Finding a Quality Teen Retail Stock

If you've attempted to invest in a teen retailer over the past several years, you've likely had a difficult experience. You have seen everything from changing tastes away from recent norms in regard to attire (away from expensive T-shirts and jeans to more thrifty, urban apparel), more teen spending on electronics than clothes, a former CEO's comments offending many people, and an extremely promotion-saturated environment. None of these are positives for teen retailers. However, what's done is done. It's now time to figure out whether or not American Eagle, Aeropostale , or Abercrombie & Fitch might present a bargain. I'll focus on industry trends as well as online exposure.

A changing industry

According to government statistics, the current teen unemployment level is higher than last year. Combining this with a lower demand for jeans, hoodies, and T-shirts, teen retailers have a big problem. The aforementioned teen retailers are attempting to increase demand by offering constant promotions, but it's not working very well. Consider the top-line performances for American Eagle, Aeropostale, and Abercrombie & Fitch over the past year:

AEO Revenue (TTM) data by YCharts.

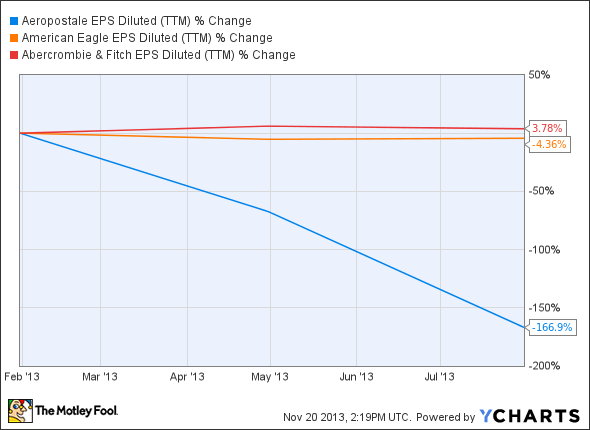

Not cool. Plus, only one of these companies has seen positive bottom-line growth over the past year:

ARO EPS Diluted (TTM) data by YCharts.

I haven't been an advocate of Abercrombie & Fitch this year, and it still doesn't look like a time to be optimistic on the company. However, it's somewhat impressive that Abercrombie & Fitch has managed to deliver on the bottom line (in a small way), considering all the negative press it has received. However, Abercrombie & Fitch isn't likely to be the best teen retail investment at this time, nor is American Eagle. But, for the record, American Eagles does yield 3.10%. Abercrombie & Fitch yields 2.30%. Aeropostale doesn't offer any dividend, and it's the weakest on both the top and bottom lines over the past year.

If none of these teen retailers are likely to present quality long-term investment options, then you might wonder where to go. Fortunately, while there are never any guarantees, one company should offer more potential.

Outperformers

H&M and Forever 21 have been stealing the show, thanks to their diversification targeting a broader range of shoppers. For example, if you visit one of the companies' websites, you will see a "stylish" teen, sporting a look meant to seduce potential customers. This, in turn, is supposed to elicit a desire to purchase clothes for your teenager. Or, if you're a teenager, it might tempt you to buy clothes for yourself. However, if you visit H&M's website, hm.com, you won't see just that stylish teenager. Instead, you will see an entire family, and each member of that family has their own style.

H&M saw sales increase 10% in the first half of the year, and after examining online traffic rankings, it's apparent that the company has more exposure than American Eagle, Aeropostale, and Abercrombie & Fitch:

Company Website | Global Traffic Ranking |

|---|---|

ae.com (American Eagle) | 5,340 |

aeropostale.com | 7,876 |

Abercrombie.com | 6,567 |

Forever21.com | 2,061 |

hm.com | 917 |

Source: Alexa.com.

H&M's greater online exposure is likely to lead to more sales than its peers, especially considering more people shop online every day.

There's just one problem for H&M if you're an investor: It's not a United States-based company; it's Swedish. This makes investing in the company somewhat of a hassle. If you would prefer a domestic company that offers diversification as well as top-line and bottom-line growth, you will find this mystery company below.

Urban appeal

Urban Outfitters might not be known as a teen retailer, but it's important to realize that its namesake brand targets the 18-to-28-year-old demographic, and that the majority of teens want to dress in a manner that makes them appear a few years older. Therefore, the company targets teens, even if indirectly. Regarding diversification, Urban Outfitters also has Anthropologie (which targets the 28-to-45-year-old demographic), Free People (which targets the 25-to-30-year-old age demographic), Terrain (home and garden), and BHLDN (wedding gowns and accessories).

Unlike American Eagle, Aeropostale, and Abercrombie & Fitch, and more like H&M and Forever 21 (sales up 82% from 2007 to 2012), Urban Outfitters has been trend-right. Consider its top-line and bottom-line performances over the past year:

URBN Revenue (TTM) data by YCharts.

This increase in sales doesn't guarantee future success, but it has to put investors' minds more at ease than taking a stake in American Eagle, Aeropostale, or Abercrombie & Fitch.

Urbanoutfitters.com also sports an online global traffic ranking of 3,049. It's not as high as H&M or Forever 21, but higher than American Eagle, Aeropostale, and Abercrombie & Fitch.

The bottom line

American Eagle and Abercrombie & Fitch have weathered industry trends better than Aeropostale, and both pay dividends, whereas Aeropostale does not. However, none of these companies appear to be ideal investments at this point in time. Thanks to being trend-right and offering broad diversification, Urban Outfitters is likely to offer more potential.

Capitalizing on the right retailers

To learn about two retailers with especially good prospects, take a look at The Motley Fool's special free report: "The Death of Wal-Mart: The Real Cash Kings Changing the Face of Retail." In it, you'll see how these two cash kings are able to consistently outperform and how they're planning to ride the waves of retail's changing tide. You can access it by clicking here.

The article Finding a Quality Teen Retail Stock originally appeared on Fool.com.

Fool contributor Dan Moskowitz has no position in any stocks mentioned. The Motley Fool recommends Urban Outfitters. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.