Why Are Stocks Hitting All-Time Highs?

The year 2013 has been another great one for the stock market. The Dow JonesIndustrial Average is up 22.8% for the year, and it appears that nothing can upend the market's momentum. Sequestration hasn't made a dent, the government shutdown was brushed off, and even continued weakness in Europe hasn't affected U.S. stocks.

You can see below that, not only has the Dow Jones Industrial Average gained a significant amount this year, but some of the most diverse and economically dependent companies have led the market. 3M has exposure around the world, Microsoft is a leader in all parts of tech, and Boeing is dependent on businesses and consumers flying to increase profits. Yet, all three companies are up despite a pretty weak economic recovery.

So, why is the stock market doing so well if unemployment is still 7.3%, and it doesn't look like the recovery has reached all parts of the economy? Let's take a look at what investors see.

The economy is improving

Believe it or not, the economy is getting better. Since the beginning of the year, the number of layoffs are down, the unemployment rate is down, and GDP is up.

US Initial Claims for Unemployment Insurance data by YCharts

These statistics may not be as good as we want, but they're improving, and that will help drive profits.

Earnings are up

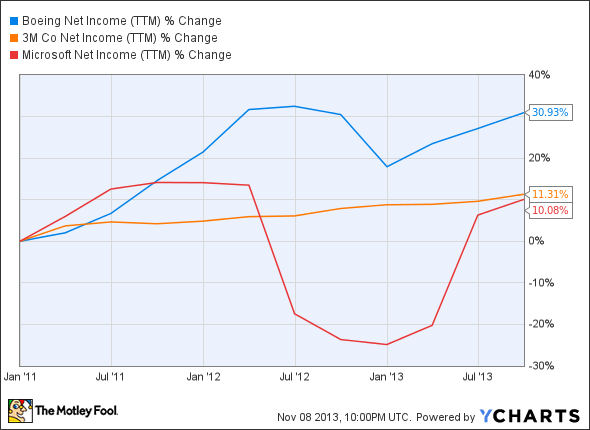

Long-term, what drives stock prices is earnings. On that front, we're doing quite well. Let's take a look at those same three companies, and see how earnings have trended over the past three years.

You can see below that there are some dips and dives, especially for Microsoft, which wrote down $6.2 billion in 2012 because of a botched acquisition; but, generally, the trends are higher.

BA Net Income (TTM) data by YCharts

The good news here is that there's still fuel left to drive profits higher. A total of 7.3% of Americans are still unemployed and, as they get jobs, there's more money flowing through the economy.

There's also $1.48 trillion of cash just sitting in the bank accounts of U.S. companies. When they see significant economic growth, they'll put that money to work, giving another boost to the economy.

The economic recovery may not be as fast as some had expected, but it's happening slowly, and when it picks up steam, there will be room for profits to grow even more.

Flow of easy money

The final reason stocks are up significantly this year is the flow of easy money from the Federal Reserve. Not only are short-term interest rates near 0%, but the Fed is buying long-term bonds with an $85 billion per-month plan intended to keep interest rates low.

This pushes borrowing rates for companies down, and also pushes investors into stocks and away from low-yield bonds. The money flow alone is enough to push markets higher.

Foolish bottom line

It may not seem like a year when the market should be up as much as it is, but there are a variety of factors pushing stocks higher. The crazy thing about the stock market is that, short term, it may not make a lot of sense at all. Next year, we could see the economy boom, and stocks fall flat.

That's why we tell investors to stick around for the long haul. There will be bumps along the road, but you won't miss out on a booming market like we have had this year.

Three long-term picks

If you're looking for some long-term investing ideas, you're invited to check out The Motley Fool's brand-new special report, "The 3 Dow Stocks Dividend Investors Need." It's absolutely free, so simply click here now and get your copy today.

The article Why Are Stocks Hitting All-Time Highs? originally appeared on Fool.com.

Fool contributor Travis Hoium manages an account that owns shares of Microsoft. The Motley Fool recommends 3M. The Motley Fool owns shares of Microsoft. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.