Should You Buy J&J Snack Foods?

In the food industry, each player has its own way of overcoming competition and luring customers. For example, Kellogg , provider of convenience foods, has been introducing new products to stir demand. However, snack maker J&J Snack Foods has a different strategy to boost its top line. It has been on an acquisition spree, strengthening its product portfolio by gobbling up smaller businesses. This strategy has paid off as the company has been posting great results, and its recently reported fourth quarter was not an exception.

J&J's acquisition-led growth

J&J's revenue for the quarter stood at $238 million, an increase of 5% over last year on a comparable basis. Revenue was primarily driven by the sale of soft pretzels to both food service customers and retail customers. Sales of churros grew 15% over last year, also helping the top line move north. The beverages segment was a drag, however, as sales for frozen juice and slushies weakened as a result of cooler weather.

J&J's soft pretzel product offerings were expanded last year when the company acquired Kim & Scott's Gourmet Pretzels. Kim & Scott's pretzels are made of natural ingredients and are sold to both retail and food service customers. Sales from Kim & Scott's pretzels to food service customers increased 20% for the year. The acquisition has been quite rewarding for the snack retailer.

The churros business was strengthened with the acquisition of California Churros in 2010. Since then, J&J has witnessed growing churro sales. For the 2013 fiscal year, churro sales to food service customers surged 22% over last year. This shows how the acquisition has been a key driver for the company's growth.

On the other hand, Kellogg's recently reported quarterly results highlighted declining cereal sales because customers are shifting to newer options such as Greek yogurt, breakfast sandwiches, and smoothies. In order to win back its customers, Kellogg introduced a new nutritional drink as an alternative to a bowl of cereal. Kellogg also developed a variety of flavors of its Special K cereal brand that will attract young consumers to a traditional cereal breakfast. Therefore, both companies have been able to grow revenue, but by different methods.

Great stock price performance

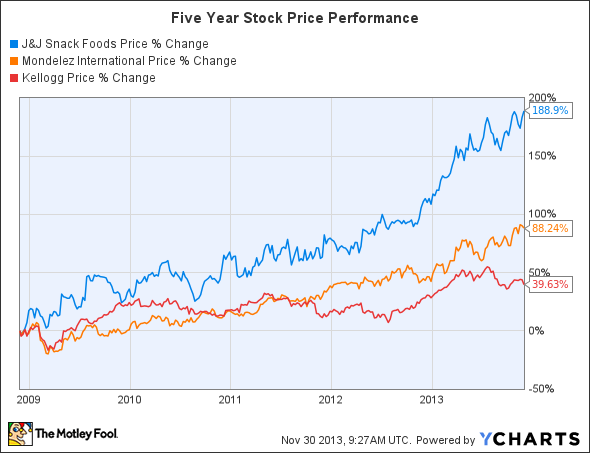

J&J Snack Foods has been a commendable performer when it comes to stock price appreciation. When compared to rival Mondelez International , the soft pretzel retailer has been an outperformer, as reflected in the chart below:

J&J Snack Foods' share price jumped 188.9% over the last five years, while Mondelez rose 88.2%. This is thanks to J&J's great product portfolio and the acquisition strategy which helped the retailer boost its revenue. Mondelez has not been very active on the strategic front.

Mondelez reported a lackluster third quarter recently as it was affected by weak demand in China, lower coffee prices, and decreased demand for gum in developed nations. Its revenue inched up by only 1.8% over last year's quarter, which missed analysts' estimates. Moreover, the company lowered its revenue outlook for fiscal 2013, which added to investors' disappointment.

Even Kellogg lowered its outlook for the year as it witnessed lower volumes in its recently reported quarter, which led to flat sales. Its top line was hurt by lower demand for cereals and unfavorable currency fluctuations. Also, Kellogg's stock price return was comparatively lower at 39.6% over the last five years. Of these stocks, J&J Snack Foods provided the highest return to its investors.

Bright future

J&J Snack Foods has some more positive points which make its future look bright. The company has been shifting its focus to retail and restaurant customers, as food service customers are highly price sensitive. This shift in focus will help the company widen its margins.

J&J also recently added another business to enhance its product portfolio. Last month it acquired New York Pretzel, which sells soft pretzels in the Northeast region. Since pretzels are the key driver of J&J's growth, the company has been enhancing its strength in this market even further. This will help the company drive its revenue higher, making its future look bright.

The bottom line

Overall, the snack food maker has been performing well with a great acquisition strategy in place. Although the beverage segment has been lagging recently, the company has been able to compensate for this by expanding its other product lines, especially pretzels. With great results, better performance than its peers, and a bright future, this company looks interesting. Investors should take note of this snack maker.

Is J&J one of the Fool's favorite growth picks?

Tired of watching your stocks creep up year after year at a glacial pace? Motley Fool co-founder David Gardner, founder of the No. 1 growth stock newsletter in the world, has developed a unique strategy for uncovering truly wealth-changing stock picks. And he wants to share it, along with a few of his favorite growth stock superstars, WITH YOU! It's a special 100% FREE report called "6 Picks for Ultimate Growth." So stop settling for index-hugging gains... and click HERE for instant access to a whole new game plan of stock picks to help power your portfolio.

The article Should You Buy J&J Snack Foods? originally appeared on Fool.com.

Pratik Thacker has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.