Cisco Systems Took a Wild Ride in 2013

Cisco Systems has been on a rocky ride in 2013. The networking equipment specialist's shares have at times trailed its peers on the Dow Jones index, only to jump far ahead at other times. The changes have been sudden and massive. Right now, Cisco stock is having one of its bad episodes. Cisco investors would by this point have been better off owning a Dow Jones tracker such as the SPDR Diamonds ETF, year to date.

Dow stocks tend to be a docile bunch. The Dow Jones currently holds an average one-year Beta score of 0.88, meaning that the index members are about 12% less volatile than the wider S&P 500 market meter. But Cisco pulls that average up. Cisco's 1.37 one-year Beta is the Dow's second-highest, underscoring the company's recently risky investment profile.

The numbers rarely tell the whole story, of course.

The 12% overnight surge in Cisco's share price this spring sprung from a strong third-quarter earnings report plus a fantastically well-managed (or maybe just lucky) share buyback program.

The fourth-quarter report in August was a very different story. Cisco handily met analyst targets across the board, but the stock still took a 9% steel bath overnight. You see, Cisco's management laid out some gloomy guidance for the back half of the calendar year, where both earnings and revenue would miss the prevailing Wall Street projections.

When the first-quarter report rounded the corner a couple of weeks ago, I was convinced that Cisco would beat its own pessimistic guidance and the analyst targets it inspired. But I was wrong.

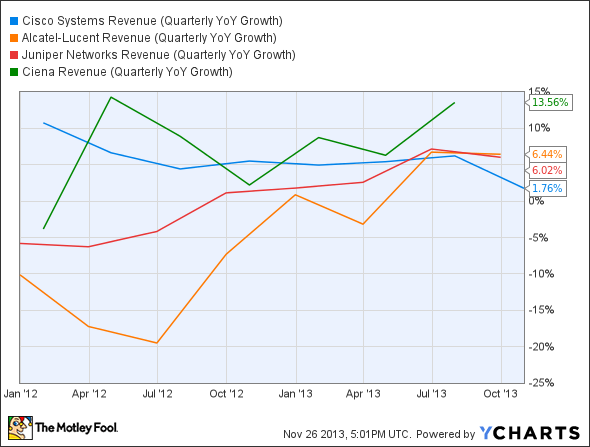

Cisco beat Wall Street's earnings targets but missed revenue estimates by a wide margin. Cisco's sales fell off a cliff in the last few weeks of the fiscal first quarter. That kind of action usually inspires management teams to predict rosy results in the next quarter as those slipping deals come to a late close. But not Cisco.

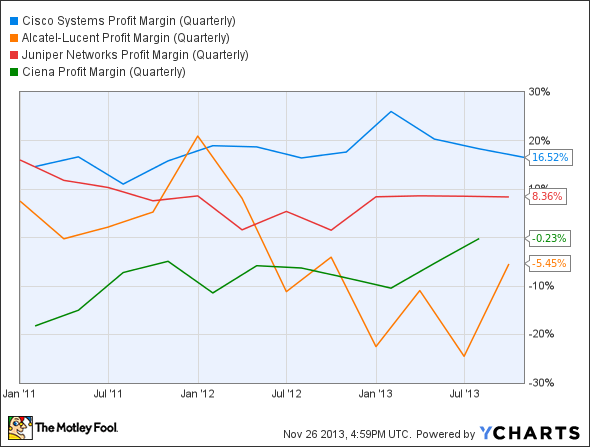

CSCO Profit Margin (Quarterly) data by YCharts

CEO John Chambers said Cisco is letting low-margin deals go to other companies in an effort to preserve its industry-leading profit margin. In particular, Alcatel-Lucent appears to have stolen a few choice contracts in China and Europe.

Alcatel investors can celebrate those crucial wins as the embattled company claws its way back from the brink of bankruptcy. But Cisco investors have to wonder if it's wise to let a near-extinct rival back in the game so easily.

Cisco is still the 800-pound gorilla in the networking industry, and it will remain unrivaled for years to come. But the smaller players are obviously doing their darndest to catch up where they can, and Cisco has given them plenty of opportunity to steal market share in 2013.

CSCO Revenue (Quarterly YoY Growth) data by YCharts.

Can you show me something safer to own in 2014?

The market stormed out to huge gains across 2013, leaving investors on the sidelines burned. Even Cisco's investors made money, despite the stock's double serving of massive drops. Opportunistic investors can still find huge winners by looking ahead. The Motley Fool's chief investment officer has just hand-picked one such opportunity in our new report: "The Motley Fool's Top Stock for 2014." To find out which stock it is and read our in-depth report, simply click here. It's free!

The article Cisco Systems Took a Wild Ride in 2013 originally appeared on Fool.com.

Fool contributor Anders Bylund has no position in any stocks mentioned. Check out Anders' bio and holdings or follow him on Twitter, LinkedIn, and Google+. The Motley Fool recommends Cisco Systems. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.