How Dividends Change the Game for Faithful IBM Investors

The wealth-building power of compound interest will never cease to amaze me.

It's a story of patience and attention to detail, where small short-term differences add up to massive divergence over decades. And in the end, the biggest winners don't always deliver the fattest share-price returns.

Today, I'll take another look at Dow Jones bellwether IBM . It's been about six months since I last dove into IBM's dividend and buyback policies, and things have changed dramatically since then. This is a very unusual picture for IBM investors:

The Big Blue stock has underperformed its Dow Jones peers dramatically over the last two quarters. IBM has missed earnings estimates, discussed dramatic strategy shifts, and generally not acted like the rock-steady blue-chip company investors had come to know. All of these rare headwinds have damaged IBM's stock returns. But that's not always a disaster for long-term investors.

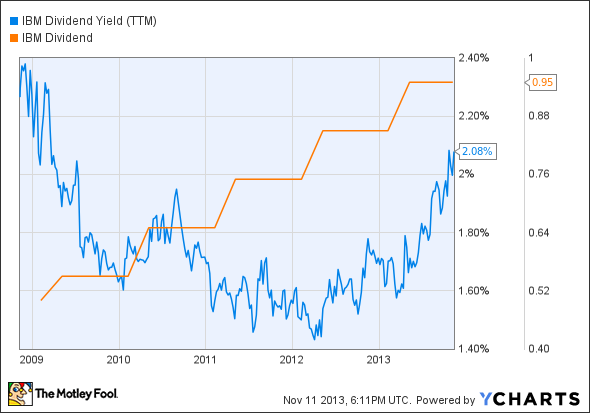

Low share prices have a couple of upsides, too. For one, IBM's 2.1% dividend yield offers payouts not seen since the height of the 2008-2009 financial crisis:

IBM Dividend Yield (TTM) data by YCharts.

For another, IBM keeps buying back shares at a breakneck pace, and it added another $15 billion to its repurchasing plans only two weeks ago. That's a fantastic way to return value to shareholders when share prices are running low. You get so much more bang for your buyback buck when you're trading 15% below 52-week highs.

The same theory also applies to regular investors, especially those with an active DRIP plan or some other automatic dividend-reinvestment strategy. Again, you simply get more IBM shares for your dividend check when stock prices are falling.

All of these theoretical upsides are null and void if IBM never returns to its characteristic long-term price gains, of course. If the business is falling apart, it doesn't really matter how cheaply you can buy the stock, or how rich the dividend yield may look in the short term.

But that's hardly the case here. Remember the strategy shift we talked about earlier? IBM is adapting to a changing market by stepping away from the one-stop shop business model and focusing on high-growth opportunities like cloud computing and smart infrastructure installations.

IBM has been around for more than a century, and this isn't the company's first drastic market shift. There are always uncharted waters to map out, but few companies are better-equipped to get it done than this surprisingly nimble veteran.

Warren Buffett believes in IBM -- so much that he invested nearly $11 billion in the company. If Buffett feels this strongly about a technology stock, it's almost foolhardy to bet against him. And at today's low prices, IBM delivers an unusual combination of discounted value and historically strong dividend yields.

What's not to like?

Building a truly great long-term portfolio around fantastic dividend payers

Dividends may not be sexy, but they make investors wealthy in the long run. It's that simple. If you're looking for some long-term investing ideas, you're invited to check out The Motley Fool's brand-new special report, "The 3 Dow Stocks Dividend Investors Need." It's absolutely free, so simply click here now and get your copy today.

The article How Dividends Change the Game for Faithful IBM Investors originally appeared on Fool.com.

Fool contributor Anders Bylund has no position in any stocks mentioned. Check out Anders' bio and holdings or follow him on Twitter, LinkedIn, and Google+. The Motley Fool owns shares of International Business Machines. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.