Top Telecom Stocks for 2014

Telecoms are some of the most efficient cash machines on the face of the earth. In the increasingly digital age we live in, the definition of a telecom is stretching over some brand-new -- and very interesting -- business models. A far cry from the traditional idea of telecoms as cash-cow businesses with massive dividend yields, the stocks I'm about to show you offer no dividend at all but plenty of growth opportunity instead. Here are three of the top telecom stocks for 2014.

The traditional telecoms

U.S. Cellular and Alaska Communications Systems provide utterly normal telephony services on American soil. U.S. Cellular focuses on a wireless network centered around the rural Midwest, while Alaska Telecom sells both wired and wireless services waaaay up north.

Turkcell Iletisim Hizmetleri is an exclusively mobile operator like U.S. Cellular, except that it focuses on the exploding Turkish economy and is the largest telecom in Turkey.

These three stocks have struggled in 2013, and look like excellent values as we move into 2014:

Is it grim up north?

Alaska Telecom used to be a huge dividend play. The stock hovered around a 10% yield for years, then spiked to more than 25% in 2012. That's when the dividend was cut to one-quarter of its formerly generous self, triggering an even larger share price drop. When dividends were cancelled altogether, the writing was on the wall and shareholders didn't panic a second time.

The company took its dividend budget and spent it on building a high-speed 4G LTE network. That strategy paid off in 2013 as wireless sales skyrocketed, driven by the new high-speed data plans.

The stock trades at a very affordable 15 times forward earnings, Alaska Telecom is back to making over $20 million of operating cash flows per quarter, and the company has a healthy strategy going on. This stock is poised for a big turnaround in 2014, and I'd be shocked if Alaska Telecom didn't return to paying generous dividends again. Maybe not in 2014, but certainly in the next couple of years.

Take me home, country roads

U.S. Cellular's rural focus was sharpened even further last spring, when the company sold most of its spectrum licenses in Midwestern cities to Sprint for a quick $480 million cash infusion. The new strategy is based on collecting roaming charges from other mobile operators as their customers go wandering about U.S. Cellular's unmatched countryside coverage.

That move created a more profitable business model, and U.S. Cellular's rural assets still paint a large buyout target on the company's back. Sprint might come back for a double dip if it wants to offer something the dueling duopolists on top can't quite match, and Sprint itself isn't a terrible play right now. But Sprint's stock is nowhere near as spring-loaded as U.S. Cellular's is.

Istanbul (not Constantinople)

Finally, Turkcell is more than just another mobile network. It's the dominant mobile option in a market with 68 million cell phone customers, an economy emerging from "emerging" to "developed" in large strides, and a relatively immature market for 3G and 4G high-speed connections. Mobile broadband contracts are far more profitable than plain old voice and messaging services, so that last point is an important growth driver in the years ahead.

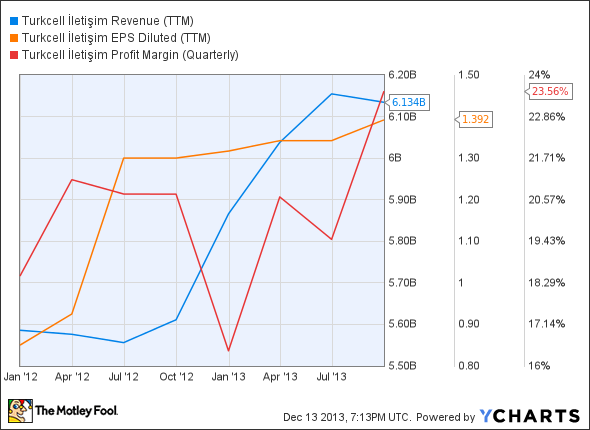

Looking backward a bit, Turkcell has been on a roll:

TKC Revenue (TTM) data by YCharts.

And you get all of this at an astonishing discount. Turkcell shares sell for a value-loaded 10.6 times trailing earnings. Like Alaska Telecom, Turkcell is taking a break from dividend payments to boost its network investments. In both cases, I think it's a sound strategy that may scare investors in the short term but sets the stocks up for huge rebounds as the tactic pays off -- and dividends return.

Those are my three favorite telecom stocks for 2014. Do you agree? Got better ideas up your sleeve? Either way, share your thoughts in the comments box below.

From "good" to "great" to "totally awesome"

There's a huge difference between a good stock, and a stock that can make you rich. The Motley Fool's chief investment officer has selected his No. 1 stock for 2014, and it's one of those stocks that could make you rich. You can find out which stock it is in the special free report: "The Motley Fool's Top Stock for 2014." Just click here to access the report and find out the name of this under-the-radar company.

The article Top Telecom Stocks for 2014 originally appeared on Fool.com.

Fool contributor Anders Bylund has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.