Why the Defense Sector's Yields Are Shrinking

Though investors had every right to expect the defense sector to struggle over the last year, the way defense stocks Lockheed Martin , Northrop Grumman , and Raytheon spent their precious shareholder capital sent other signals. Coming into 2012, these three businesses poured substantial amounts into share buybacks. In addition, all three pay solid dividends, providing astute investors signs that their ability to generate strong cash flows might have exceeded the market's expectations.

While the run in these defense stocks might not be over, yield data points suggest the management teams are less convinced of gains going forward. Remember, the executives from these stocks have keen insights into their potential for future orders. Either that, or the valuation gains have outstripped these companies ability to generate enough free cash flow to support high yields.

Simple valuation metric

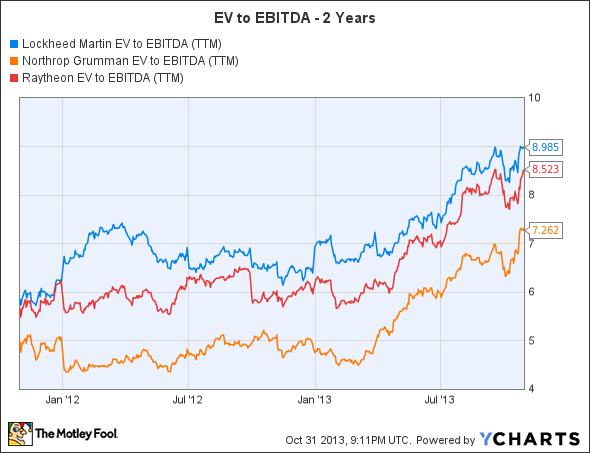

Investors can use lots of metrics to derive whether a stock is undervalued. One simple metric is comparing the enterprise value, or the market cap less net cash, to the EBITDA. This metric helps you gauge how a company's priced relative to its operations' ability to generate earnings.

Going into 2012, all three of these stocks traded at the very low EV-to-EBITDA multiple of 6. But as the stocks have surged, this multiple has followed suit. As the chart below shows, Lockheed Martin now trades at an EV-to-EBITDA multiple of 9:

LMT EV to EBITDA (TTM) data by YCharts.

Obviously, this is only one simple valuation metric, and it only shows the relative difference over time. The key is the warning that the price appreciation over the last year has been mostly on the back of expanding multiples and not actual improvements in the business.

Even with the gains, Northrop Grumman isn't overly expensive at a multiple of 7.2 times EBITDA. But its value has clearly risen from the EV of less than five times EBITDA at which it traded throughout most of 2012.

Declining buybacks

Another worrying sign is the substantial decline in buybacks over the last year. While many investors will claim a preference for dividends over buybacks, one can't deny that these defense companies were wisely buying back stock in 2012. In particular, Northrop Grumman was busy, as it was buying stock at a 15% rate in 2012.

Taking into account these management teams' success in those efforts, buybacks' current decline could signal that executives now have less confidence in their shares' current price. While these companies may still be value plays, they are no longer dirt cheap.

LMT Net Common Buyback Yield (TTM) data by YCharts.

These significantly reduced buyback yields for Lockheed Martin and Raytheon are a strong sign that their stocks are not as attractively priced. Remember that all three companies face declining revenue trends that aren't improving. Lockheed Martin recently announced the intent to eliminate 4,000 jobs.In the case of Northrop Grumman, analysts expect revenue to decline from $25.2 billion in 2012 to $23.5 billion next year. The ability to reduce costs faster than revenue declines has led to profit and cash flow gains, but the question is whether this can last.

These scenarios are where the significance of a major change in a buyback plan can make important signals to investors. When these defense stocks were 50% lower at the start of 2012, the management teams were buying at paces to exceed 10% of the outstanding shares. Now with increased earnings, the management teams are reigning in the buybacks due to the higher stock valuations. Or even worse, the reduced buyback plans could be a sign of concerns that cost cuts have ran their course.

Bottom line

For investors looking for signs of when to sell a stock, few indicators are better than a company that reduces a successful buyback plan, after a large gain in the stock. The ultimate key is that these buyback plans were very successful and significant in size, which should distinguish the plans over a typical buyback. None of these defense stocks have completely eliminated buybacks, but the signs clearly suggest that, like the companies themselves, investors should be more cautious going forward.

9 dividends that won't back down

Dividend stocks can make you rich. It's as simple as that. While they don't garner the notoriety of high-flying growth stocks, they're also less likely to crash and burn. And over the long term, the compounding effect of the quarterly payouts, as well as their growth, adds up faster than most investors imagine. With this in mind, our analysts sat down to identify the absolute best of the best when it comes to rock-solid dividend stocks, drawing up a list in this free report of nine that fit the bill. To discover the identities of these companies before the rest of the market catches on, you can download this valuable free report by simply clicking here now.

The article Why the Defense Sector's Yields Are Shrinking originally appeared on Fool.com.

Mark Holder and Stone Fox Capital clients own shares of Lockheed Martin, and Northrop Grumman. The Motley Fool owns shares of Lockheed Martin, Northrop Grumman, and Raytheon Company. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.