This Is the Biggest Difference Between Microsoft and Google

Microsoft and Google have a lot in common. The two tech giants sport market caps in the $300 billion range, supported by business models leaning heavily on the Internet. They often compete head-to-head for the same engineering talent, the same consumer eyeballs, the same big-ticket data management contracts.

But you can spot the core difference between Google and Microsoft from a mile away by looking at what makes them tick. I don't mean the financial platforms or even their product portfolios, but the values nearest and dearest to each company's heart.

In a Forbesinterview this week, Microsoft's soon-to-retire CEO Steve Ballmer explained his strategy this way: "How do you make money? How do you make money? How do you make money?"

Compare and contrast that attitude to Google's stated philosophy: "Focus on the user and all else will follow."

I own Google shares and avoid Microsoft, and this philosophical split explains exactly why.

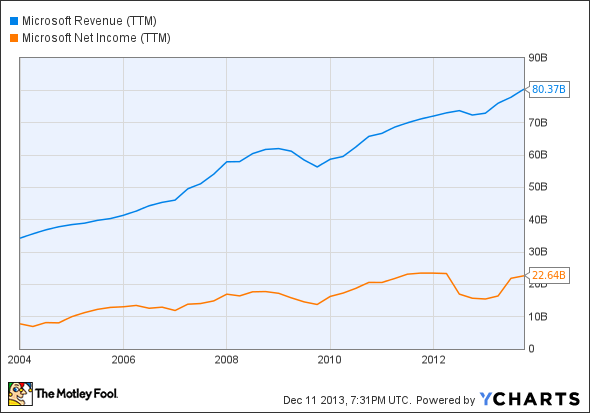

There's no question that Steve Ballmer is good at making money. Microsoft has more than doubled its revenues and nearly tripled net income over the last 10 years, and it wasn't a small company at the start of that period.

MSFT Revenue (TTM) data by YCharts.

But the relentless profit focus has led Microsoft astray many times. Windows Vista might not have been such a failure if Microsoft hadn't overcharged international customers so harshly. The Xbox gaming console line requires a monthly Xbox Live Gold membership in order to do anything interesting online, and could boost its consumer uptake drastically by removing that silly restriction. The Surface tablet was always too expensive to succeed, because Microsoft just doesn't do loss-leader sales to build a new platform. The examples go on and on.

At Google, pretty much everything the company does is available for free. You can often pay for an upgraded experience, like a larger storage space or a business-class suite of email and productivity tools. But most of Google's revenue comes from advertising around a robust collection of free tools, from Google search to Gmail to YouTube.

The question is never, "How do we make more money?" Instead, Google asks how to make its stuff better, friendlier, and easier to use than what Microsoft and other rivals might come up with. Getting that crucial question right will bring in money somewhere down the line. Making money is not Google's main focus, and it shouldn't be. It's just a positive by-product of setting up an efficient advertising structure and then working hard to please the user.

Google would fall apart in no time flat with a dollar-chasing leader like Ballmer at the helm. Conversely, I think Microsoft would do well to pick a user-centric CEO instead of another bean counter when Ballmer finally steps out. And if you still want to call me a hippie dreamer, you haven't seen the next chart yet. Clearly, Google's approach isn't stopping the company from making money or rewarding investors:

GOOG Total Return Price data by YCharts.

The two words that scared Bill Gates into early retirement

Interested in the next tech revolution? Then you'll need to learn about the radical technology shift some say forced the mighty Bill Gates into a premature retirement. To nobody's surprise, Google is a driving force behind this revolution. Meanwhile, early in-the-know investors are already getting filthy rich off of it... by quietly investing in the three companies that control its fortune-making future. You've likely heard of one of them, but you've probably never heard of the other two... to find out what they are, click here to watch this shocking video presentation!

The article This Is the Biggest Difference Between Microsoft and Google originally appeared on Fool.com.

Fool contributor Anders Bylund owns shares of Google. The Motley Fool recommends and owns shares of Google. It also owns shares of Microsoft. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.