Why Cisco Systems Pulled the Dow Lower Today

Stock markets have traded significantly lower for most of the day, but the Nasdaq has broken into positive territory while the S&P500 is near breakeven late in the day. The Department of Labor said initial jobless claims rose 68,000 last week to 368,000, a large increase but just one data point in a volatile holiday jobs season. The long-term trend is for lower layoffs, so watch to see if the figure stays elevated or if this is a one-time jump.

The other important data out today was a Department of Commerce report that retail sales were up 0.4% excluding autos in November and 0.7% including autos. This is particularly impressive when you consider that Thanksgiving was exceptionally late in the month, leaving little room for holiday shopping in November. This could set the stage for strong retail sales growth in December.

While the other major indices bounced back late in trading, the Dow Jones Industrial Average hasn't had the same recovery. It's is still down 0.37% at 3:27 p.m. EST, in part because of a drop in tech giant Cisco's stock.

Cisco disappoints again

Chief Financial Officer Frank Calderoni said today Cisco Systems expects to grow revenue 3%-6% over the next three to five years, which was lower than a previous forecast of 5%-7%. The fear is that competition from lower-cost networking equipment providers will limit Cisco's growth in the future; that may be what Calderoni is already forecasting.

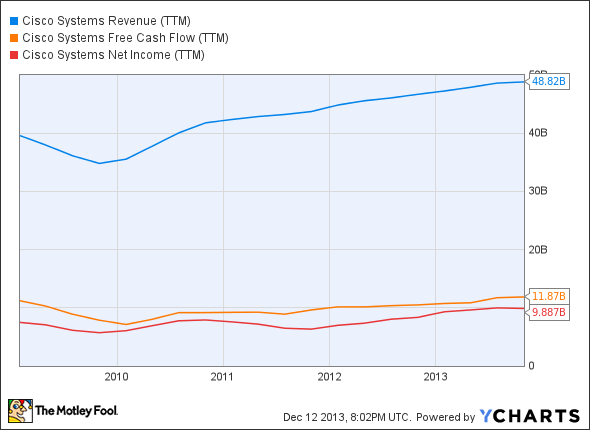

The days of double-digit growth may be in the past, but let's not lose sight of the fact that Cisco is a highly profitable company that spits out lots of cash each year.

CSCO Revenue (TTM) data by YCharts.

The company's current market cap is less than 10 times free cash flow, and that's before considering the $34.4 billion in cash and short-term investments less debt.

Time to buy Cisco Systems

The market can often react strongly when guidance doesn't meet expectations, but in the case of Cisco I see another overreaction to a stock that's a great value. Management could do more to return cash to shareholders, and if it does even a slow growth rate will make for a great stock return.

One top stock for next year

It's time to start setting up your portfolio for growth next year and The Motley Fool's chief investment officer is here to help with his No. 1 stock for 2014. You can find out which stock it is in the special free report: "The Motley Fool's Top Stock for 2014." Just click here to access the report and find out the name of this under-the-radar company.

The article Why Cisco Systems Pulled the Dow Lower Today originally appeared on Fool.com.

Fool contributor Travis Hoium has no position in any stocks mentioned. The Motley Fool recommends Cisco Systems. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.