eBay Doubles Down On Mobile

PayPal, the online payment juggernaut, has been the single greatest growth driver for E-commerce giant eBay for the last several years.

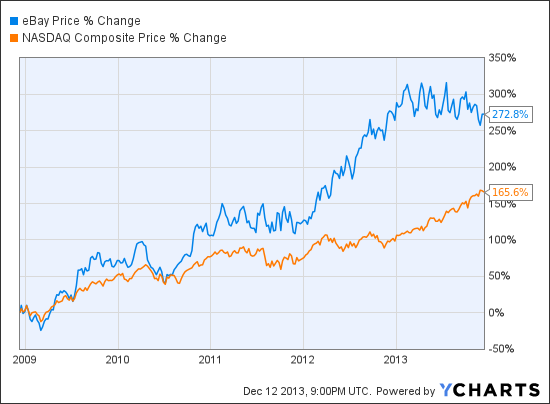

In the last five years alone, revenue from eBay's PayPal has compounded at an average rate of 18% annually. PayPal's overriding success in the booming industry for online payments has clearly been a major contributor to eBay's outstanding performance. Looking at the last 5 years, eBay's shares have surged 260%, handily trouncing the Nasdaq's 164% gain during the same time frame.

The best is yet to come

Although this run has been impressive for both companies in question here, there's plenty left in the tank at PayPal to help fuel eBay's returns for years to come.

One particularly interesting area of opportunity for PayPal and eBay is mobile. In just the latest example to date, over the Thanksgiving holiday, PayPal noted an impressive 114% spike in mobile payments compared to the year prior.

As you can imagine, PayPal, and eBay by extension, are laser focused on this booming market, as tech and telecom analyst Andrew Tonner examines in the video below.

Is this tech's top growth stock?

This incredible tech stock is growing twice as fast as Google and Facebook, and more than three times as fast as Amazon.com and Apple. Watch our jaw-dropping investor alert video today to find out why The Motley Fool's chief technology officer is putting $117,238 of his own money on the table, and why he's so confident this will be a huge winner in 2013 and beyond. Just click here to watch!

The article eBay Doubles Down On Mobile originally appeared on Fool.com.

Fool contributor Andrew Tonner owns shares of eBay. Follow Andrew and all his writing on Twitter at @AndrewTonner. The Motley Fool recommends eBay, MasterCard, and Visa. The Motley Fool owns shares of eBay, MasterCard, and Visa. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.