Can Caesars Entertainment's Strategic Relationships Help It Perform?

Caesars Entertainment has suffered some bad luck recently. The biggest headwind has been debt. At the moment, Caesars has $1.7 billion in cash and short-term cash equivalents versus $21.5 billion in long-term debt.

This debt is a big concern, as it impedes growth potential... especially if interest rates increase in the future. Caesars is likely to use divestments in an effort to reduce its debt. Caesars recently sold 10.3 million shares of its common stock for $200 million; it sold its Macau golf course to Pearl Dynasty for $438 million; and last year it sold its Harrah's St. Louis property to Penn National Gaming for $610 million.

However, Caesars Entertainment is still highly leveraged, and it has been trailing peers Las Vegas Sands and MGM Resorts International on the top line. We'll take a look at that soon.

Despite all these negatives, Caesars Entertainment has been rewarding its shareholders, seeing stock appreciation of 164% in the past year. This has a lot to do with the company's online gambling potential. But Caesars Entertainment isn't relying on just one potential revenue stream to fuel the top line. It has been wheeling and dealing in the physical world as well.

A HOT deal

Caesars Entertainment recently partnered with Starwood Hotels & Resorts Worldwide to combine Caesars' Total Rewards and Starwood Hotels' Preferred Guest programs. Thankfully, this is a simple partnership to understand. If you're a Total Rewards member, you can redeem your points at a Starwood Hotels location. This includes the following brands: W, Westin, St. Regis, The Luxury Collection, Le Meridien, Sheraton, Four Points, and Element.

I began with Total Rewards because it has a whopping 45 million members. If you're a Preferred Guest member, then you can redeem those points at Caesars Entertainment properties.

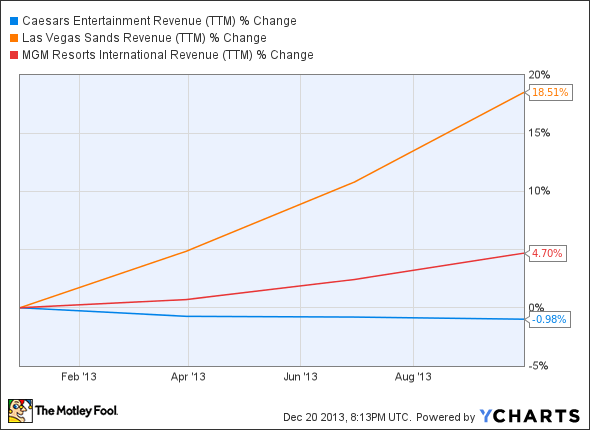

This might not be a massive marketing move for Caesars Entertainment, but it's not going to hurt. It's also a wise move considering MGM Resorts and Hyatt Hotels formed a similar partnership earlier this year. Caesars Entertainment can ill afford to fall short of its peers in any area. On top of being highly leveraged, consider its weak top-line performance compared to peers for the past year:

Caesars revenue (trailing-12-month) data by YCharts.

Caesars Entertainment recently made a bigger announcement...

AXIS

I only used one word in the subtitle above because that's what Caesars Entertainment is trying to accomplish in regard to branding: The goal is for The AXIS at Planet Hollywood Resort & Casino to become the No. 1 live music venue in Las Vegas.

Considering the company's partnership with Live Nation , which has established a top-notch reputation for delivering popular names that draw big crowds, this partnership is likely to pay dividends for Caesars. And just like all great partnerships, both sides have put themselves in a position to win. For Live Nation, this will be the biggest test yet, and the company will be eager to prove its capabilities, which would build its brand.

The biggest draw for AXIS, and an immediate one, will be "Britney: Piece of Me," which is set to open on Dec. 27. Britney Spears has stated that she's excited about performing in such a unique venue, where she can see the faces of everyone in the crowd. She's also likely to draw large audiences.

Company direction

Unfortunately, the Caesars Entertainment story needs more time to unfold before determining whether or not it's likely to be a successful turnaround. Its online gambling potential has yet to be established, and it's highly leveraged. However, it's finding ways to free up cash to pay off debt while also forming partnerships to help drive the top line. Stay tuned.

A free report on strategic investing

Millions of Americans have waited on the sidelines since the market meltdown in 2008 and 2009, too scared to invest and put their money at further risk. Yet those who've stayed out of the market have missed out on huge gains and put their financial futures in jeopardy. In our brand-new special report, "Your Essential Guide to Start Investing Today," The Motley Fool's personal finance experts show you why investing is so important and what you need to do to get started. Click here to get your copy today -- it's absolutely free.

The article Can Caesars Entertainment's Strategic Relationships Help It Perform? originally appeared on Fool.com.

Fool contributor Dan Moskowitz has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.