Is Exelon Destined for Greatness?

Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Exelon fit the bill? Let's look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Exelon's story, and we'll be grading the quality of that story in several ways:

Growth: Are profits, margins, and free cash flow all increasing?

Valuation: Is share price growing in line with earnings per share?

Opportunities: Is return on equity increasing while debt to equity declines?

Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's look at Exelon's key statistics:

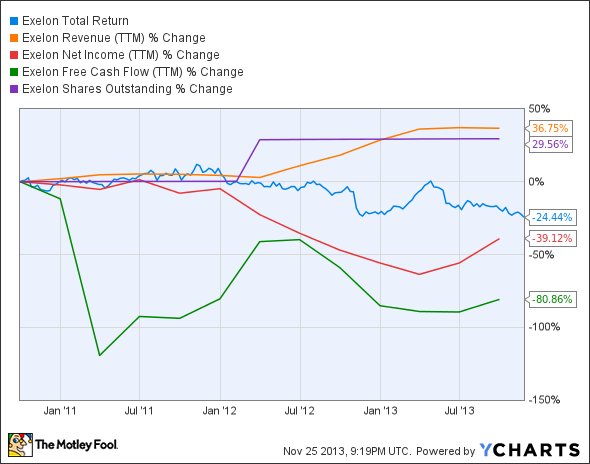

EXC Total Return Price data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | 36.8% | Pass |

Improving profit margin | (55.5%) | Fail |

Free cash flow growth > Net income growth | (80.9%) vs. (39.1%) | Fail |

Improving EPS | (52.8%) | Fail |

Stock growth (+ 15%) < EPS growth | (24.4%) vs. (52.8%) | Fail |

Source: YCharts.

*Period begins at end of Q3 2010.

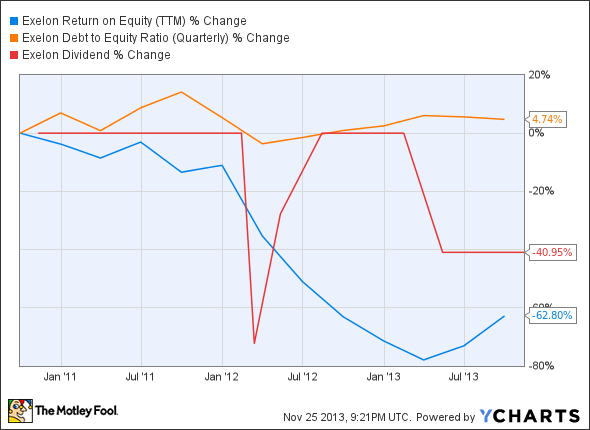

EXC Return on Equity (TTM) data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving return on equity | (62.8%) | Fail |

Declining debt to equity | 4.7% | Fail |

Dividend growth > 25% | (41%) | Fail |

Free cash flow payout ratio < 50% | 341.3% | Fail |

Source: YCharts.

*Period begins at end of Q3 2010.

How we got here and where we're going

Last year, Exelon picked up a single passing grade in its first analysis here, and the utility company has failed to make any progress since then, as it still musters only a single passing grade. It should be little surprise, then, that Exelon is one of the few stocks in this surging market to have lost value over the past year. While revenue continues to grow, there's little else about Exelon's fundamentals for investors to like -- margins have collapsed, free cash flow continues to be low, and the company's once-heralded dividend was slashed this year. Can Exelon turn it around in 2014? Let's dig deeper to find out.

Exelon has had problems passing along the relatively high cost of nuclear energy to consumers in the midst of a boom in cheaper natural gas. However, the company posted unexpected market-beating third-quarter results, thanks to its increased nuclear capacity and improved margins. Fool contributor Justin Loiseau notes that Exelon has been aggressively investing in hedges to keep power and natural gas prices at a lower level, which has helped keep its nuclear-centric energy portfolio more competitive. However, Exelon may face cost pressures from fellow utilities Southern and Duke Energy , which have been aiming to convert coal-fired power plants to natural gas, producing more competitive pricing via lower-cost power-generation.

Fool contributor Dan Caplinger points out that Exelon has made few strategic moves to diversify beyond its nuclear plants with more renewable energy capacity. There have been some efforts, but these are relatively modest in comparison to Exelon's total generating capacity: Exelon subsidiary Constellation Energy Resourcesformed a partnership with Hanwha SolarOne to build a 5.7 megawatt Outback solar project in Oregon, and Exelon also acquired the Antelope Valley Solar Ranch, which is expected to add up about 230 megawatts to its renewable energy portfolio.

The company might also benefit from its regulated-utility businesses, which currently serve more than 6.6 million households in Pennsylvania, Maryland, and Illinois, as it plans to request rate hikes from regulators -- but the divergent experience of its two peers highlights the challenges this strategy faces. Duke Energy recently gained a 8.2% rate increase for its South Carolina operations, but Southern has faced resistance to its requests for higher rates. Considering the more liberal political makeup of the three states Exelon's targeted for rate increase requests, it seems more reasonable to expect resistance than easy acceptance. However, Exelon has also been pushing smart electric meters, which will allow it to track real-time prices, and thus manage base-load demand on its generating plants throughout the day. This endeavor will take time to pay off unless Exelon subsidizes the installation of these meters in all customer homes, and that is likely to prove cost-prohibitive if not stretched out over several years.

Putting the pieces together

Today, Exelon has few of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

Next year's best stock?

The market stormed out to huge gains in 2013, leaving investors on the sidelines (and in most utilities) burned. However, opportunistic investors can still find huge winners. The Motley Fool's chief investment officer has just hand-picked one such opportunity in our new report: "The Motley Fool's Top Stock for 2014." To find out which stock it is and read our in-depth report, simply click here. It's free!

The article Is Exelon Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes has no position in any stocks mentioned. The Motley Fool recommends Exelon and Southern. Try any of our Foolish newsletter services free for 30 days. We Fools don't all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.