Is priceline.com Destined for Greatness?

Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does priceline.com fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Priceline's story, and we'll be grading the quality of that story in several ways:

Growth: are profits, margins, and free cash flow all increasing?

Valuation: is share price growing in line with earnings per share?

Opportunities: is return on equity increasing while debt to equity declines?

Dividends: are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Priceline's key statistics:

PCLN Total Return Price data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | 122.5% | Pass |

Improving profit margin | 72.3% | Pass |

Free cash flow growth > Net income growth | 199.8% vs. 283.5% | Fail |

Improving EPS | 272.9% | Pass |

Stock growth (+ 15%) < EPS growth | 242.3% vs. 272.9% | Pass |

Source: YCharts. * Period begins at end of Q3 2010.

PCLN Return on Equity (TTM) data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving return on equity | 10.9% | Pass |

Declining debt to equity | 23.2% | Fail |

Source: YCharts. * Period begins at end of Q3 2010.

How we got here and where we're going

We first looked at Priceline last year, and it's picked up two more passing grades in its second assessment to finish with a solid five out of seven possible passing grades. One of the failing grades only happened because gains in net income outpaced gains in free cash flow during our tracked period, but Priceline's nominal free cash flow has been higher than its net income throughout the past three years. All in all, this is a strong performance, but can Priceline keep up its progress? Let's dig a little deeper to find out.

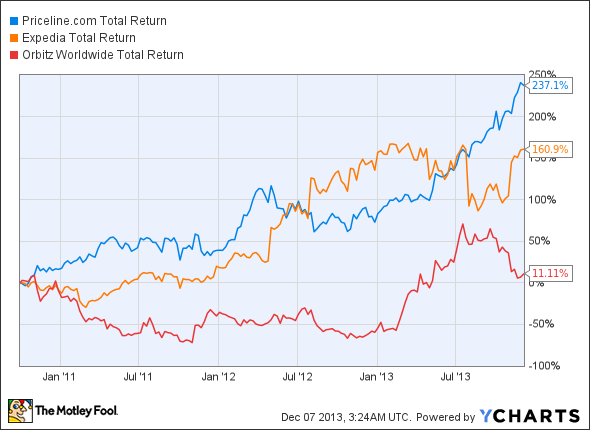

Online travel broker Priceline has continued to outperform rivals Expedia and Orbitz Worldwide this year, thanks to the impressive gross bookings growth which rose by 37.5% to $10.8 billion -- Expedia's and Orbitz'sgross travel bookings grew by a comparatively modest 15% and 4.6%, respectively. Longtime Fool contributor Selena Maranjian points out that Priceline's remarkable growth is derived from a combination of extensive hotel relationships, a strong mobile footprint, a diverse geographical presence, and its recent acquisition of Kayak.com. While the company still faces stiff competition from Expedia in the U.S., Priceline dominates European markets with its Booking.com and Agoda.com subsidiaries. Orbitz, on the other hand, is a rather distant third in the travel-portal race, which explains why it's failed to keep pace with the indexes as Priceline and Expedia have both become multibaggers:

PCLN Total Return Price data by YCharts

Longtime Fool contributor Rick Munarriz has been waiting for the split-averse Priceline to become a member of the rare $1,000-share club, a level to which it beat search engine giant Google in a closely followed race earlier this year. GoldmanSachs also recently added the online travel merchant to its prestigious "conviction buy" list due to three straight quarters of improving metrics compared to its peers. These are both relatively meaningless milestones that nevertheless signal increased institutional confidence in one of the market's better-performing stocks. Since nearly all of Priceline's shares are owned by institutional investors , it's important that their confidence is maintained.

Priceline's also undergone a recent leadership change, replacing Jeffery Boyd with Booking.com honcho Darren Huston as its new President and CEO. Under Huston's leadership, the company plans to fuel growth through geographical expansion, new content, and more promotional offerings. Expedia has been moving in a similar direction, maximizing its social media exposure with daily offers, and it plans to boost mobile bookings to 20% of all transactions by next year. In an effort to capitalize on rising demand for hassle-free shopping, Orbitz recently initiated a travel loyalty program, in which customers can earn and redeem "Orbucks" on hotels and other travel offers. Priceline has William Shatner on its side, though, and neither Expedia nor Orbitz has come up with anything as memorable to market their offerings.

Putting the pieces together

Today, priceline.com has many of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

Is Priceline a "forever stock"?

As every savvy investor knows, Warren Buffett didn't make billions by betting on half-baked stocks. He isolated his best few ideas, bet big, and rode them to riches, hardly ever selling. You deserve the same. That's why our CEO, legendary investor Tom Gardner, has permitted us to reveal The Motley Fool's 3 Stocks to Own Forever. These picks are free today! Just click here now to uncover the three companies we love.

The article Is priceline.com Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes has no position in any stocks mentioned. The Motley Fool recommends Goldman Sachs, Google, and Priceline.com. The Motley Fool owns shares of Google and Priceline.com. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.