General Electric Got a Radical Makeover in 2013

The new year is only a few weeks away and it's high time to take a look back at 2013. Today, I'll shine a spotlight on the transformation of General Electric . The oldest Dow Jones member got a radical makeover in 2013, completing one massive deal and striking a few smaller ones. The new GE is leaner, meaner, and more profitable.

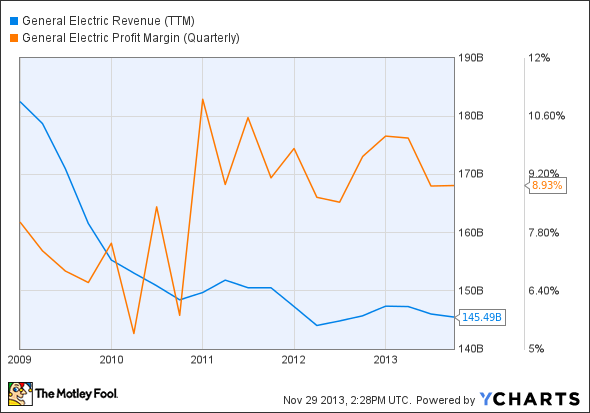

GE Revenue (TTM) data by YCharts

GE started the year with a bang -- though it was two years in the making. The deal to spin NBC Universal off to cable giant Comcast had left General Electric owning 49% of the media operation since the original deal closed in 2011. There was a seven-year plan to move the rest of GE's NBC stake over to Comcast, but nothing of the sort happened in 2012.

But in February of 2013, Comcast said it wanted the rest of NBC Universal all at once. The transaction closed in March, leaving GE out of the media game but $16.2 billion richer.

That sudden move set the tone for the rest of GE's 2013. The company got busy spending its NBC capital on plug-in acquisitions firmly within the industrial realm. These include:

$3 billion to acquire oil field and power transmission equipment builder Lufkin Industries, a profitable operation with $1.3 billion in trailing sales at the time of GE's buyout offer.

$4.3 billion to absorb the aviation business of Italy-based aerospace-propulsion expert Avio. This one wasn't a full acquisition as the stand-alone Avio company held on to its space operations. Yes, Virginia -- this all-cash deal is rocket science. Financial details on Avio are hard to come by, but the company did collect $2.4 billion in 2012 revenue.

In October's third-quarter-earnings call, General Electric's CEO Jeff Immelt said that these two acquisitions were "strategic." Avio expanded GE's margins in the third quarter but Lufkin's operations were less profitable. Together, the two deals reduced GE's total segment margins by about 1%.

GE is also unloading its 75% stake in a Thai banking operation to Japanese money-center bank The Bank of Tokyo-Mitsubishi UFJ. That $5.7 billion all-cash deal is expected to close in the fourth quarter.

GE used 2013 to rebuild itself as a more focused industrial conglomerate with fewer distractions in unrelated markets. The new GE runs with slightly leaner revenue inputs but stronger profit margins, and the transformation paid off with a large earnings beat in the third quarter. See if you can spot the report date by comparing GE to the Dow in this chart:

What's so special about oil field equipment, anyway?

Lufkin attracted GE's roving eye by working in an amazingly innovative market. Imagine a company that rents a very specific and valuable piece of machinery for $41,000... per hour (that's almost as much as the average American makes in a year!). And Warren Buffett is so confident in this company's can't-live-without-it business model, he just loaded up on 8.8 million shares. An exclusive, brand-new Motley Fool report reveals the company we're calling OPEC's Worst Nightmare. Just click HERE to uncover the name of this industry-leading stock... and join Buffett in his quest for a veritable LANDSLIDE of profits!

The article General Electric Got a Radical Makeover in 2013 originally appeared on Fool.com.

Fool contributor Anders Bylund has no position in any stocks mentioned. The Motley Fool owns shares of General Electric Company. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.