Why Hawaiian Holdings Is Still My Top Airline Pick

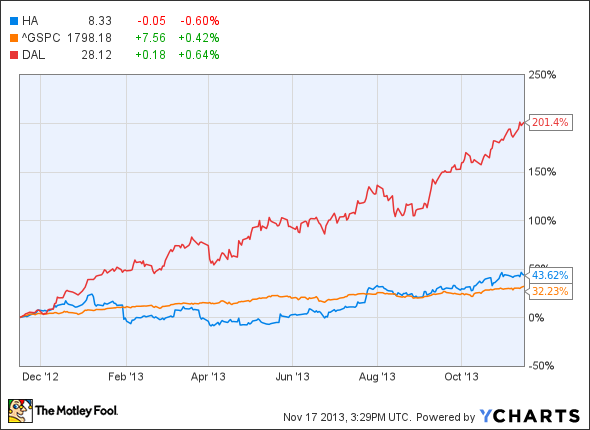

Since late 2010, Hawaiian Holdings subsidiary Hawaiian Airlines has rapidly expanded across the globe to bring more travelers to Hawaii from Asia and Oceania. In the past year investors have begun to see a payoff from this growth, as Hawaiian's stock has appreciated by more than 40%. That's about 10% better than the S&P 500's return, though still well below Delta Air Lines' 200% gain.

Hawaiian Holdings vs. Delta and the S&P 500, data by YCharts

While Hawaiian's stock performance since late 2012 has been good by any measure, it has still fallen short of my expectations so far. A glut of airline capacity between the West Coast and Hawaii led to lower fares in late 2012 and early 2013. Meanwhile, the strong U.S. dollar has put increasing pressure on international revenues. These factors have caused year-to-date earnings to drop compared to 2012.

However, market conditions are already improving, and I believe that Hawaiian will see quick improvement in its financial results over the next several quarters. As a result, I think the stock has a lot of upside for 2014 and beyond, and Hawaiian Holdings remains my top pick in the airline sector.

Domestic operations back to normal

Massive domestic capacity increases in Q4 2012, and Q1 2013 forced Hawaiian and competitors like Alaska Air to drop fares between the U.S. West Coast and Hawaii. However, Alaska and other carriers have started cutting flights to Hawaii. By September, the number of air seats between the West Coast and Hawaii was down 5.6% year-over-year.

The result has been a quick turnaround in Hawaiian's domestic results. In Q3, unit revenue for Hawaiian's flights between Hawaii and the mainland grew 10% year over year. Changes in the company's interisland flight schedule led to an even stronger performance for flights within the state of Hawaii: unit revenue was up 15.9%.

Fixing the international business

Thus, at this point, Hawaiian's problems can be traced solely to its international operations. In Q3, international unit revenue fell by 17.7% due to the sharp drop of the yen -- and to a lesser extent, the Australian dollar -- since the same period of 2012. These currency fluctuations diminished the value of tickets sold abroad.

The effect of the strong U.S. dollar was further exacerbated by overcapacity in some markets, as many airlines were slow to cut back on expansion plans as market conditions worsened. One of the worst hit was Seoul, where capacity grew 26.1% in the first half of the year. However, both of Hawaiian's competitors in that market (Korean Airlines and Asiana Airlines) began cutting capacity to Hawaii last quarter. Capacity in that market is expected to decline by 10% in Q4.

Osaka is another market where Hawaiian will see some relief this fall and beyond. In the first nine months of the year, capacity between Osaka and Honolulu was up 0.9% year over year. However, the weak yen has motivated Delta to cut back capacity from Japan to beach markets like Hawaii. Delta recently moved from a Boeing 747 to a smaller Airbus A330 on the Osaka-Honolulu route, cutting overall market capacity by around 8%.

With various competitors rationalizing capacity on routes where they compete with Hawaiian, international results are likely to improve substantially. Hawaiian is also dialing back its own growth for the next few years, in order to allow its current markets to fully mature. The company is projecting a 2.5%-5.5% unit revenue increase next quarter, which would be the best result since Q2 2012, and better international performance is a key part of that.

Other initiatives

Capacity rationalization from other airlines and the shift from Hawaiian's rapid expansion will go a long way toward reversing the recent international unit revenue declines. However, Hawaiian is also looking to grow its ancillary revenue. It is making good progress in the cargo market, and a new IT system rolling out next year should help the company capture more hotel and car bookings through its website.

Hawaiian is also introducing its first premium economy seating product next summer. This will give it the opportunity to earn incremental revenue from customers who are willing to pay extra for more legroom on Hawaiian's long flights, but cannot afford a pricey first-class ticket.

Hawaiian is also poised to benefit from lower jet fuel prices. Gulf Coast jet fuel averaged $3.056 per gallon in 2012, but recently Gulf Coast jet fuel has been selling for $2.70-$2.80 per gallon. As a result, Hawaiian is likely to see a significantly lower fuel bill for the next few quarters.

Hawaiian is also changing its fuel hedging practices to use swaps rather than options. This means that it will give up some of its potential exposure to lower fuel prices in order to reduce the up-front cost of its hedging program. This type of strategy has been implemented with great success at Alaska Air recently. Considering that Hawaiian has recognized over $11 million of realized fuel hedge losses this year, reducing options expense seems like a wise idea.

Foolish bottom line

A number of positive factors are all contributing to a big improvement in Hawaiian Holdings' financial performance. The company is on track for strong earnings growth going forward, and could potentially double earnings in 2014 alone. While other airlines have performed better than Hawaiian this year, over the next several years Hawaiian Holdings is poised to soar above them all.

Money in the bank

Imagine a company that rents a very specific and valuable piece of machinery for $41,000... per hour (that's almost as much as the average American makes in a year!). And Warren Buffett is so confident in this company's can't-live-without-it business model, he just loaded up on 8.8 million shares. An exclusive, brand-new Motley Fool report reveals the company we're calling OPEC's worst nightmare. Just click HERE to uncover the name of this industry-leading stock... and join Buffett in his quest for a veritable LANDSLIDE of profits!

The article Why Hawaiian Holdings Is Still My Top Airline Pick originally appeared on Fool.com.

Fool contributor Adam Levine-Weinberg owns shares of Hawaiian Holdings and is long April 2014 $8 calls on Hawaiian Holdings. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.