Here's What Should Save the Coal Industry

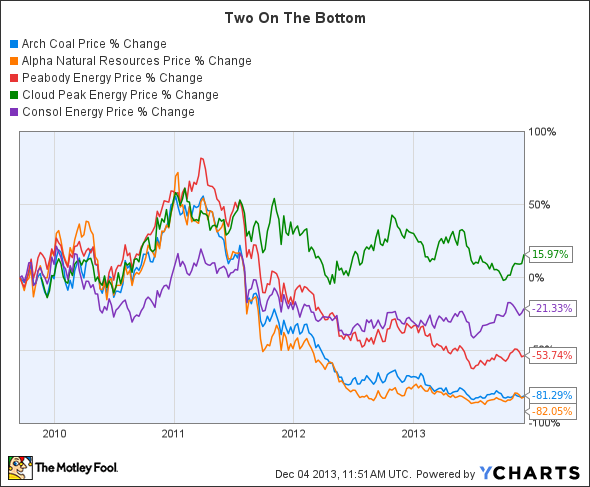

Coal is dirty, and that has made it an energy industry pariah. But what if technology could change that image? Then, out of favor companies like Arch Coal , Alpha Natural Resources , Cloud Peak Energy , and giant Peabody Energy would start to look at a lot more appealing. Brett Harvey, CEO of CONSOL Energy believes it's just a matter of time.

Dirty dancing

The big competition for coal is natural gas, which, domestically, is abundant, cheap, and burns cleaner. However, in a recent speech, CONSOL's Harvey noted that "Since, the mid-90s, we've tripled the use of coal and we've taken 70 percent of the [pollutants] out." That improvement was made possible by technology.

"CO2 is the one that everybody's working on now, so [you're] going to clean coal technology. A lot of science is being put in and that will be solved, just like everything else is." That's a pretty positive view of coal, but, in the end, Harvey has good reason to be positive and so do you: "I have a lot of faith that the 30 percent of the world's coal inside the United States is going to be used for the benefit of the citizens over time..."

That's right, there's a lot coal under U.S. soil, and companies like Peabody Energy, Arch Coal, Alpha Natural Resources, and Cloud Peak are working to deliver it to market. Interestingly, however, CONSOL recently inked a $3.5 billion deal to sell most of its domestic thermal coal operations so it could focus on exporting coal and drilling for natural gas.

A commentary or prognostication?

CONSOL's logic for the asset sale was to focus on faster growing businesses. So U.S. thermal coal isn't making the grade right now, but the potential from markets like China and India are. That's one of the reasons why Peabody Energy highlights that China is building 20 coal gasification plants. That process doesn't make coal clean, but it makes it cleaner. And more change is likely as that giant country faces increasing calls to protect the environment while also providing desperately needed power.

Since the U.S. doesn't have the same need for increasing its power supply as China or India, it's easy to imagine clean coal advances taking shape overseas and being imported back to the States. That makes CONSOL's export focus look pretty bright. Peabody, which has extensive operations in Australia, also has a front-row seat at that table. Cloud Peak, meanwhile, is the largest U.S. player in South Korea and has been trying to push into Japan. So it, too, is looking to benefit as Asia continues to use coal in new ways.

That said, Cloud Peak's exports are still a relatively small part of its business. And it lacks the port access that Peabody, Alpha, and Arch have. It's worth noting, however, that the ultra-cheap Powder River Basin, or PRB, coal to which Cloud Peak, Peabody, and Arch have notable exposure makes up only a small fraction of Alpha's business. That's a distinct disadvantage right now, since domestic coal use is shifting toward the PRB and similarly cheap Illinois Basin.

Maybe not tomorrow...

Before new technology cleans up coal, mine closures will resolve the supply/demand imbalance now holding the industry back. That alone should lift the shares of Arch, Alpha, Cloud Peak, Peabody, and CONSOL. However, keep an eye on coal technology, particularly what's happening in Asia, because technological advances are the real future for coal. And if history is any guide, CONSOL's Harvey is making a prescient, if early, call.

That said, with the coal miners so out of favor, you should take the time to examine the sector before it cleans up its act. For example, despite the industry's difficulties, Cloud Peak hasn't bled red ink. And Peabody's global footprint positions it well for the future. CONSOL's export shift and natural gas exposure is also notable. The stories at Arch and Alpha are less clean, but both have notable upside over the near term and the financial strength to survive until technology makes coal environmentally palatable again.

Rather stick to en vogue fossil fuels? Check out these 3 companies

Record oil and natural gas production is revolutionizing the United States' energy position. Finding the right plays while historic amounts of capital expenditures are flooding the industry will pad your investment nest egg. For this reason, the Motley Fool is offering a comprehensive look at three energy companies set to soar during this transformation in the energy industry. To find out which three companies are spreading their wings, check out the special free report, "3 Stocks for the American Energy Bonanza." Don't miss out on this timely opportunity; click here to access your report -- it's absolutely free.

The article Here's What Should Save the Coal Industry originally appeared on Fool.com.

Reuben Brewer has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.