Is Silver Wheaton Destined for Greatness?

Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Silver Wheaton fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Silver Wheaton's story, and we'll be grading the quality of that story in several ways:

Growth: Are profits, margins, and free cash flow all increasing?

Valuation: Is share price growing in line with earnings per share?

Opportunities: Is return on equity increasing while debt to equity declines?

Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Silver Wheaton's key statistics:

SLW Total Return Price data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Revenue growth > 30% | 140.6% | Pass |

Improving profit margin | 38.9% | Pass |

Free cash flow growth > Net income growth | (30,320%) vs. 234.2% | Fail |

Improving EPS | 229.4% | Pass |

Stock growth (+ 15%) < EPS growth | 13.7% vs. 229.4% | Pass |

Source: YCharts. * Period begins at end of Q2 2010

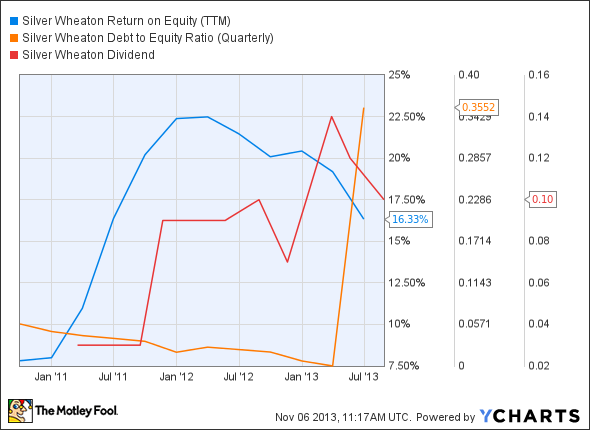

SLW Return on Equity (TTM) data by YCharts

Passing Criteria | 3-Year* Change | Grade |

|---|---|---|

Improving return on equity | 80.6% | Pass |

Declining debt to equity | 440.6% | Fail |

Dividend growth > 25% | 233.3% | Pass |

Free cash flow payout ratio < 50% | Negative FCF | Fail |

Source: YCharts. * Period begins at end of Q2 2010

How we got here and where we're going

Last year, Silver Wheaton put together a really strong performance by racking up eight out of nine possible passing grades, but it has lost two passing grades in its second assessment. One source of that weakness is Silver Wheaton's decimated free cash flow, which has slipped deep into negative territory. But Silver Wheaton has been consistently paying quarterly dividends to shareholders in spite of this collapse, and if its free cash flow can resume an upward trajectory to rejoin other metrics, the company has a shot at returning to an eight-of-nine score, or possibly even a perfect score. Will Silver Wheaton be able to move past this weakness, or is the silver specialist going to be tarnished for some time to come? Let's dig a little deeper to find out.

Fool contributor Rupert Hargreaves notes that Silver Wheaton's all-in sustaining-cash costs for silver production came at $9.57 per ounce, making it a leader in the metal industry. But Silver Wheaton's profit margin has declined with the price of silver, as you might expect. The potential for a rebound in silver prices hinges quite heavily on a rebound in gold -- over the past five years, silver has risen and fallen right along with gold prices, but its movements are exaggerated compared to the yellow metal. SPDR Gold Trust ETF and iShares Silver ETF depicts that movement well: from the start of 2010 to the start of 2012, the gold ETF gained 38% but the silver ETF rose 56%. Over the past year, however, gold has lost 22% to silver's 30% decline. Diversification into more gold projects doesn't help much due to the close correlation, but that hasn't stopped Silver Wheaton from doing so.

Silver Wheaton recently entered into an agreement with Hudbay Minerals to acquire 50% of the life-of-mine gold production at its Constancia mine in Peru. Silver Wheaton expects to produce 35,000 ounces of gold over the first five years and 18,000 ounces thereafter. The company already bought out silver stream rights from Hudbay to avoid any short supply from the expiration of contracts in 2013, so the success of this mine will be important to Silver Wheaton's future.

On the other hand, Barrick Gold has suspended its operations at the Pascua- Lama project -- Fool contributor Vladimir Zernov notes that the company needs to install a new water management system in accordance with Chilean government regulations before it can restart production. As a result, Silver Wheaton, which owns a 25% stake in Pascua-Lama, will receive cash compensation of $625 million, less credit for any silver already delivered. Barrick's Pascua-Lama decision also allows Silver Wheaton to purchase silver from three of Barrick's mines throughout 2014 and 2015, as the company's timeline for completion of Pascua-Lama project has been pushed back to 2017. That could be a long-term positive for Silver Wheaton, as it does not bear the brunt of cost overruns, but it's still going to dent near-term profitability.

Putting the pieces together

Today, Silver Wheaton has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.

Invest in stocks that are as good as gold

As every savvy investor knows, Warren Buffett didn't make billions by betting on half-baked stocks. He isolated his best few ideas, bet big, and rode them to riches, hardly ever selling. You deserve the same. That's why our CEO, legendary investor Tom Gardner, has permitted us to reveal The Motley Fool's 3 Stocks to Own Forever. These picks are free today! Just click here now to uncover the three companies we love.

The article Is Silver Wheaton Destined for Greatness? originally appeared on Fool.com.

Fool contributor Alex Planes has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy.

Copyright © 1995 - 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.