as a percentage of sales.

Toll Brothers, the largest U.S. luxury homebuilder, recently reported Q4 and full-year results. On the surface they may look like a let-down, with earnings falling a whopping 65%. But just a little digging shows that 2012's numbers were aided by a one-time tax break. On a pre-tax basis, Toll Brothers actually doubled its profits year over year. Toll Brothers has also seen an increase in the average sales price, up 21% versus 2012. The company's strength lies largely in its status as a luxury homebuilder. This segment of the market is less affected by rising interest rates, and a continually strengthening economy is definitely a positive for Toll Brothers.

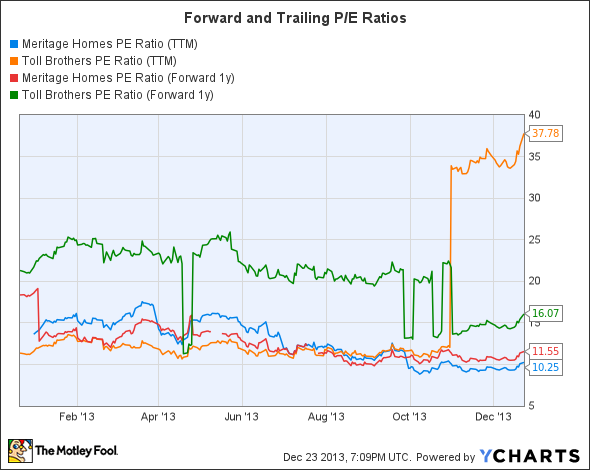

Getting a good value

MTH P/E Ratio (TTM) data by YCharts

Toll Brothers' trailing-12-month, price-to-earnings ratio was largely deflated by the tax benefits in 2012, which is why its forward P/E ratio can help evaluate the stock price. Meritage's trailing-12-month ratio of below 10 is quite low. For both companies, the forward P/E ratios are near 2013 lows, indicating that today's price could be a good value.

Final thoughts: good value on the cyclical upswing

The investment opportunity is largely based on growth; so an investment in either of these two is belief that housing will continue to recover. From Toll Brothers chairman Robert Toll:

We believe that Toll Brothers, as well as the other public home building companies, still have significant room for growth. The economy, while still improving slowly, is far from fully recovered. National housing starts, although projected to be up in 2013 compared to 2012, will still be well below the average of the last forty years despite an increased population.

The future looks great for housing, and both Meritage and Toll Brothers are positioned to perform exceptionally.

More long-term investing ideas from the Fool

As every savvy investor knows, Warren Buffett didn't make billions by betting on half-baked stocks. He isolated his best few ideas, bet big, and rode them to riches, hardly ever selling. You deserve the same. That's why our CEO, legendary investor Tom Gardner, has permitted us to reveal "The Motley Fool's 3 Stocks to Own Forever." These picks are free today! Just click here now to uncover the three companies we love.

The article Housing Starts at Highest Levels Since Before the Recession: Is It Really Different This Time? originally appeared on Fool.com.

Jason Hall owns shares of Meritage Homes. The Motley Fool recommends Meritage Homes. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.