Pfizer Stock: 3 Things to Know Before 2014

Pharmaceutical giant Pfizer has had a surprisingly solid year so far, with its stock climbing 27% year-to-date and outperforming the market by a slim margin.

Many investors probably hadn't considered investing in Pfizer after its loss of patent exclusivity for cholesterol treatment Lipitor -- the former top-selling drug in the world -- which generated $13 billion in peak sales in 2011. Last quarter, global Lipitor sales fell 29% year-over-year to $533 million.

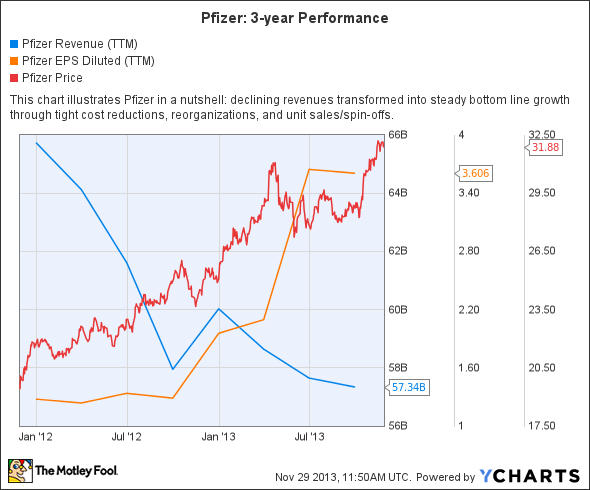

Despite that gaping hole in its top line, Pfizer has aggressively cut costs by shutting down redundant facilities, selling business units, reducing its R&D footprint and sharpening its focus, and cutting more than 50,000 jobs over the past eight years. The end result, as seen in the following chart, is a company that has been able to grow its EPS by triple digits over the past two years, even though its revenue has fallen dramatically.

Source: YCharts.

Now, as we approach the end of 2013, let's take a look at three major things Pfizer investors should pay attention to going into 2014 -- and how Regeneron , Sanofi , Amgen , and Novartis could affect its future.

An apparent heir to Lipitor

First and foremost, Pfizer hasn't given up on the cholesterol crown yet. Its former blockbuster Lipitor, along with Merck's Zocor and AstraZeneca's Crestor, were all statins -- the widely used standard of treatment for high levels of LDL ("bad") cholesterol.

However, statins caused a wide array of side effects, including liver, muscle, and nerve damage, memory loss, digestive problems, and a higher risk of developing type 2 diabetes, which meant that the risks often outweighed the benefits.

Therefore, Pfizer is moving beyond statins and testing RN-316, a new type of cholesterol drug known as a PCSK9 inhibitor. PCSK9 is an enzyme which binds to the liver's LDL receptors, degrading them and throttling the liver's ability to lower LDL cholesterol levels. RN-316 attempts to inhibit the production of PCSK9 so LDL receptors are able to lower levels of cholesterol more naturally.

By comparison, statins target another enzyme in the liver, known as HMG-CoA, which is used in the production of LDL cholesterol. Although shutting down HMG-CoA lowers LDL levels, it also inadvertently stimulates the production of PCSK9, limiting the effectiveness of LDL receptors.

Pfizer is banking heavily on the success of RN-316 -- it is testing the drug on a massive phase 3 group of 22,000 patients with a wide variety of cholesterol levels.

However, three other companies -- Sanofi, Regeneron, and Amgen -- are also competing against Pfizer in the PCSK9 arena. Sanofi and Regeneron's alirocumab is forecast to generate annual peak sales of $3.5 billion if approved, and Amgen's AMG 145 is expected to hit $4.0 billion. Both drugs are also currently in phase 3 trials, and both companies have already released encouraging interim data.

Growth in oncology

Last quarter, Pfizer's oncology portfolio accounted for only 3% of its top line. However, it was also the company's fastest growing segment, with 24% year-over-year revenue growth. The three main drugs to pay attention to in this segment are Xalkori, Inlyta, and palbociclib.

Sales of Xalkori, its treatment for non-small-cell lung cancer, climbed 92% year-over-year to $73 million last quarter. Xalkori is a first-line treatment for a rare mutation of NSCLC known as ALK, which only affects 4% of NSCLC patients. Meanwhile, sales of Inlyta, a second-line treatment for late-stage kidney cancer, climbed 186% to $83 million last quarter. Inlyta primarily competes against Nexavar from Bayer and Onyx Pharmaceuticals (now part of Amgen).

However, the most promising treatment in Pfizer's oncology portfolio is palbociclib, a breast cancer drug which could generate peak sales of $1.9 billion by 2019, and up to $5 billion if approved for other indications.

Palbociclib belongs to a new class of drugs known as CDK inhibitors, which target CDKs -- enzymes that regulate cell division but sometimes become overactive in cancer patients, causing unregulated cell division and tumor growth. Palbociclib targets HER2-negative and ER-positive breast cancer -- which together account for more than 75% of all breast cancer cases.

This could be a major breakthrough in breast cancer treatment, since other targeted treatments like Roche's Herceptin only target HER2-positive patients, which account for 15% to 25% of patients. Therefore, the FDA granted palbociclib a breakthrough therapy designation in April, putting it on a fast track toward a possible approval in 2015.

Palbociclib is currently in phase 3 trials, putting it ahead of rival treatments from Novartis and Eli Lilly. Novartis' CDK inhibitor, LEE011, is currently starting phase 3 trials, while Eli Lilly's trails far behind in phase 1 studies.

The upcoming three way split

Last but not least, Pfizer investors should be aware of the company's upcoming three-way split.

Starting in fiscal 2014, Pfizer will be split into these three groups:

Division | Businesses | Group President |

Innovative Products | Immunology, metabolic treatments, products patented until after 2015 | Geno Germano |

Innovative Products | Patented vaccines, oncology, consumer health care | Amy Schulman |

Value Products Group | Generic medications, branded treatments going off patent before 2015 | John Young |

Source: Company release.

The financials of the three segments will be reported separately, although they will all remain under the Pfizer umbrella. This means that the split is really an experiment to test the viability of spinning off or selling its businesses to streamline its revenue growth.

Earlier this year, Pfizer spun off its animal health unit, Zoetis, into a publicly traded company-- a shrewd move that allowed Pfizer to profit from the IPO and avoid a large tax bill from an outright sale.

Pfizer has stated that it intends to wait three full fiscal years before deciding whether or not to spin-off or sell any of the three units, such as its generics business -- which reported a 4% year-over-year sales decline last quarter but still comprises 18% of its top line.

The Foolish takeaway

In closing, Pfizer is hardly the boring, slow growth stock that some investors presume it to be. With new opportunities in cholesterol and cancer treatments, Pfizer still has plenty of opportunities to revive its lagging top line growth.

In the meantime, Pfizer excels at preserving its bottom line and its forward annual dividend yield of 3% -- both solid reasons to stick with this stock in 2014.

Another stock with big growth ahead

Pfizer's a solid bellwether bet on big pharma, but investors with a greater appetite for risk might want to check out this incredible tech stock. It's growing twice as fast as Google and Facebook, and more than three times as fast as Amazon.com and Apple. Watch our jaw-dropping investor alert video today to find out why The Motley Fool's chief technology officer is putting $117,238 of his own money on the table, and why he's so confident this will be a huge winner in 2013 and beyond. Just click here to watch!

The article Pfizer Stock: 3 Things to Know Before 2014 originally appeared on Fool.com.

Fool contributor Leo Sun has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.